IRS Creates Program for 403(b) Plan Document Compliance

Rev. Proc. 2019-39 establishes remedial amendment periods (RAPs) and plan amendment deadlines for correcting defective document provisions in Code Section 403(b) plans. The rules are similar to those that apply to Section 401(a) qualified plans under Rev. Proc. 2016-37. The new guidance gives 403(b) plan sponsors a system to maintain compliant documents — and their plans’ tax-favored status — after the initial RAP for 403(b) plans expires on March 31, 2020.

Remedial Amendments to Plan Documents

Final IRS regulations adopted in 2007 required all employers offering 403(b) plans — including plans not subject to ERISA — to maintain a written plan document as a condition of the plan’s tax-favored status (although a narrow exception applies to some churches). The regulations required employers to adopt written plan documents (or amend existing documents) to comply with the regulations by Jan. 1, 2009 (or the plan’s effective date, if later). However, in Notice 2009-3, IRS issued transition relief that gave sponsors until Dec. 31, 2009, to satisfy the written document requirement if they operated their plans under a reasonable interpretation of Section 403(b) and retroactively corrected any operational failures.

Initial 403(b) RAP Ends March 31, 2020

Sponsors that met the Dec. 31, 2009, deadline have a RAP to correct any document defects retroactive to Jan. 1, 2010. In general, sponsors must amend their plan documents before this initial RAP ends to correct any plan terms that don’t comply with Section 403(b) and add any missing necessary provisions. In Rev. Proc. 2017-18, IRS announced that the initial 403(b) plan RAP would end on March 31, 2020. However, Rev. Proc. 2019-39 provides transition relief that extends the initial RAP for certain amendments (see Transition Rules below).

RAPs for Plan Defects Arising After March 31, 2020

Rev. Proc. 2019-39 also establishes RAPs and amendment deadlines for 403(b) plan sponsors to correct document defects arising after March 31, 2020. An employer must amend its plan to fix any provision that violates the 403(b) requirements before the end of the RAP for the defective provision. These RAPs and amendment deadlines are explained separately below for individually designed and preapproved plans and summarized in tables in the Appendix at the end of this article.

The new rules for 403(b) plans are similar — but not identical — to the remedial amendment rules for qualified plans under Rev. Proc. 2016-37. For example, IRS will now include changes in the 403(b) requirements on its annually updated Required Amendments List (RA List). The end of the RAP and plan amendment deadline for a revised 403(b) requirement will be the end of the second calendar year after the year in which the change appears on the RA List.

Preapproved Plans Offer Assurance

IRS does not offer determination letters for individually designed 403(b) plans, so sponsors of these plans can’t receive assurance from IRS that their plan documents comply with Section 403(b). However, IRS does offer opinion or advisory letters for preapproved prototype and volume submitter 403(b) plans.

IRS has published a list of preapproved 403(b) plan documents for the initial RAP. Sponsors that adopt one of these preapproved 403(b) plans by the March 31, 2020, deadline will be deemed to comply with the 403(b) requirements during the initial RAP. After the initial RAP, sponsors that want assurance that their plan documents are in compliance will have to adopt a preapproved plan or switch from an individually designed to a preapproved plan.

Individually Designed Plans

Rev. Proc. 2019-39 establishes RAPs for individually designed plans in the following situations:

A newly adopted plan contains provisions that violate the 403(b) requirements or is missing provisions necessary to comply with those requirements.

A change in the 403(b) requirements causes one or more provisions in an existing plan to violate those requirements (or affects provisions that are integral to a changed 403(b) requirement).

An amendment to an existing plan violates the 403(b) requirements.

In each case, the employer must amend its plan to fix the defective provision by the last day of the RAP for that provision. The rules for these amendment deadlines are different for nongovernmental and governmental plans.

![]() Nongovernmental Plans

Nongovernmental Plans

New plans. When an employer adopts a new 403(b) plan, the last day of the RAP — and deadline to fix any noncompliant or missing provisions — is Dec. 31 of the second calendar year after the calendar year in which the plan takes effect.

Example. Tax-exempt organization X adopts a new 403(b) plan effective Jan. 1, 2020. The plan includes language requiring a six-month suspension of an employee’s elective deferrals after a hardship distribution. Final IRS hardship distribution regulations issued in 2019 prohibit suspensions of elective deferrals for all hardship distributions made on or after Jan. 1, 2020. X has until Dec. 31, 2022, to amend its plan document to correct the noncompliant provision (and the plan in operation must not suspend elective deferrals after any hardship distributions made on or after Jan. 1, 2020).

