Mercer projects 2022 retirement plan limits will soar

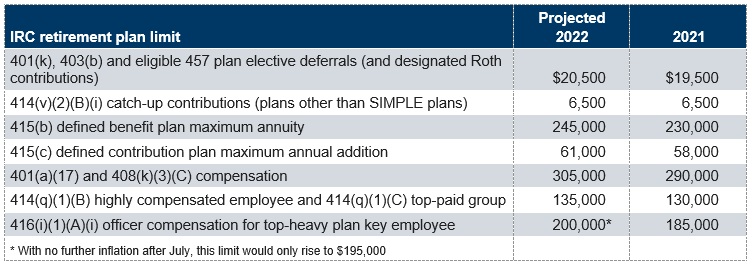

Almost every key Internal Revenue Code (IRC) limit for qualified retirement plans will increase significantly in 2022, Mercer projects. The 2022 limits will reflect increases in the Consumer Price Index for All Urban Consumers (CPI-U) from the third quarter 2020 to the third quarter 2021. Using this measure, inflation will likely reach its highest level since 2008 — possibly since 1990 — and cause some limits to rise by the equivalent of up to three years’ worth of ordinary increases. Only the catch-up contribution limit, which has a relatively large rounding value, is expected to stay the same next year.

These estimates are determined using the tax code’s cost-of-living adjustment and rounding methods, the CPI-U through July, and estimated CPI-U values for August and September. Figures can’t be finalized until after September CPI-U values are published in October. IRS usually announces official limits for the coming year in late October or early November.

Despite the volatile economic environment, these values should hold unless August and September inflation is exceptionally high or reverses (i.e., inflation shifts to deflation).