Mercer DC Master Trust puts your pension savings in safe hands

What is a DC master trust?

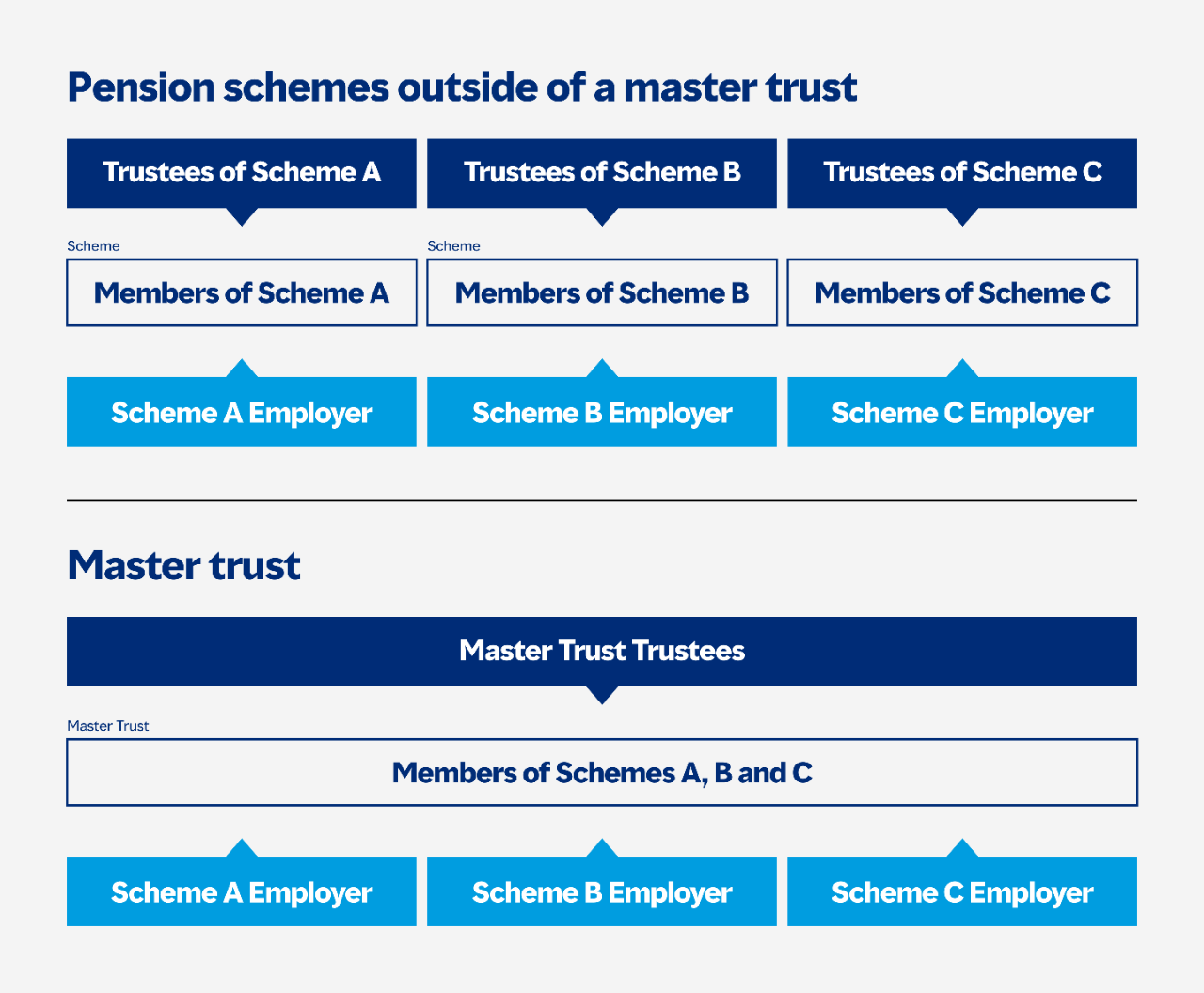

A DC master trust is a workplace pension scheme that looks after the retirement savings of employees from multiple employers.

Master trusts are looked after by professional trustees and operate within strict regulations to ensure their members’ savings are protected and managed to the highest standard. The Mercer DC Master Trust is one of only 36 authorised master trusts in the UK.

