Mercer Survey Finds Employers Hold Health Benefit Cost Increases

For those of us involved with Mercer’s National Survey of Employer-Sponsored Health Plans, Fall is more like Spring -- a time of anticipation. While the full survey results are still some weeks away, we crunched about 1,500 responses submitted through August to provide you with one key result and our thoughts about it. Nearly 2,500 employers ultimately participated in the survey, which is now closed.

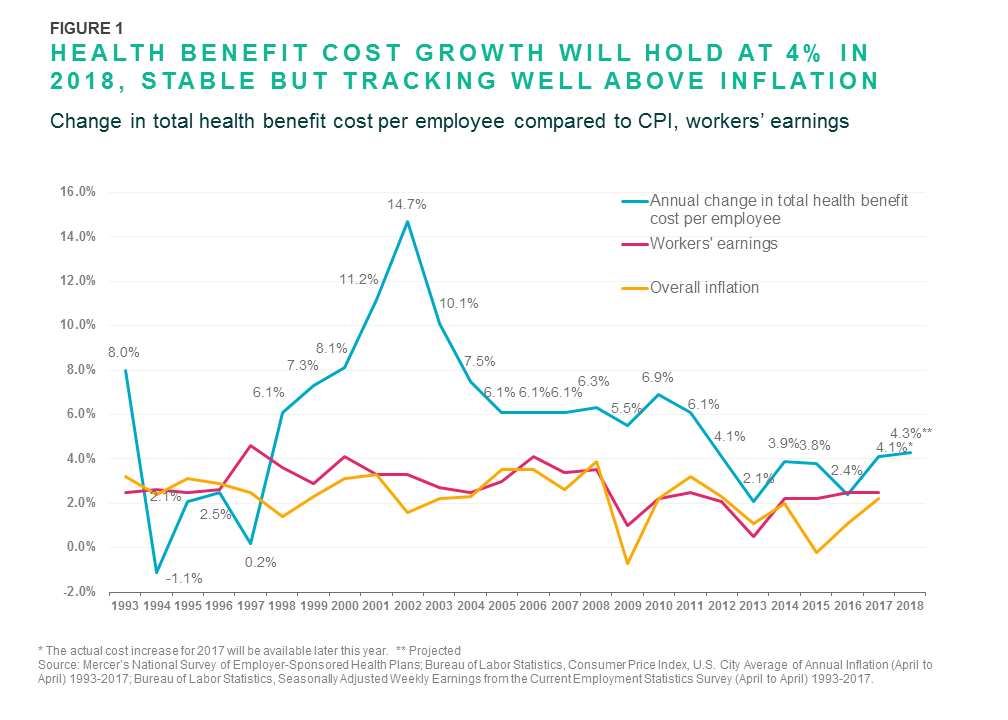

Employers project that health benefit cost per employee will rise by 4.3% on average in 2018 after they make planned changes such as raising deductibles or switching carriers. Over the past five years, Mercer’s surveys have found that the average annual increase has been about 3%; an increase of 4.3% would be the highest since 2011, when cost rose 6.1%.

The projected underlying cost growth from 2017 to 2018 is 6.0%. That is the increase employers would expect if they made no changes to their medical plans; however, the survey found that 46% of employers will take steps to reduce cost growth in 2018. Offering lower-cost, high-deductible health plans has been an important strategy for holding down cost over the past decade, and the need to minimize exposure to the ACA’s excise tax on high-cost plans has accelerated this trend.

Employers find the challenge of juggling cost-management objectives and affordability issues for employees gets harder every year. Consumerism has a role in addressing rising costs, but there are many factors that drive costs, separate and distinct from relative generosity of the plan design. Importantly, employers must contend with cost increases that occur with medical advances – like the introduction of new medications used to treat complex conditions like cancer, multiple sclerosis, and hepatitis C. Respondents to Mercer’s survey reported that spending on these specialty drugs rose by about 15% at their last renewal, pushing up growth in the overall cost of prescription drugs to more than 7%. With so many new specialty drugs in the pipeline and few well-known brand-name drugs going off-patent in the near future, the spiraling drug cost problem will certainly get worse before it gets better.

But with the ACA’s excise tax still on the books and slated to go into effect in 2020, employers may have to pick up the pace of change to try to stay ahead of cost increases. Based on last year’s survey data, we estimate that 31% of large employers (500 or more employees) would be liable to pay the excise tax in 2020 – and with the tax threshold indexed to inflation and rising at about half the rate of health benefit cost, more employers would pass the threshold each year.

The excise tax creates pressure to generate immediate cost savings though cost-shifting or other short-term fixes. But employers are also making good progress with longer-term strategies that address the root causes of high cost and cost growth.

Strategies that employers are adopting to manage medical costs without raising employee out-of-pocket spending include providing care coordination and support for high-cost claimants (learn more about the experience of employers using Mercer’s Health Advantage for this purpose). Employers are also addressing quality by using incentives to direct employees to Centers of Excellence and other high-performance provider networks. And they are shifting away from traditional fee-for-service provider reimbursement toward new payment models that reflect the value of the services provided rather than just the quantity.