Regulators Clarify Implementation Timeline of Transparency Provisions

Recent agency FAQs clarify the timeline for health plans and insurers to implement key transparency provisions in the Consolidated Appropriations Act, 2021 (CAA). The FAQs also address the interplay between the final transparency-in-coverage (TiC) rules published in November 2020 and the CAA’s transparency provisions. This alert describes this much-awaited guidance from the departments of Labor, Health and Human Services, and Treasury.

Machine-readable files enforcement delayed; more to come on prescription drug reporting

Final TiC rules require nongrandfathered group health plans and insurance issuers in the individual and group markets to disclose extensive price and cost-sharing information beginning in 2022. Potential prescription drug disclosures have been particularly controversial. The FAQs provide three important enforcement delays:

- Enforcement related to posting machine-readable files with prescription drug prices delayed pending further rulemaking. The final TiC rules and the CAA contain “potentially duplicative and overlapping reporting requirements for prescription drugs,” regulators acknowledge. This enforcement delay gives the departments more time to determine whether the requirement to publish prescription drug information in a machine-readable format remains appropriate in light of the duty to report information on pharmacy benefits and drug costs to the departments, described below.

- Prescription drug reporting deferred until Dec. 27, 2022. The CAA requires plans and issuers to report data on plan coverage and costs associated with prescription drugs to the departments. The agencies will use this data to issue public reports on prescription drug coverage, pricing trends and impacts on premium rates. Both the first reporting deadline of Dec. 27, 2021, and the second deadline of June 1, 2022, are postponed pending the issuance of regulations. The departments encourage plans to prepare to report 2020 and 2021 data by Dec. 27, 2022.

- Enforcement related to posting machine-readable files with in-network rates and out-of-network allowed amounts and billed charges delayed until July 1, 2022. This TiC requirement applies starting with plan or policy years beginning on or after Jan. 1, 2022, but the departments will defer enforcement until July 1, 2022. This six-month delay gives plans, issuers and third-party vendors extra time to fully comply.

Price comparison tool requirements clarified

Both the final TiC rule and the CAA require plans and issuers to make price comparison tools available to individuals. The TiC and CAA requirements for these tools largely overlap, although the CAA requires making price comparisons available by telephone in addition to online or on paper upon request. The departments plan to add telephone access to the TiC price comparison requirements and solicit comments regarding whether compliance with the TiC rules will satisfy the CAA’s similar requirements for price comparisons.

Delayed enforcement of CAA’s price comparison tool requirements

The departments also are delaying enforcement of the CAA's price comparison tool requirements for plan years beginning before Jan. 1, 2023, to align the enforcement of the CAA and TiC requirement. The guidance nonetheless encourages plans and issuers to make the TiC price comparison tools available by the appropriate deadlines. Under the final rules, health plans and insurance issues must make price comparison data for 500 specific items and services available for plan years beginning on or after Jan. 1, 2023, then issue price comparison data for all remaining covered items and services for plan years beginning on or after Jan. 1, 2024.

Additional implementation guidance and enforcement delays

Some CAA guidance won’t be issued by applicable effective dates. Plans and issuers must prepare to comply with the following requirements using a “good faith, reasonable interpretation of the law”:

- New identification (ID) card requirements

- Prohibition on gag clauses: The FAQs confirm the CAA’s prohibition on gag clauses in provider and other service provider agreements took effect Dec. 27, 2020, although regulators may issue additional guidance on the annual compliance attestation that plans and issuers must submit to the departments.

- Accurate provider directories

- Balance-billing disclosure

- Continuity-of-care protections

The FAQs provide some examples of what good faith compliance means for these requirements. With the exception of the prohibition on gag clauses, all provisions listed above take effect for plan or policy years beginning on or after Jan. 1, 2022.

Delayed enforcement of some CAA requirements

Certain CAA requirements are more difficult to implement, so the departments are delaying enforcement of the following provisions pending publication of regulatory guidance:

- Advance explanation of benefits (EoB). Regulations detailing the advance EoB requirement are not anticipated before Jan. 1, 2022.

- Reporting on pharmacy benefits and drug costs. As noted earlier, the guidance encourages plans to prepare to report 2020 and 2021 data by Dec. 27, 2022.

