Massachusetts sets dollar limits for individual-mandate coverage

The Massachusetts Health Connector has announced the 2021 dollar limits on deductibles and other cost sharing for minimum creditable coverage (MCC), as required by revised 2019 regulations (956 Mass. Code Regs. 5). The Massachusetts individual mandate, in place since 2007, requires state residents to maintain MCC or face a potential state tax penalty. Though employers have no obligation to provide MCC for their Massachusetts employees, many employees use their employment-based health coverage to satisfy the mandate. In addition, reporting requirements compel health plan sponsors (or their vendors) to determine whether the coverage they offer meets MCC standards. Beginning Jan. 1, 2020, deductibles receive annual adjustments tied to federal indexing. The revised regulations also clarify the MCC criteria for health arrangements that religious organizations provide for their members.

MCC reporting

By Jan. 31 after the close of a coverage year, health plans that provide MCC must distribute Form MA 1099-HC to covered individuals who reside in Massachusetts and report this information to the state Department of Revenue (DOR). While the MCC reporting law applies to plan sponsors and state-regulated insurers, most self-funded employers rely on their third-party administrators (TPAs) to determine MCC status, distribute the forms and file the DOR report. Insurers subject to Massachusetts regulation must comply with the reporting requirements. However, MCC reporting falls to the employer if its health plan is from an insurer that isn’t subject to the state’s laws. Reporting may be more complex for employers that have multiple TPAs for a single plan.

Determining MCC status

Insurers subject to Massachusetts regulation must determine and disclose the MCC status of their health plans. Plan sponsors whose insurance vendors don’t do this can review plan provisions and self-certify that the plan qualifies as MCC if it meets all the requirements outlined below. Employers that self-certify don’t need to complete or submit any special form or filing. They need only to distribute Forms 1099-HC and report to the DOR.

Certification application

A plan that fails to meet MCC standards due to a financial deviation and doesn’t meet alternative MCC standards described below may submit an MCC Certification Application to the Health Connector. Applications for the 2020 plan year must be submitted by Nov. 1, 2020. Applications for other years won't be accepted for review in 2020., Any application must identify a deviation from MCC standards. If a plan received certification for 2016 or later and hasn’t expanded any deviation from MCC standards, resubmission is not necessary.

The application may include an actuarial attestation showing equal or greater value than a Health Connector bronze plan. While not required (unless requested), the attestation may expedite the application process. Actuarial equivalence doesn't guarantee MCC certification. Even if actuarially equivalent, a plan that fails to provide the core services discussed below won’t receive MCC certification.

Attestation

TPAs providing MA 1099-HC services commonly require self-insured plan sponsors to attest that their plans meet MCC standards. Any self-insured employer — including one with different vendors for the medical plan and carved-out prescription drug or mental health benefits — has to base its attestation on the combined features of the medical plan and the carved-out benefits. TPAs typically ask employers for this attestation in late summer or early autumn, well before the January reports are due.

MCC standards

- To qualify as MCC, a plan must cover four core services: physician services, inpatient acute care, day surgery, and diagnostic procedures and tests. Within these services, the plan must cover a broad range of services that include the following:

- Ambulatory patient services, including outpatient, day surgery and related anesthesia

- Diagnostic imaging and screening procedures, including X-rays

- Emergency services

- Hospitalization, including — at a minimum — inpatient services typically provided at an acute care hospital for benefits covered under the member's subscriber certificate or plan description

- Maternity and newborn care, including prenatal care, post-natal care, and delivery and inpatient maternity services

- Medical/surgical care, including preventive and primary care

- Mental health and substance abuse services

- Prescription drugs

- Radiation therapy and chemotherapy

MCC may consist of a single plan or a combination that together meet the standards. Coverage for all individuals must include all core services and the broad range of benefits. For example, a plan can’t limit coverage for maternity services to an employee or a spouse, but exclude that coverage for covered dependent children. Indemnity-type plans aren’t permitted.

A plan cannot impose a dollar limit or utilization cap on core services or any single illness or condition, or an overall maximum on prescription drugs. Utilization limits may apply if based on “reasonable medical management techniques” rather than dollar amounts.

Cost sharing

A plan’s out-of-pocket maximum (OOPM) applies to deductibles, copayments, coinsurance and similar charges an enrollee must pay for essential health benefits. Annual preventive services, as determined under federal law (42 USC § 300gg-13), must be covered without a deductible, even if the plan is grandfathered under the Affordable Care Act (ACA).

Deductible

The annual MCC deductible has historically been set at $2,000 for individual coverage and $4,000 for family. Beginning with the 2020 plan year, the revised rules (956 Mass. Code Regs. 5) add indexing tied to the annual OOPM adjustment, rounded down to the next $50, under the ACA (42 USC § 18022(c)(4)). The Department of Health and Human Services (HHS) annually announces the ACA adjustment for the coming year in the Notice of Benefit and Payment Parameters. The Connector has applied this figure for calculating OOPM since 2014.

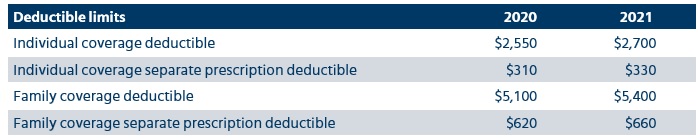

In Bulletin 01-20, the Connector announced 2020 maximum MCC deductibles as $2,550 for individual coverage and $5,100 for family coverage (double the individual rate). If the plan has a separate prescription drug deductible, those amounts for 2020 can’t exceed $310 for individual coverage and $620 for family coverage. However, the overall maximum deductible applies.

