Walmart & Humana - Next Disruptor in Health Care?

It has been a busy few months tracking all the merger/acquisition/partnership announcements in the health care market: CVS/Aetna, Cigna/Express Scripts, Amazon/Berkshire Hathaway/JP Morgan, and several large hospital system mergers on top of that. Each in their own way informing different ways for us to think about health care delivery and the potential positive impact of disruption. Disruption is one of Mercer’s four vitals for change – areas where we believe change is most needed to create a more rational health care marketplace.

Even though a deal has not been announced, let’s explore the potential of a Walmart/Humana partnership.

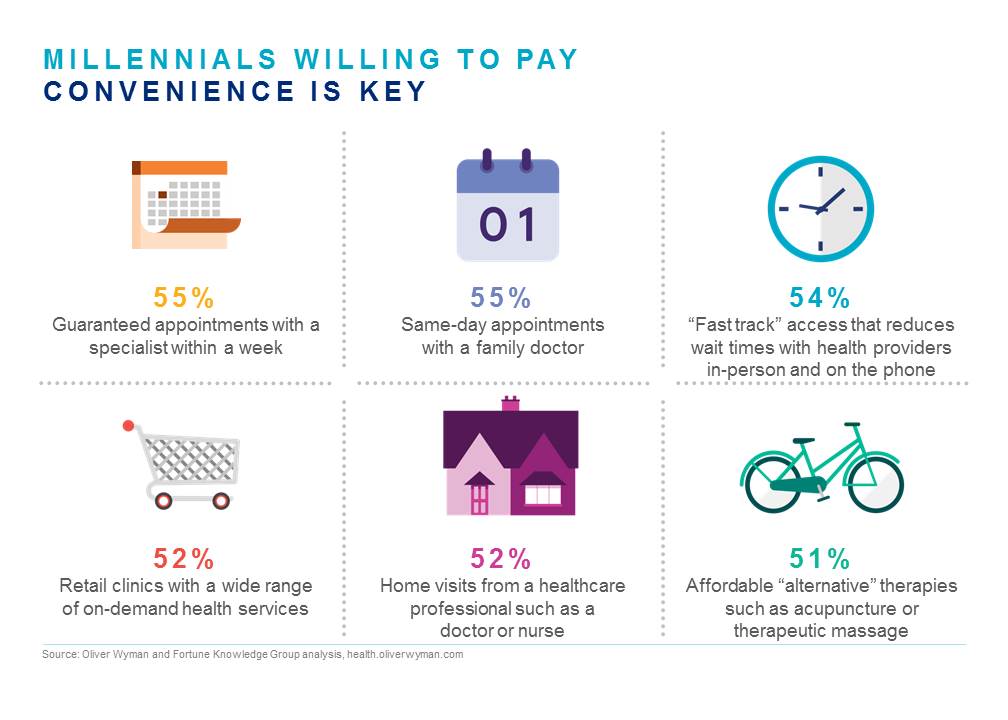

1. Health care is local. Walmart/Sam’s Warehouse is everywhere – 4,700 stores across the US, most with pharmacies and some with retail clinics. Larry Levitt, SVP at Kaiser Family Foundation, put it best in a recent comment to CNN Money: “People still get their health care in person.” While some think a technology play may be the smarter approach in the long run - a la Amazon/BH/JPM – survey and analysis from both Oliver Wyman and Fortune Knowledge Group suggests millennials are the most interested generation in new health care offerings, they still have value for health care delivered in person. (See graphic below).

2. Data is power. According to the WSJ the deal would bring a “rich trove of data” combining Humana data with Walmart pharmacy, on-site clinic, and possibly lab data from on-site lab testing services. The data provide an advantage when building a strategy for what services to offer and how best to engage customers.

3. Build what people want. Walmart has on-site clinic experience – while reports of the success of the clinics is mixed, remember that some of the best lessons are learned from failures. I heard someone from their operations side speak at a conference several years ago. He shared some of their learnings for their on-site clinic experience. Their customers were interested in getting health care at WalMart, just not necessarily the services offered. For example, some of their female shoppers expressed interest in getting their annual well woman visit – something not typically offered at a convenience care clinic. They also learned of interest from Medicaid members in rural areas where health care access is very limited. This partnership could foster new ways to bring people what they want and need.

4. Walmart/Humana as a new insurance company in group market? Today Humana’s footprint in the group market is as a regional player with strength in the southern states. At a time when the number of national group insurance options have been shrinking, could a partnership with Walmart catapult them into the arena with other national players?

5. Medicare is the fastest growing segment of health care purchasing. Walmart and Humana already partner on Medicare Part D drug plans. Humana has a large stake in the Medicare market with 3.5 million in Medicare Advantage plans and 4.9 million in Medicare Part D drug plans. As more baby boomers retire, the Medicare market with continue to grow at a fast pace. This could open up new opportunities for how seniors buy and access care.

6. Potential cost effective access point for new programs for the uninsured. As the government seeks to give States more flexibility for Obamacare replacement plans, the Walmart-Humana partnership could open new, cost effective opportunities especially in rural locations where access to health care providers is challenging.

Will it really happen? Will Walmart become a new entrant into the health insurance market? None of us know yet. What we do know is that disruption is a good thing. Embracing disruption means leveraging constant changes in the system – with internal stakeholders and external partners – to the best advantage of everyone. Stay tuned.

To learn more regarding this topic, please visit this CNBC article quoting Tracy Watts.