2020 Health FSA, Other Health and Fringe Benefit Limits Now Set

IRS Rev. Proc. 2019-44 gives the 2020 limits for salary-reduction contributions to health flexible spending arrangements (FSAs); Archer medical savings accounts (MSAs); and qualified small-employer health reimbursement arrangements (QSEHRAs), long-term care (LTC) policies, transportation fringe benefits and adoption assistance. The 2020 adjusted figures reflect the increase in the average chained Consumer Price Index for All Urban Consumers (C-CPI-U) for the 12 months ending Aug. 31, 2019, after applying statutory rounding rules. Regulations issued in June set the 2020 limit for excepted-benefit HRAs, which will also be subject to annual adjustment. Mercer’s 2020 Quick Benefit Facts guide highlights other key health and retirement benefit amounts announced earlier this year.

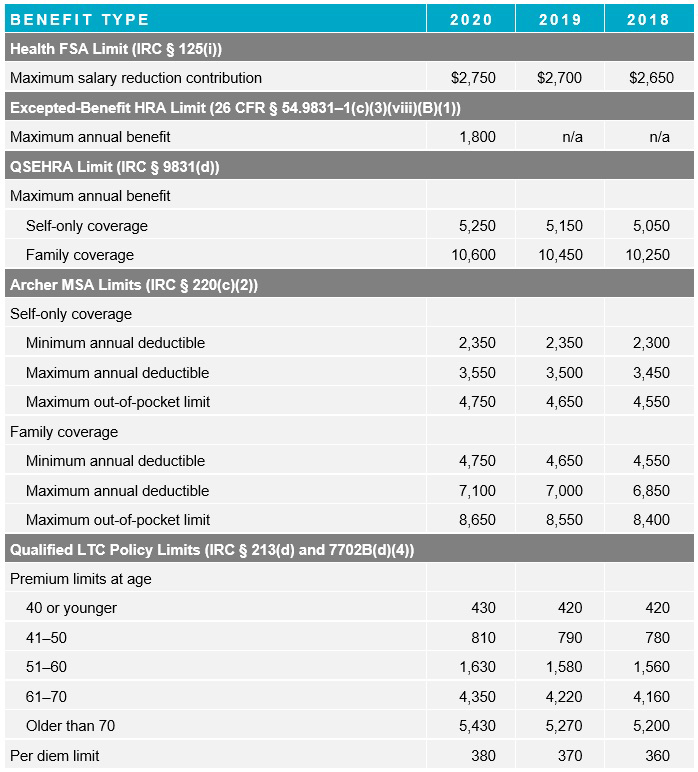

Health FSA, Certain HRA, Archer MSA and LTC Limits

The table below shows the 2020 adjusted amounts for health FSAs, QSEHRAs, Archer MSAs and qualified LTC policies set by Rev. Proc. 2019-44, along with the limits for 2019 and 2018. Also shown is the 2020 maximum annual benefit set by June regulations for the newly allowed excepted-benefit HRAs.

The 2020 adjusted amounts for health savings accounts (HSAs), HSA-qualifying high-deductible health plans, certain nongrandfathered health plans and various indexed amounts for the Affordable Care Act’s employer-shared responsibility provision were announced earlier this year.

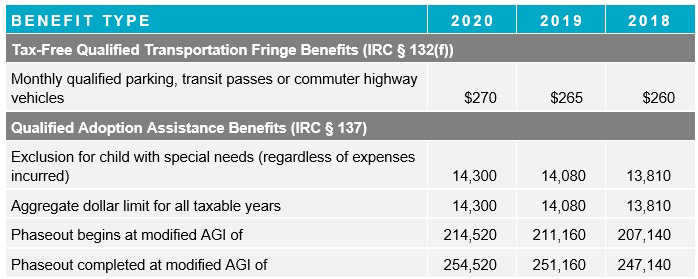

Qualified Transportation and Adoption Assistance Benefits

This table shows the 2020 adjusted figures for qualified transportation fringe benefits and adoption assistance set by Rev. Proc. 2019-44, along with amounts for 2019 and 2018.

Related Resources

Non-Mercer Resources

- Rev. Proc. 2019-44 (IRS, Nov. 6, 2019)

- Press Release: IRS Provides Tax Inflation Adjustments for Tax Year 2020 (IRS, Nov. 6, 2019)

- Rev. Proc. 2019-29 (IRS, June 22, 2019)

- Final Rule: Health Reimbursement Arrangements and Other Account-Based Group Health Plans (Federal Register, June 20, 2019)

- Rev. Proc. 2019-25 (IRS, May 28, 2019)

- Final Rule: HHS Notice of Benefit and Payment Parameters for 2020 (Federal Register, April 25, 2019)

Mercer Law & Policy Resources

- 2020 Quick Benefit Facts (Nov. 6, 2019)

- 2020 Qualified Transportation, Health FSA and Archer MSA Limits Projected (Aug. 16, 2019)

- 2020 Affordable Percentage for Employer Health Coverage Shrinks (July 23, 2019)

- Final Rules Ease Restrictions on Health Reimbursement Arrangements (June 14, 2019)

- 2020 Health Savings Account, High-Deductible Health Plan Figures Issued (May 28, 2019)