Changes in 403(b) requirements. For changes in the 403(b) requirements, the last day of the RAP — and deadline for amending the plan to comply with the change — is Dec. 31 of the second calendar year after the year in which the change appears on the RA List.

Example. The facts are the same as the prior example, except X’s plan has been in effect since Jan. 1, 2015. If IRS places its final hardship distribution regulations on the 2019 RA List, X will have until Dec. 31, 2021, to amend its plan to remove the language requiring a suspension of elective deferrals after a hardship distribution. The plan still must not suspend elective deferrals after a hardship distribution in the meantime.

The same deadline applies to provisions that are integrally related to a change in the 403(b) requirements but not required to comply with Section 403(b).

Example. The final hardship regulations add a new safe harbor hardship distribution for losses incurred by an employee in a federally declared disaster if the employee’s principal residence or principal place of employment is located in the disaster zone. Plans do not have to offer the new safe harbor, which is available for distributions made on or after Jan. 1, 2018. Nonetheless, the regulations identify the new safe harbor as integral to a change in the 403(b) requirements. Sponsor X in the prior example wants to allow hardship distributions under this new safe harbor starting Oct. 1, 2019. If IRS puts the final hardship distribution regulations on the 2019 RA List, X will have until Dec. 31, 2021, to amend its plan to add the new safe harbor distribution. In the meantime, the plan can allow distributions under the new safe harbor.

Amendments that violate 403(b) requirements. When an employer adopts an amendment that violates the 403(b) requirements, the last day of the RAP — and deadline for amending the plan to fix the defect — is Dec. 31 of the second calendar year after the year in which the defective amendment was adopted or effective (whichever is later).

Example. Tax-exempt organization Y sponsors a 403(b) plan. Y decides to start offering hardship distributions from its plan on Jan. 1, 2022. The amendment reflecting the change includes language that requires a six-month suspension of elective deferrals after a hardship distribution. This provision violates the 2019 final hardship distribution regulations. Y has until Dec. 31, 2024, to amend its plan to correct the noncompliant provision but must not suspend elective deferrals after a hardship distribution in the meantime.

Note on timing. Rev. Proc. 2019-39 says this amendment timing rule applies to a defect “with respect to an amendment to an existing plan (other than a Form Defect that is related to a change in § 403(b) Requirements, or that is integral to such a change ….” This would include a discretionary amendment that violates a 403(b) requirement. Although less clear, this rule would seem to cover any amendment that violates a 403(b) requirement; IRS clarification of this point would be helpful.

Governmental Plans

For governmental plans, a plan amendment typically requires action by the legislative body with authority for the plan. Accordingly, the deadline for fixing plan defects is the later of the applicable deadline for nongovernmental plans (discussed above) or:

For new plans, 90 days after the close of the third regular legislative session that begins after the end of the plan’s initial plan year

For amendments required by (or integral to) changes in the 403(b) plan requirements, 90 days after the close of the third regular legislative session that begins on or after the date the change appears on the RA List

For amendments to fix amendments that violate 403(b) requirements, 90 days after the close of the third regular legislative session that begins on or after the calendar year in which the amendment is adopted or effective, whichever is later

DB Plan Amendments

Depending on plan terms, some DB pension plans may need to be amended for partial annuity distribution regulations issued in 2016 and for updated static mortality tables. Certain eligible cooperative and charity plans that became subject to benefit restrictions rules in 2017 will also need amendments by Dec. 31, 2019. Finally, some nonbargained hybrid plans will need amendments for requirements that appeared on the 2017 RA List.

Partial Annuity Distribution Options

Under final IRS regulations issued in 2016, DB plans that allow participants to split their benefits into annuity and lump sum (or other accelerated) portions can use one of two methods for calculating those distributions:

- Apply 417(e)(3) actuarial assumptions to determine both the lump sum and annuity portions (the "total 417(e) method")

- Apply a simplified method that applies 417(e)(3) actuarial assumptions to the lump sum portion only and the plan's actuarial assumptions to determine the remaining annuity portion.

Before the 2016 regulations, no formal guidance addressed whether sponsors could use the simplified method for these calculations. Some sponsors used the total 417(e) method based on informal comments by IRS that it was required. The final regulations allowed sponsors that were using the total 417(e) method to switch to the simplified method without protecting a minimum benefit under Code Section 411(d)(6), but they had to amend their plans by Dec. 31, 2017. Notice 2017-44 supplied model amendments that sponsors could (but weren’t required to) use for this purpose.

