Nearly Half of Employers Allowing Mid-Year Election Changes

In response to COVID-19, recent IRS guidance allows health plan employer-sponsors to “reopen” their benefit plans and flexible spending accounts (FSAs) for the 2020 plan year to all employees and their dependents, whether they currently participate or not. Mercer’s current COVID-19 survey, with about 300 responses to date, asks employers if they are in fact permitting employees to make any type of mid-year changes allowed by the IRS guidance.

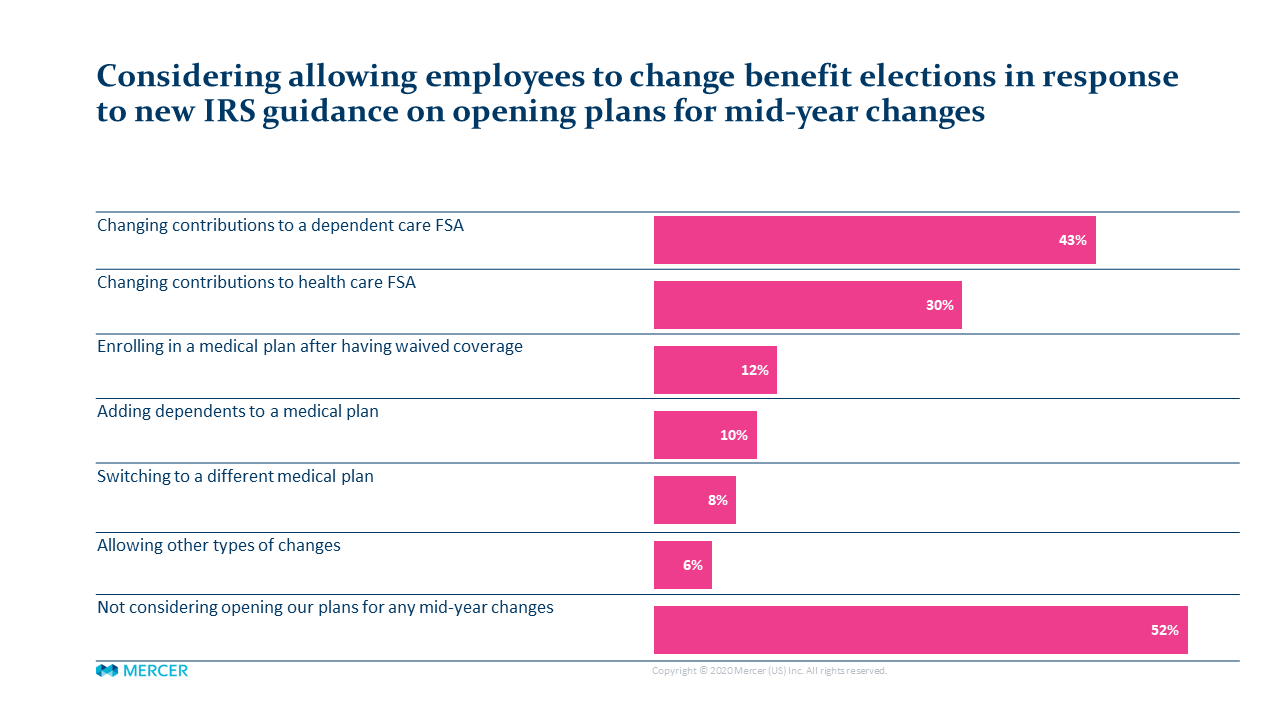

Just under half (48%) of the employers surveyed indicated they will allow some type of mid-year change, most commonly “changing contributions to a dependent care FSA”(43%) and “changing contributions to health care FSA” (30%). Fewer employers are planning to allow changes to medical plan elections, such as enrolling in a plan after having waived coverage or adding a dependent. Nevertheless, just over 1 in 10 say they will allow these types of changes.

Allowing participants to change their contributions to dependent care or health FSAs can be a relatively simple way for employers to support employees coping with COVID-19 related issues. If a child’s summer camp is cancelled, for example, an employee might not be able to spend the money in a dependent care account, while another employee might have new childcare expenses because of school closings. Or an employee whose spouse is out of work might simply need more money in their paycheck.

For employers, there is virtually no downside in allowing dependent care FSA changes. There are some potential risks associated with allowing changes to health FSAs. These include immediate employee access to full account limits, which might be an issue for employers that are hyper-focused on conserving cash. There is also potential for employees to accelerate their use of health FSA funds and leave the plan in a deficit if they discontinue employment.

Permitting enrollment changes mid-year in core medical plans, however, brings with it much greater risk to the sponsor, such as incurring high cost claims and generally enabling adverse selection. It can also have collateral impact on stop-loss reinsurance and other related contracts. Employers should weigh these risks thoughtfully before liberalizing the terms of mid-year enrollment in medical plans in 2020.

The full US results of the current Mercer COVID-19 survey are available here.

Source: Mercer COVID-19 survey, US results as of 6/9/2020 (279 respondents, more than one response allowed)