For 2021 plan years, Bulletin 05-20 sets the maximum MCC deductibles as $2,700 for individual coverage, and $5,400 for family coverage. If the plan has a separate prescription drug deductible, the individual/family amounts for 2021 can’t exceed $330/$660. The overall maximum deductible applies.

OOPM

The MCC rules set the OOPM to match the federal ACA limits. The 2020 OOPM announced in the 2020 Notice of Payment and Parameters is $8,150 for individual coverage and $16,300 for family coverage. Under the 2021 Notice of Payment and Parameters, those amounts will rise to $8,550 /$17,100.

Alternative MCC plans

The revised rules expand other types of plans that may qualify as MCC without meeting all the standards set out above. As in the past, certain high-deductible health plans (HDHPs) can qualify. Religious organizations providing care for their members can be considered MCC if certain conditions apply. A list of other state and federal health plans also meet the requirements.

HDHPs

The Connector will allow a plan sponsor or insurer to self-certify an HDHP if it meets one of these standards:

- The HDHP complies with federal health saving account (HSA) requirements under 26 U.S.C. § 223, meets all MCC standards that don’t conflict with HSA contributions and facilitates access to an HSA.

- The plan sponsor maintains a health reimbursement arrangement (HRA) in combination with a federally compliant HDHP.

Religious organizations

Starting in 2020, a health arrangement provided by an established religious organization composed of individuals with sincerely held beliefs may be considered MCC. Beyond any financial statement or disclosure required by law, the organization cannot represent that it has sufficient financing to meet members' anticipated financial or medical needs or has had a successful history of meeting them. The organization also cannot use common insurance terms, such as “health plan,” “coverage,” “copay,” “copayment,” “deductible,” “premium,” and “open enrollment” or refer to itself as “licensed.” Additional requirements apply to use of funds, disclosures and reporting to the Connector.

Other MCC qualified coverage

Individual policies sold on or off the health insurance exchange and certain publicly funded state and federal health plans also qualify as MCC, including the following:

- Catastrophic health plan that meets ACA requirements

- Medicare Part A or Part B plan

- Public health plan offered under the Public Health Service Act

- Children’s Health Insurance Program (CHIP) and Medicaid coverage (except limited programs)

- Qualifying student health insurance program under the laws of any state

- Indian Health Service or tribal organization medical care

- State health benefits risk pool

- Federal Employees Health Benefits Program coverage

- Health benefit plan offered via the Peace Corps

- Young adult health benefit plans

- US Veterans Health Administration plan

- Health plan offered to AmeriCorps National Service Network members

Penalties

Employers may face a $50 penalty per individual for reporting failures and unspecified fines for state tax-filing noncompliance. However, employers don't have to provide MCC, and no direct penalty applies to an employer for not offering MCC. Massachusetts requires residents to maintain coverage that complies with MCC rules.

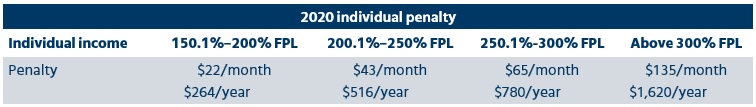

Resident penalties for failure to maintain MCC vary and apply only to adults whom the Connector deems able to afford health insurance under the state’s affordability rules. The Health Connector annually establishes affordability standards based on a resident’s income relative to the federal poverty level (FPL) and affordable health insurance premiums. Anyone deemed unable to afford health insurance won’t face a penalty. Any penalty won’t exceed 50% of the minimum monthly premium an individual would have paid for insurance through the Health Connector. Individuals may appeal a penalty to claim that hardship prevented them from purchasing health insurance.

The following chart outlines the 2020 penalties for uninsured Massachusetts residents:

Employer considerations

Employers that sponsor health plans covering employees residing in Massachusetts should take the following steps:

- Determine if the plan covering state residents satisfies MCC requirements.

- Contact the plan insurer or TPA to find out if it will send the 1099-HC and report to the DOR.

- Complete any requested attestation by the due date the vendor requests.

- Complete an MCC application for any plan that deviates from MCC standards and didn’t previously receive certification.

Plan for any changes needed to offer 2021 MCC.

Non-Mercer resources

- Administrative information bulletin 05-20, Guidance on MCC regulations for calendar-year 2021 (Massachusetts Health Connector, May 21, 2020)

- MCC Certification Application (Massachusetts Health Connector, Feb. 11, 2020)

- 2019 Form MA 1099-HC, Individual mandate healthcare coverage (Massachusetts DOR, Dec. 16, 2019)

- Massachusetts Health Connector

- 956 Mass. Code Regs. 5, Minimum creditable coverage rules

- 956 Mass. Code Regs. 6, Affordability rules

- 956 Mass. Code Regs. 12.00, Eligibility, enrollment and hearing process for Connector programs

- 26 USC § 223(c)(2)(A)(ii), High-deductible health plan exclusion

- 42 USC § 300gg-13, Coverage of preventive health services

- 42 USC § 18022(c)(4), Levels of coverage in exchange plans