Some sponsors might still need to amend their plans for the final regulations (and can use the model amendments to do so). For example, sponsors that were already using the simplified method before 2017 might need to amend their plans if plan terms are ambiguous. The 2017 RA List included the final regulations, setting a Dec. 31, 2019, amendment deadline. The regulations are on Part B of the RA List, which contains changes that IRS anticipates will only require amendments for plans with unusual provisions. IRS didn’t provide additional guidance on which plans might need to be amended for the final regulations, so sponsors that used the simplified method before 2017 may want to consult legal counsel.

Updated Static Mortality Tables for 2017

The annual RA List automatically includes certain periodic updates, even though these items aren’t directly referenced on the RA List. Examples of these updates include changes in cost-of-living adjustments, spot segment rates used to determine the 417(e)(3) applicable interest rate, and 417(e)(3) applicable mortality tables for the year in which such changes are effective.

Notice 2016-50 updated the static mortality tables used to determine minimum lump sums for distributions with annuity starting dates during stability periods beginning in the 2017 calendar year. The mortality table update is among the items automatically included on the 2017 RA List, so any required plan amendments to reflect the updated mortality tables for 2017 must be adopted by Dec. 31, 2019. However, most plans incorporate the IRS mortality tables by reference, eliminating the need for amendment.

Similar amendment timing rules apply to the updated mortality tables for 2018 and 2019, requiring any amendments by the end of 2020 and 2021, respectively.

Benefit Restrictions for Certain Eligible Cooperative and Charity Plans

Certain eligible cooperative and charity plans described in Section 104 of the Pension Protection Act of 2006 were not subject to the benefit restriction rules under Code Section 436 until the plan year beginning on or after Jan. 1, 2017. The 2017 RA List included the benefit restrictions rules for those plans. Therefore, sponsors of those plans have until Dec. 31, 2019, to adopt compliant benefit restriction language. (However, a plan that falls within the definition of a "CSEC plan" as defined in Code Section 414(y) is exempt from those rules, unless the plan sponsor elects to be treated as a non-CSEC plan.)

Final Regulations on Hybrid Plans

Under the final rules for hybrid plans, nonbargained plans generally needed amendments for the market rate of return rules (and other requirements that first became applicable for the plan year beginning in 2017) by the end of the 2016 plan year to get certain anti-cutback relief. The same amendment-timing rules applied to collectively bargained plans, which had to comply with the final regulations by the first plan year beginning on or after the later of these dates:

- Jan. 1, 2017

- The earlier of Jan. 1, 2019, and the date on which the last bargaining agreement ratified on or before Nov. 13, 2015, expires (regardless of any extension)

The 2017 RA List included other amendments required to conform to the final regulations (but not needing anti-cutback relief) for hybrid plans. Sponsors must adopt these amendments by Dec. 31, 2019. However, the RA List didn't address collectively bargained plans. Those plans generally must have already adopted any amendments requiring anti-cutback relief before the beginning of the applicable plan year, but IRS hasn't yet specified the deadline for adopting other conforming amendments.

Preapproved Plans

The IRS preapproved plan program gives employers assurance that their plan documents satisfy the 403(b) requirements. (As noted above, IRS does not offer determination letters on individually designed 403(b) plans.) A preapproved plan’s opinion or advisory letter covers the plan document and any adoption agreement, but not the terms of any investment contracts or other documents incorporated by reference into an adopting employer’s plan.

Preapproved Plan Cycles

Rev. Proc. 2019-39 establishes a system of recurring 403(b) preapproved plan cycles, during which a 403(b) preapproved plan sponsor will be able to apply for an opinion or advisory letter for its plan. IRS expects each cycle will last six years. Sponsors will have a one-year window — generally at the beginning of the cycle — to submit their plans for approval.

When IRS is close to finishing its review of applications for a cycle, the agency will announce the date by which employers must adopt a newly approved plan — a deadline that IRS expects will be a uniform date for all adopting employers. Employers will have approximately two years to adopt a newly approved plan.

Here are the timetables for the first two cycles:

Cycle 1. The initial 403(b) RAP that ends on March 31, 2020, is the first 403(b) preapproved plan cycle (Cycle 1). A plan for which a letter is issued for this cycle is considered a Cycle 1 plan.

Cycle 2. Cycle 2 will begin immediately after March 31, 2020. However, IRS doesn’t expect the submission period for Cycle 2 to begin until 2023. Before then, IRS will issue additional guidance on the submission procedures and a cumulative list of changes in the 403(b) plan requirements that weren’t considered during Cycle 1 but will be reviewed in Cycle 2.

