Checklist: Open Enrollment Messages

Every year, I compile a list of things for people to consider during the annual enrollment season. It’s a helpful reminder for us benefits professionals, and might even trigger another idea for your open enrollment communications.

1. Take more than five minutes to look at your open enrollment materials and see what is new for 2020. This is also the perfect time to re-assess all the benefits your employer offers to be sure you are taking advantage of all your benefits – and not just medical. Consider things like income needed in the event of disability, life insurance needs, and retirement planning. Also, student loan repayment has become a hot topic. Some employers may be offering new programs to help refinance and/or supplement repayment.

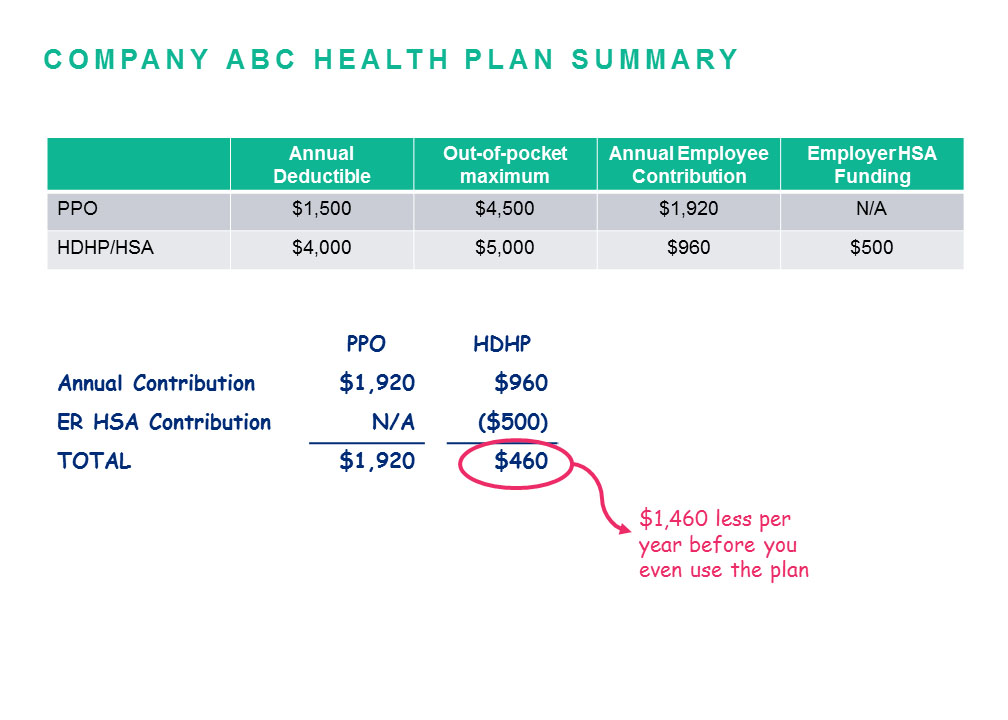

2. Really do the math. Quite often, the lowest cost medical plan is the most financially beneficial plan to sign up for. I know this is hard to believe, but many people buy more health insurance than they need. Don’t just look at the deductibles in each plan. It is important to calculate the annual amount that will be withheld from your paycheck for each option with a credit for any money your employer will put in a Health Savings Account (H.S.A.) just for enrolling. Here is a basic example of how to “do the math”:

3. Take advantage of incentives. Read the enrollment materials carefully. Some employers provide a financial incentive to complete a health assessment and/or participate in biometric screening. Participating could result in lower paycheck deductions or money in your Health Savings Account.

4. Contribute to your Health Savings Account (H.S.A.) – If you decide to sign up for the low option plan, use the savings from what would have been deducted from your paycheck for the more expensive plan and contribute that money to your H.S.A. Then, if you need care, you will have money saved to cover your out of pocket expense. Also, this is your only opportunity to get a TRIPLE tax advantage. If you save $50,000 for retiree medical and plan to withdraw $5,000/year once you turn age 65, the $50k in the H.S.A will last SIX years longer than the same $50k in your 401k because of the tax free withdrawals. Note that the H.S.A. withdrawals can only be for health care expenses. See our blog post on HSAs for a deeper analysis.

5. Review supplemental health coverage options. An example of a supplemental plan is a hospital indemnity plan or accident plan that would pay a cash benefit if you are hospitalized or have an accident. Each plan will have a list of what qualifies for the benefit and how much the payment will be. You can use the cash for your deductible and out of pocket medical expenses. The cost of supplemental coverage is inexpensive and provides peace of mind.

6. Consider new plans with smaller networks. Some companies are offering plans that are in-network providers only and in some cases the network is a specific group of doctors and hospital. These options may be available at a lower cost. When considering a more limited network for you and your family, check to see if your doctor is participating. If you don’t have a doctor, look for information about the quality of the providers participating in the plan. In many cases, the focus of the more limited network is to promote use of higher quality providers.

7. Sign up for Telemedicine – Most health plans include a telemedicine benefit. Do yourself a favor – sign up for it. It is as easy as going on the website and setting up your account. You can use telemedicine for things like colds & flu, bronchitis, sinus infection, upper respiratory infections and pink eye. You can also use for many dermatology issues such as skin infection, acne, skin rash, abrasions, moles/warts and more. Telemedicine is the least expensive way to access care – the cost for a visit ranges from $10 to $40. Some plans may provide the first visit or two at no cost. Once your account is set up, it is easy to schedule an appointment at your convenience via phone or video conference.

8. If you have a chronic condition such as high blood pressure or diabetes, check to see if there is a program offered through the medical plan to help you. Most medical plans have resources to help people manage their chronic conditions. For some reason, the participation is low in these programs. If you are struggling to get your condition under control, give it a chance. The coaches have experience helping people just like you. The faster you learn how to manage your health, the better you will feel.

9. If you, or a family member, get a scary diagnosis. Reach out for help. Your medical plan will assign a case manager to help you, and your family, navigate the health system. Some employers may have special programs to help you – centers of excellence programs for certain conditions or procedures such as orthopedics, cardiology, oncology and infertility. An expert medical opinion program may also be available to help review and confirm diagnosis along with advice on the best treatment approach.

10. Check out dental and vision plan options to be sure you are in the right plan for you/your family. Especially if one of your kids is in need of orthodontia.

Companies invest a lot in providing benefits to meet a wide range of needs. Take the time during open enrollment to understand your options to inform the best decisions for you and your family. It will be time well spent.