Pooling multiple pension arrangements together delivers cost savings to you while also providing lots of market-leading tools to help you plan and support your financial wellbeing in retirement.

A comparison between pension schemes outside of, and in a master trust

Our DC master trust helps you secure the retirement you deserve

The Mercer DC Master Trust puts your pension in the safe hands of our experts. It invests your savings to guide you towards the retirement you deserve and help you manage your money now and after you stop work.

Workplace Savings Strategy & Commercial Leader

Get started to make the most of the Mercer DC Master Trust

If your employer’s pension scheme is part of our DC master trust, here’s a checklist to help you make the most of the benefits it offers.

- Sign up for Mercer Money to manage the full range of your finances – from savings to payments – and track your journey to retirement.

- Link your pension accounts to get a consolidated view of your position today, and use our modelling tools to see if you are on track for the future you deserve.

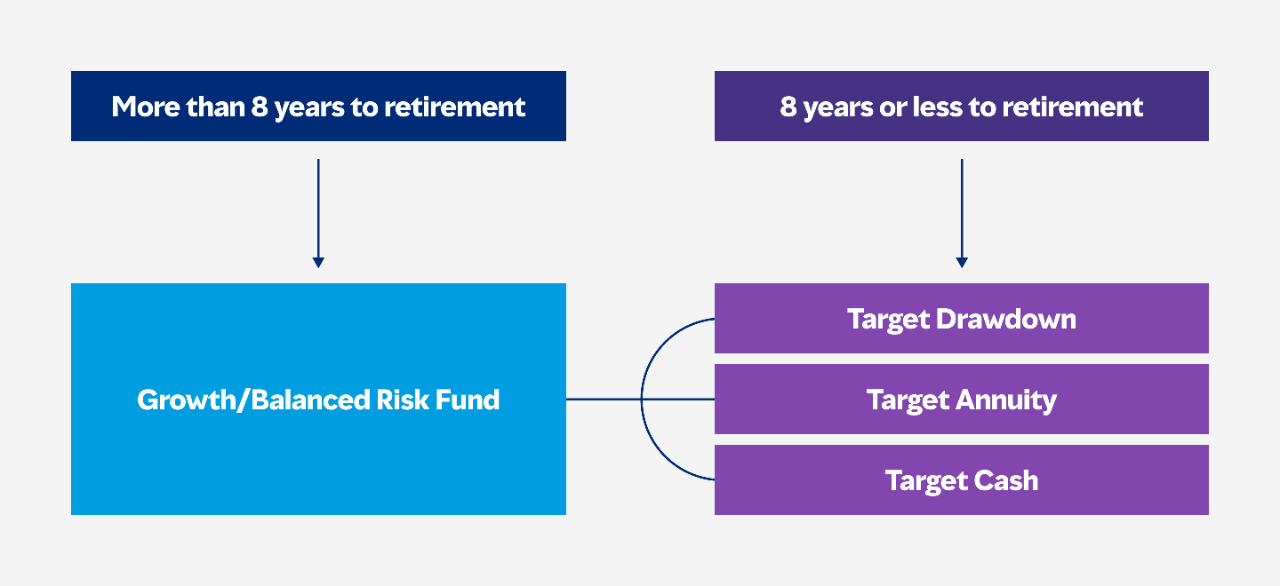

- Consider whether you want to choose your own investments or let Mercer SmartPath guide you towards retirement.

- If you want to choose your investments, find out about the range of funds available to you in the Mercer DC Master Trust.

- Read up on protecting your pension from scammers. Don’t make any decision about transferring your pension pot without talking to an authorised financial adviser.

These actions will help you plan your future, protect your savings and work towards the retirement you hope to achieve.

Contact details

Important notice:

Before you access this page, please read and accept the terms and legal notices below. You’re about to enter a page intended for sophisticated, institutional investors only.

This content is provided for informational purposes only. The information provided does not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities, or an offer, invitation or solicitation of any specific products or the investment management services of Mercer, or an offer or invitation to enter into any portfolio management mandate with Mercer.

Past performance is not an indication of future performance. If you are not able to accept these terms and conditions, please decline and do not proceed further. We reserve the right to suspend or withdraw access to any page(s) included on this website without notice at any time and Mercer accepts no liability if, for any reason, these pages are unavailable at any time or for any period.