2020 Health Savings Account, High-Deductible Health Plan Figures Issued

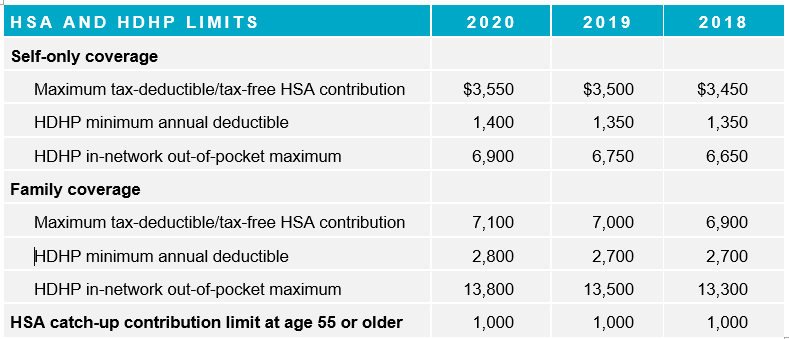

The IRS has announced that all 2020 inflation-adjusted amounts for health savings accounts (HSAs) and high-deductible health plans (HDHPs) will increase from 2019 levels. The HSA catch-up contribution is set by statute and is not indexed for inflation after 2009. The table below shows the limits for 2018‒2020.

ACA out-of-pocket maximums are higher. As announced by the Department of Health and Human Services in April, the 2020 out-of-pocket maximums for non-grandfathered group health plans under the Affordable Care Act (ACA) — $8,150 for self-only and $16,300 for other coverages — are higher than 2020 HDHP out-of-pocket maximums.

Related Resources

Non-Mercer Resources

- Rev. Proc. 2019-25 (IRS, May 24, 2019)

- HHS Notice of Benefit and Payment Parameters for 2020 (Federal Register, April 25, 2019)

Mercer Law & Policy Resources

- 2020 ACA Cost-Sharing Caps Set, Play-or-Pay Penalties Projected (May 8, 2019)

- 2019 Quick Benefit Facts (March 22, 2019)

- Summary of 2019 Benefit-Related Cost-of-Living Adjustments (March 18, 2019)

- 2019 Compliance and Policy Outlook for Employer-Sponsored Health Benefits (Feb. 6, 2019)

Other Mercer Resources

- Employers Stepping Up, Not Stepping Away From, CDHPs (Nov. 8, 2018)

- How HSAs Bend the Cost Curve — Making the Case to Congress (June 8, 2018)

About the author(s)

Kaye Pestaina

Related Solutions

Related insights