IRS anticipates the cycle system will continue after Cycle 2.

Interim Amendments

Rev. Proc. 2019-39 requires the preapproved plan sponsor or adopting employer to adopt interim amendments to comply with changes in the 403(b) requirements occurring during a preapproved plan cycle. Timely adoption of an interim amendment — or a good faith determination by the sponsor or adopting employer that an interim amendment isn’t required — will extend the plan’s RAP for the changed 403(b) requirement to the end of the cycle. The employer can then fix any defects in the amendment by adopting a newly approved plan for the next cycle.

Nongovernmental plans. For a nongovernmental plan, an interim amendment is due by Dec. 31 of the calendar year after the calendar year in which the changed 403(b) requirement takes effect for the plan.

Governmental plans. For governmental plans, the interim amendment deadline is the later of the deadline for nongovernmental employers or 90 days after the legislative body authorized to amend the plan closes its third regular legislative session that begins on or after the date the change takes effect for the plan.

Transition Rules

Although the initial 403(b) RAP is scheduled to end on March 31, 2020, Rev. Proc. 2019-39 includes transition rules to ensure that the time available for correcting a provision that arises near the end of the initial RAP is at least as long as the time that would be available to adopt remedial amendments required after March 31, 2020.

Individually Designed Plans

For individually designed plans with noncompliant provisions arising during the initial RAP, the initial RAP ends on the later of March 31, 2020, or the last day of the RAP that would apply under the rules that take effect after March 31, 2020.

Example. Tax-exempt employer A adopts a discretionary amendment effective Jan. 1, 2018. The amendment violates a 403(b) requirement. A has until Dec. 31, 2020 — the last day of the RAP for amendments that violate 403(b) under the rules that apply after March 31, 2020 — to correct the defective amendment.

Example. The facts are the same as the prior example, except the discretionary amendment is effective Jan. 1, 2017. A has until March 31, 2020, to correct the defective amendment.

However, for document defects related to changes in the 403(b) requirements, the transition rule applies only if the defect arises after 2018 (because changes in the 403(b) requirements will not appear on the RA List prior to 2019).

Example. Tax-exempt employer B sponsors a 403(b) plan that requires suspending an employee’s elective deferrals for six months after a hardship distribution. However, the final hardship distribution rules prohibit suspensions for distributions on or after Jan. 1, 2020. If the 2019 RA List includes the final hardship distribution regulations, then B will have until Dec. 31, 2021, to amend its plan to comply with those regulations.

Preapproved Plans

For preapproved plans, the transition relief extends the initial RAP for defects arising near the end of the RAP until at least the end of Cycle 2 if certain conditions are met. IRS will announce exactly when the extended initial RAP will end near the close of Cycle 2.

Change in 403(b) requirements. If the amendment is needed to comply with revised 403(b) requirements or is integral to a change in the requirements, the preapproved plan sponsor or adopting employer must adopt a conforming amendment (or determine in good faith that an amendment isn’t required) by March 31, 2020, or if later, the end of the calendar year after the year in which the change is effective for the plan.

Amendment that violates 403(b). The extended RAP is available for a plan amendment made on or after Jan. 1, 2018, that violates the 403(b) requirements. If the noncompliant amendment was made before Jan. 1, 2018, the initial RAP will end on March 31, 2020.

Discretionary Amendments

Rev. Proc. 2019-39 includes deadlines for employers to amend their plans to reflect optional plan-design changes unrelated to a revised 403(b) requirement (called discretionary amendments). The discretionary amendment deadlines — which apply for plan years starting on or after Jan. 1, 2020 — are the same for individually designed and preapproved plans, but different rules apply to nongovernmental and governmental employers.

Nongovernmental plans. Nongovernmental employers must adopt discretionary amendments by the end of the plan year in which the change is operationally put into effect.

Governmental plans. Governmental employers must amend their plans by the later of (i) the deadline for nongovernmental employers, or (ii) 90 days after the legislative body with authority to amend the plan ends its second regular legislative session that begins on or after the date the amendment is operationally put into effect.

Rev. Proc. 2019-39 doesn’t specifically address the rules for correcting a discretionary amendment to a preapproved plan that violates the 403(b) requirements. Presumably, timely adoption of the discretionary amendment should extend the RAP for correcting the defective amendment until the end of the then-current cycle.

Operational Compliance Required

Sponsors must ensure plan operations follow revised 403(b) requirements when they take effect, even before the applicable amendment deadline. IRS intends to put 403(b) changes on its Operational Compliance List to help sponsors comply.

