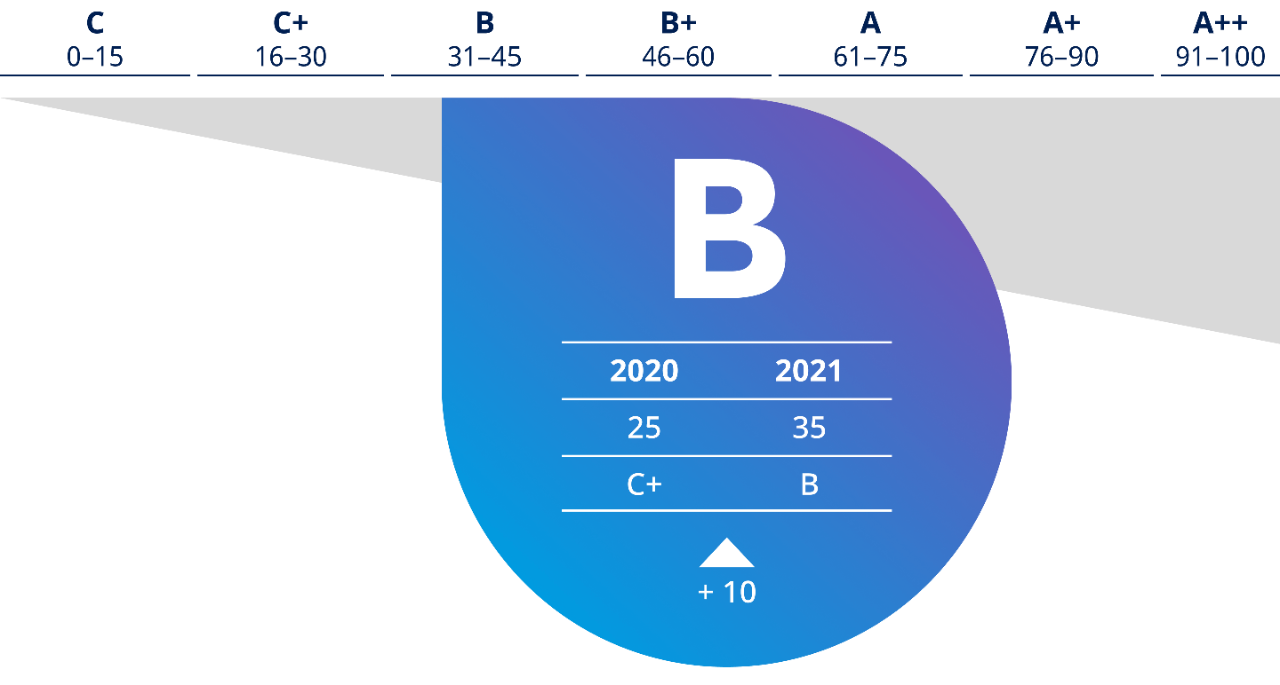

Responsible Investment Total Evaluation (RITE)

With trillions of pounds invested by large sophisticated asset owners in the UK, including £2.3 trillion of assets in UK pension schemes, institutional investors have a huge role to play and should be helping to drive the UK’s sustainable investment agenda. But how do you gain an insight as to how well you are currently integrating Environmental, Social and Governance (ESG) considerations into your overall investment decision making? And how do you identify areas for intervention that will deliver positive impact?

That’s why we created our Responsible Investment Total Evaluation (RITE).

Read our 2023 RITE report.

What is RITE?

RITE is all about taking action. It’s an easy to follow approach for helping you work towards best practice in ESG with your investment decision making.

RITE gives you an evaluation across each area of Mercer’s Sustainable Investing Pathway (Beliefs, Policy, Process and Portfolio) to show you how you are doing on an A++ to C scale, and how that compares to your peers. It also provides you with a way of monitoring your improvement over time.

With the RITE Interventions, we can work with you to improve your ESG credentials leading to well-planned and evidential improvements. As a result of this direct action, you will benefit from the RITE Impact and you can take pride as your portfolio’s evaluation improves year on year.

What is the process?

RITE is a 3 stage process:

- Firstly we will assess your portfolio against 75 different data points to gain an insight as to how well you are currently integrating ESG considerations into your investment decision making. The 75 data points cover 21 different categories within Mercer’s Sustainable Investment Pathway: Beliefs, Policy, Process and Portfolio. Each part of the Sustainable Investment Pathway will be given a rating from C to A++ depending on how you have scored in each of the 21 categories. This will then equate to an overall RITE rating for your portfolio.

- Within each part of the Sustainable Investment Pathway we provide a list of interventions that could be undertaken in order to improve the RITE score and lead to further ESG integration.

- Finally, we provide you with a revised RITE score showing the impact of the proposed interventions. The interventions selected are those that will have the biggest impact on the RITE score.

We will work with you to set out an action plan over the next 12 – 18 months to implement the agreed interventions. The RITE assessment can be completed on, for example, an annual basis to show the progression in your RITE score.

| Specifications | More information |

Year of review: 2021 AUM: £200m £101m-£250 average: C+ £101m-£250 average: C+ |

The Mercer RITE provides an evaluation of your ESG credentials. It is based on 75+ data points across 21 categories aligned with Mercer's Responsible Investment Pathway. |

Next steps

Our achievements

Before you access this page, please read and accept the terms and legal notices below. You’re about to enter a page intended for sophisticated, institutional investors only.

This content is provided for informational purposes only. The information provided does not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities, or an offer, invitation or solicitation of any specific products or the investment management services of Mercer, or an offer or invitation to enter into any portfolio management mandate with Mercer.

Past performance is not an indication of future performance. If you are not able to accept these terms and conditions, please decline and do not proceed further. We reserve the right to suspend or withdraw access to any page(s) included on this website without notice at any time and Mercer accepts no liability if, for any reason, these pages are unavailable at any time or for any period.