Other clarifications

The guidance confirms that the CAA has no broad exemption for grandfathered health plans. Certain of the CAA’s patient protections apply to grandfathered health plans, including protections against surprise medical and air ambulance bills, advance EoBs, and others.

The departments did not delay or provide enforcement relief for the CAA’s surprise billing requirements. The guidance likewise doesn’t delay or give enforcement relief for the CAA’s requirement for plans and issuers to maintain a written comparative analysis of the plan’s nonquantitative treatment limitations (NQTLs) under the Mental Health Parity and Addiction Equity Act (MHPAEA) or to provide a copy of that analysis to the departments upon request.

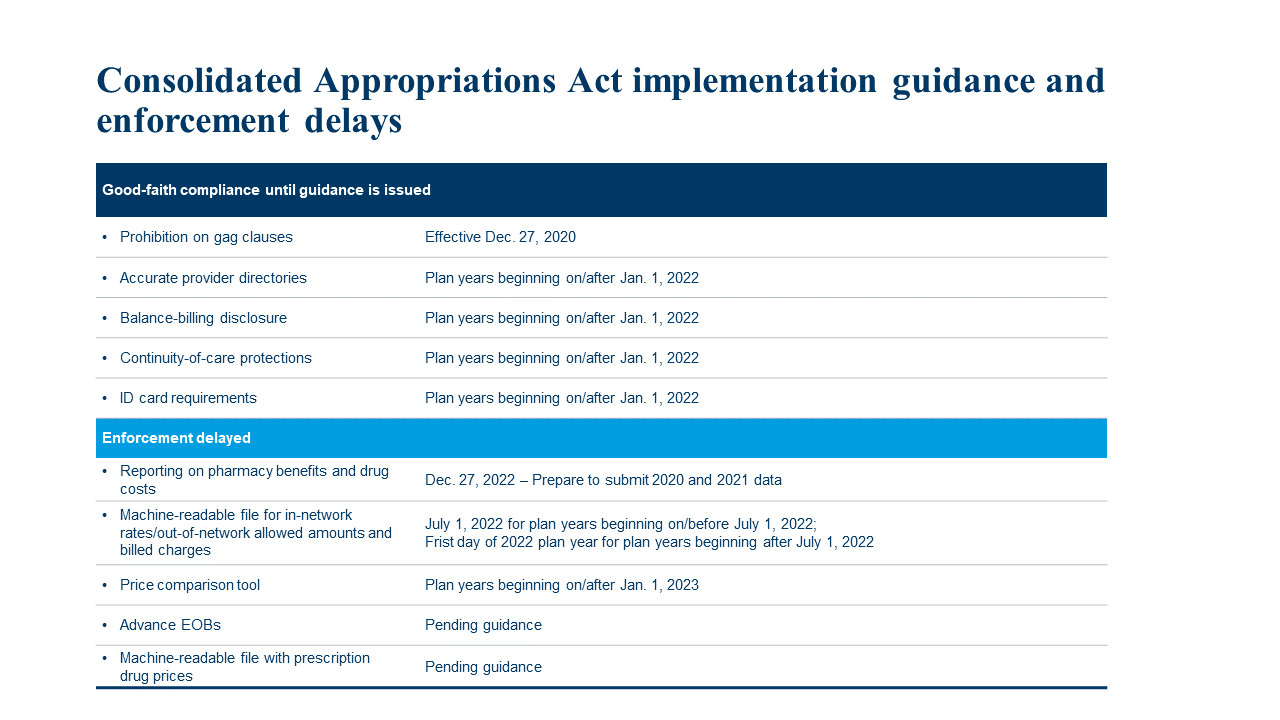

This chart summarizes the transparency-in-coverage provisions addressed in the FAQs and whether an enforcement delay applies.

Related products for purchase

Related Solutions

Related Insights

-

Reward trendsSales compensation framework: Why sales performance challenges have arisen for sales organizations in recent years.

-

Total rewards

The leaky bucket in total rewards: A cost-conscious leader’s guide to hidden overspend

Small inefficiencies can quietly elevate your total rewards spend — until they build up too much to be ignored. Find five places leaks may be lurking — and what… -

Exec comp trends

SEC roundtable: SEC lays the groundwork for significant changes to executive pay disclosure

SEC's roundtable on executive compensation calls for modernizing disclosure rules to enhance investor clarity and reduce company burdens.