If plan operations fail to comply, then the sponsor does not get the benefit of the RAP for the document defect. For example, if a plan 403(b) plan suspends elective deferrals after a hardship distribution made after 2019 (contrary to the 2019 hardship distribution regulations), then the plan amendment eliminating the suspension provision can’t be retroactive to Jan. 1, 2020 (and won’t correct the operational failure).

Additional Information for All 403(b) Plans

The following information applies to both individually designed and preapproved 403(b) plans.

Amendment deadlines by statute or regulation. The amendment deadlines discussed above apply unless a statutory provision or IRS guidance sets a different amendment deadline.

Terminating plans. The termination of a 403(b) plan will shorten its RAP. Plan provisions that don’t comply with the 403(b) requirements must be corrected in connection with the termination, even if a change in the requirements hasn’t yet shown up on the RA List.

Failure to meet amendment deadlines. If an employer fails to meet an amendment deadline, the employer may still be able to correct under the IRS’s Employee Plans Compliance Resolution System.

Related Resources

- Rev. Proc. 2019-39 (IRS, Sept. 30, 2019)

- Required Amendments List (IRS)

- Operational Compliance List (IRS)

- Employee Plans Compliance Resolution System (IRS)

- 403(b) Preapproved Plan Program FAQs — Remedial Amendment Period (IRS)

- Rev. Proc. 2016-37 (IRS, June 29, 2016)

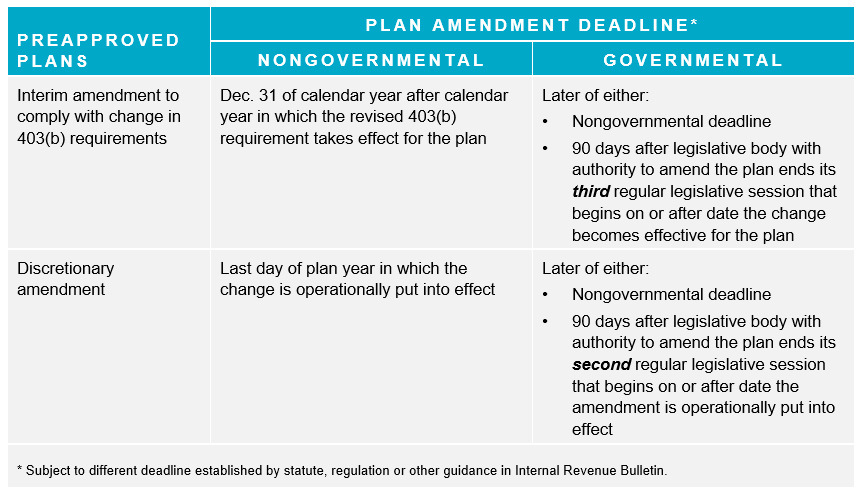

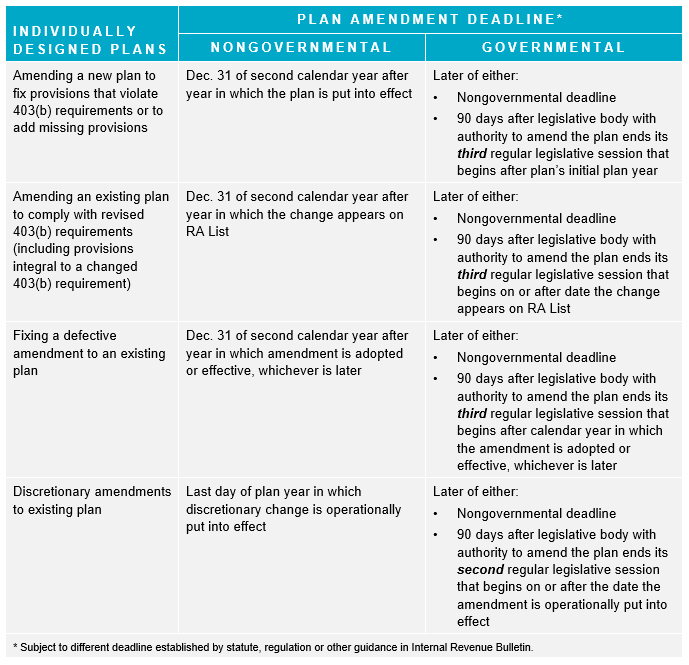

Appendix: 403(b) Plan Amendment Rules After March 31, 2020

These tables summarize the plan amendment rules after the initial 403(b) RAP expires on March 31, 2020.

RAPs for Individually Designed Plans

RAPs for Preapproved Plans