How to Achieve Higher CDHP Enrollment in 2016

Implementing a low-cost, high-deductible consumer-directed health plan (CDHP) has been one of employers’ top strategies for avoiding the excise tax in 2018 — and for managing health benefit cost growth in general. But about half of all large employers (those with 500 or more employees) already offer a CDHP — and about 9 out of 10 of them offer the CDHP as a choice rather than as a full replacement. For these employers, the challenge is to build enrollment.

Enrollment in a CDHP does rise over time, but rather slowly. According to our annual survey of employer health plans, among large employers that have offered a CDHP with a health savings account for at least three years alongside other plan options, average enrollment rose from 20% in 2012 to 29% in 2014. If you’ve put in a CDHP only recently, that pace of growth could leave you short of where you want to be by 2018.

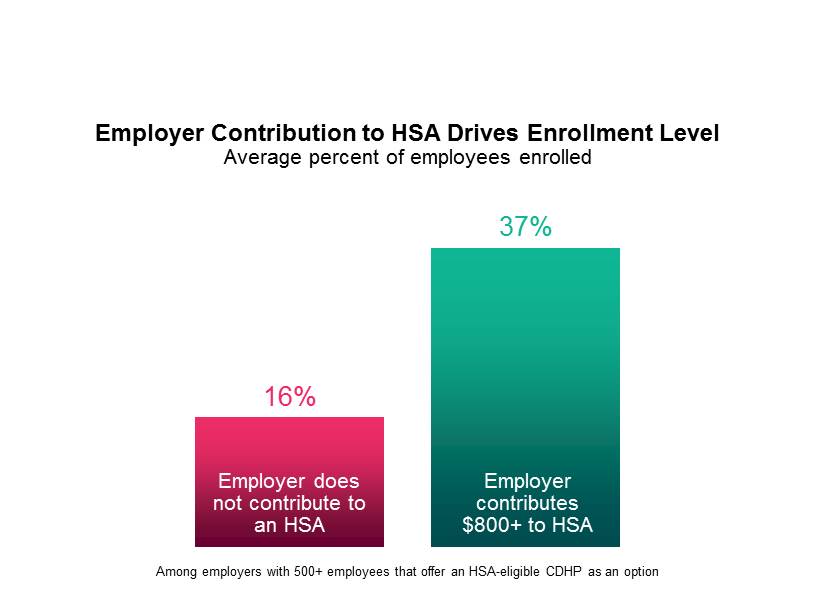

Fortunately, survey data also shows that there are steps employers can take to boost enrollment. As you might expect, employers that make a significant contribution to their employees’ HSA accounts see significantly higher enrollments. Among plans in which the employer contributes $800 or more (for the employee only), the average enrollment rate for 2014 was 37% of eligible employees, compared to just 16% among plans with no employer contribution. Currently, just 71% of sponsors make a contribution, and the median employee-only contribution is only $500.

But robust employee communication may be nearly as powerful a driver. Sponsors that describe communication levels as “extensive” achieved an average enrollment rate of 32%, compared to just 17% among those describing communication as “limited.” In the best programs, employee communication isn’t just about providing information about the plan — it’s a comprehensive education campaign to help employees learn to be better health care consumers. Sponsors can provide meaningful support for consumerism with a transparency tool to help employees find cost-effective, quality providers. Offering employees a financial incentive to try the tool can boost usage.

The benefits of a comprehensive communication campaign go beyond higher enrollment. It is associated with higher satisfaction among plan members — which, in turn, will likely drive enrollment still higher because of positive word of mouth. Among large employers with extensive communication, 78% reported that employee response to the plan has been largely positive, compared to just 66% of employers providing limited communication.

It’s not too soon to be thinking about open enrollment goals for 2016. If yours include higher enrollment in a CDHP, look to your account contribution and communication strategies.