Pensions buyout case study – Metal Box Pension Scheme

The Metal Box pension scheme completed a £2.2 billion all risks buyout with PIC.

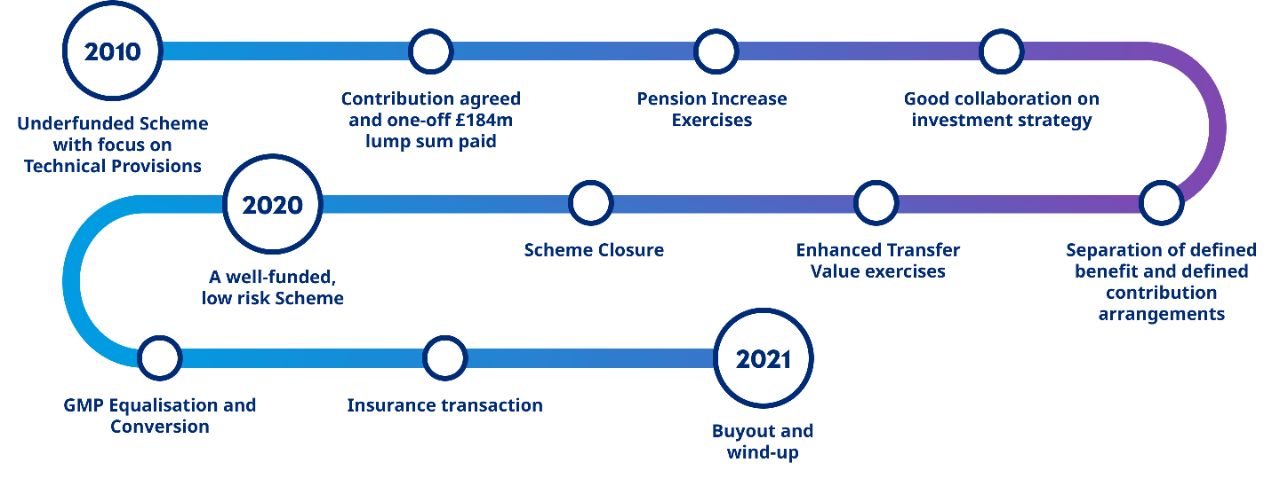

This marks the end of a truly strategic journey, which has lasted 11 years and has seen the scheme move from having a solvency funding level of 67% to a position where all member benefits have been secured with PIC. Mercer has been the strategic adviser to the Metal Box pension sponsor, Crown Packaging Manufacturing UK, throughout this pensions buyout and was the lead adviser for the bulk annuity transaction with PIC. Some key points to draw out from the journey:

- In 2010, the Metal Box pension had a solvency deficit of around £0.7 billion and a recovery plan that extended almost 30 years

- By working collaboratively with the Trustee and Company, several pension derisking projects have been implemented providing choice and flexibility to members, supported by appropriate financial advice. The derisking steps included phased pension increase exchange exercises and enhanced transfer value exercises

- Separation of the defined contribution assets into a MasterTrust, preparing the Scheme for future pensions buyout

- Use of investment protection strategies to deliver the right balance between risk and return

- GMP equalisation has been implemented for both pensioner and deferred members using method D2 (conversion) as set out in the 2018 Lloyds judgement

- Early engagement with legal due diligence to identify potential issues and smooth the later stages of any pensions buyout transaction

- Careful structuring of the bulk annuity transaction to deal with a rump of illiquid assets.

As a result of the planning and preparation, and a robust insurer selection process, the Company and Trustee of the Metal Box pension scheme were able to select PIC as the preferred insurer for a buy-in transaction in October 2021, moving to full scheme buyout one month later.

The transaction with PIC provides a pension risk transfer that secures the benefits for the Scheme’s 10,300 pensioners and 2,200 deferred pensioners. Furthermore, from the Company perspective, this was achieved in roughly one-third of the recovery plan period that came from the 2010 actuarial valuation, and at around half of the cost of the solvency deficit calculated at that time.

The buyout journey

Pensions buyout - Metal Box Pensions Scheme: key features

The buy-in and buyout transaction with PIC required a number of innovative structural points to enable both Trustee and Company objectives to be met:

- A pension risk transfer for the scheme

- Initial market testing to identify that a transaction at an attractive price was feasible in 2021

- A robust insurance market approach, led by Mercer, with strong collaboration between Trustee and Company advisers throughout the project – maximising insurer appetite for this landmark transaction

- Use of a ‘’Buyers Report’’ to allow all quoting insurers to assess Residual Risk cover at an early stage – this provided greater certainty when selecting an insurer and time to address any issues

- An agreed price lock to match the scheme assets – providing certainty to the deal economics during the pre-buy-in preparation period

- Structuring an asset solution to deal with a rump of illiquid assets

- Agreeing a one-month period to full Metal Box pensions buyout from buy-in, through:

– Completion of GMP conversion and full member data reconciliation in advance of the buy-in to enable a single premium transaction with no subsequent price adjustments

– Agreement for the insurer to use the existing scheme administrators after buyout to ensure a consistent member experience

Throughout this journey we have offered choice to members, sought to build and protect the Scheme's financial position and carefully planned ahead to allow risks to be mitigated. This extensive planning work, together with a clear engagement strategy when approaching insurers, resulted in this significant transaction being completed through a smooth process to deliver security for members and a high degree of price certainty for the Company.

FIA Partner

Before you access this page, please read and accept the terms and legal notices below. You’re about to enter a page intended for sophisticated, institutional investors only.

This content is provided for informational purposes only. The information provided does not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities, or an offer, invitation or solicitation of any specific products or the investment management services of Mercer, or an offer or invitation to enter into any portfolio management mandate with Mercer.

Past performance is not an indication of future performance. If you are not able to accept these terms and conditions, please decline and do not proceed further. We reserve the right to suspend or withdraw access to any page(s) included on this website without notice at any time and Mercer accepts no liability if, for any reason, these pages are unavailable at any time or for any period.