DC schemes: refocusing on getting your members retirement ready

Get a clearer view of your scheme and how to ensure your members are preparing for retirement.

In life, things can become so complex that we lose sight of what we are trying to achieve. This has become increasingly true of defined contribution (DC) pension schemes. In a world of regulatory change, volatile markets and cost pressures, DC schemes have understandably focused on how much is paid in, keeping abreast of constantly changing rules and investment performance against the market.

The Pension and Lifetime Savings Association’s (PLSA) Retirement Living Standards give individual pension savers an idea of how much they will need for a certain standard of living when they stop work. But DC schemes might not always consider how the likely outcomes match up to these standards to give members the best chance of being retirement ready.

We’ve been working with a number of schemes to get a clearer picture of where they stand and what actions they can take to help members getting ready for retirement. In our view, the biggest risk a pension scheme can have is people not having enough money to retire.

Getting ready for retirement

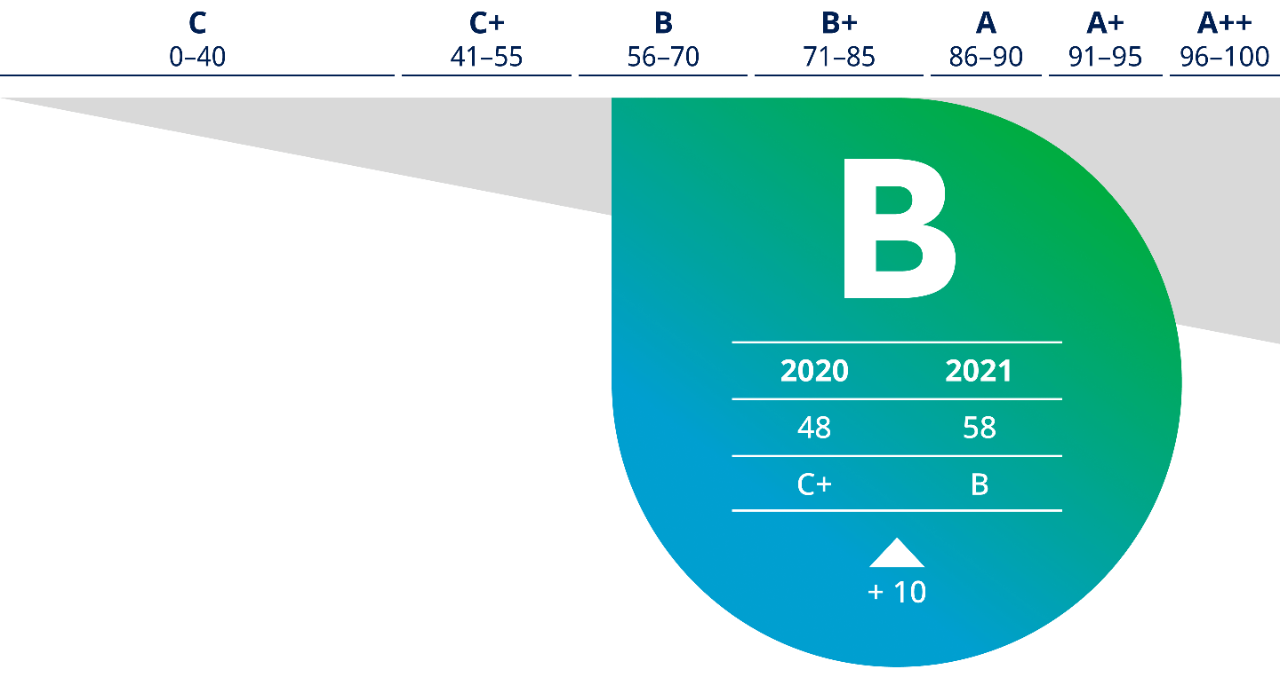

Mercer has established a Retirement Readiness Index (RRI) that assesses and grades members’ prospective retirement benefits. The analysis can explore differences by factors such as location, age and gender.

This analysis provides schemes with:

- insight into whether the scheme is good.

- interventions targeting specific actions to improve member outcomes.

- tools to monitor the impact of any changes the scheme might make to make sure members are getting ready for retirement.

These interventions span the scheme’s design, take-up rate, investment strategy, and when and how members access their benefits. Often these actions involve targeted communication from the trustee or provider to specific cohorts of scheme members.

One scheme we worked with saw members about 70% on track to have a comfortable retirement (as defined by the PLSA) on average. A large cohort of members weren’t making the most of company-matched contributions so the scheme wrote to those members encouraging them to do so.

That scheme also found its gender pay gap was about 5% but the gender pension gap was around 20% — a result of contributions ceasing during maternity leave (and the loss of compounding from this service). As a result, the company will be putting measures in place to contact women going on, and returning from, maternity leave to help them to make good the shortfall in their pension savings.

In difficult times, focusing on making sure employees are retirement ready is a good news story. A manufacturing company badly affected by Covid-19 was constrained on pay and bonuses but was able to tell its workforce about measures to improve retirement outcomes with benefits for morale.

A scheme we worked with had service-based contributions that paid more according to how long someone had worked at the company. On inspection, the company realised this wasn’t good for younger members. It is looking at revising the contribution structure to allow these employees to save earlier and benefit from compound returns (at no additional cost to the company).

Other potential actions resulting from the RRI include:

- adjusting the rate at which members are auto-enrolled.

- reviewing the scheme’s investment strategy benchmarking investment charges.

- setting a higher retirement age.

Focusing on outcomes is the right thing to do because schemes exist to provide a good retirement income for members. It can also help with business planning: enabling older employees to retire makes way for the next generation.

We’re in conversations with companies and trustees about how to do DC better across a range of subjects. An important part of those discussions is helping DC schemes refocus on their core purpose — providing a good retirement for their members.

Retirement Readiness Index (RRI)

| Specifications | |

| Year of review | 2021 |

| AUM | £2.3bn |

| Assessment type | Tenure / Drawdown |

| Average | B+ for industry sector |

| More information |

| The assessment can be done against the absolute levels of Retirement Living Standards or pro-rated for your employees' tenure in your business. The assessment can assume they buy an annuity in retirement or take benefits through drawdown. |

We’ve been working with a number of schemes to get a clearer picture of where they stand and what actions they can take to help members preparing for retirement. In our view, the biggest risk a pension scheme can have is people not having enough money to retire.

Principal

Before you access this page, please read and accept the terms and legal notices below. You’re about to enter a page intended for sophisticated, institutional investors only.

This content is provided for informational purposes only. The information provided does not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities, or an offer, invitation or solicitation of any specific products or the investment management services of Mercer, or an offer or invitation to enter into any portfolio management mandate with Mercer.

Past performance is not an indication of future performance. If you are not able to accept these terms and conditions, please decline and do not proceed further. We reserve the right to suspend or withdraw access to any page(s) included on this website without notice at any time and Mercer accepts no liability if, for any reason, these pages are unavailable at any time or for any period.