IRS issues annual update to determination letter procedures

Rev. Proc. 2021-4 contains annual updates to procedures for requesting IRS determination letters, private letter rulings and other tax advice on employee plan matters. Key changes to last year’s procedures, which focus mainly on determination letter requests, include:

- Form 5310. Section 6.02 (a) explains that Form 5310, Application for Determination for a Terminating Plan, must be filed electronically starting Aug. 1 and may optionally be e-filed starting April 16.

- Leased employees. Section 9.08 notes that if an applicant for a determination letter also seeks a ruling on the status of leased employees, the applicant must specifically request the ruling in a cover letter (in addition to providing information set forth in Section 17).

- Preapproved plans. Section 12.01 (formerly Section 12B.01) now reflects the July 31, 2022, deadline to adopt preapproved defined contribution plans for the third remedial amendment cycle and submit determination letter applications (as announced last year). The section also provides that the period for adopting preapproved defined benefit plans for the third remedial amendment cycle will not occur during 2021 — as IRS had originally anticipated — but will be announced later.

- Governmental plans. Sections 12.02–12.04 (formerly Sections 12B.02–12B.04) include a new category for determination letter requests for preapproved governmental pension plans with a normal retirement age that doesn’t satisfy any of the regulatory safe harbor definitions.

- Multiple-employer plans. Section 12.03(1)(a) (formerly Section 12B.03(1)(a)) and Section 14 now clarify that the controlling member of a multiple-employer plan is the adopting employer that submits a determination letter application for the plan.

- Employee stock ownership plans (ESOPs). Section 13.03 now includes instructions for ESOP sponsors submitting a determination letter request using Form 5307, Application for Determination for Adopters of Modified Volume Submitter Plans.

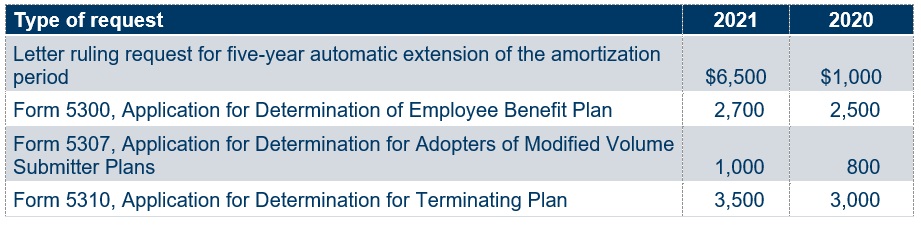

- User fees. Updates to Appendix A include user fees for two new categories of opinion letters for preapproved plans, as well as the previously announced user fee increases for certain types of employee plan letter rulings and determination letter requests, as shown in the table below.

Related resources

Non-Mercer resources

- Rev. Proc. 2021-4, Internal Revenue Bulletin 2021-1 (IRS, Jan. 4, 2021)

Mercer Law & Policy resources

- IRS issues a potpourri of guidance for retirement plans (Aug. 20, 2020)

- IRS extends preapproved DB, 403(b) plan adoption deadlines (April 6, 2020)

About the author(s)

Related insights