Private Equity Services

Challenges

- Unrealised value potential due to limitations in human capital strategy.

- Lack of information on HR readiness going into the close.

- Not enough attention paid to skill sets and redundancies.

- No framework for identifying and delivering high-impact quick wins early in the hold.

- Waiting too long to upgrade HR leadership and develop a roadmap.

- Not linking HR to the deal journey.

- Ignoring the people risks and factors that derail deals and interfere with value creation.

We view private equity deals through a different lens

Research and experience show that to maximise a deal’s potential, human resources (HR) must be in a position to unlock and amplify value. Wherever possible, it is in the best interests of a private equity investor to enable HR as a strategic partner.

Mercer’s approach to private equity consulting differs from that of other firms. We focus on exit value and help buyers optimise the value of their deals by advising them which human capital levers to focus on post-close. These levers include: workforce management, culture and governance, attrition and retention, skills matching, operations and systems architecture. All have the ability to significantly swing the pendulum from failure to success.

By intentionally and thoughtfully aligning our clients’ people strategies to their business objectives, we help them improve productivity, reduce disruptive forces, enhance data integrity and accelerate efficiencies. This allows us to unlock the greatest value creation potential. Our approach brings many benefits:

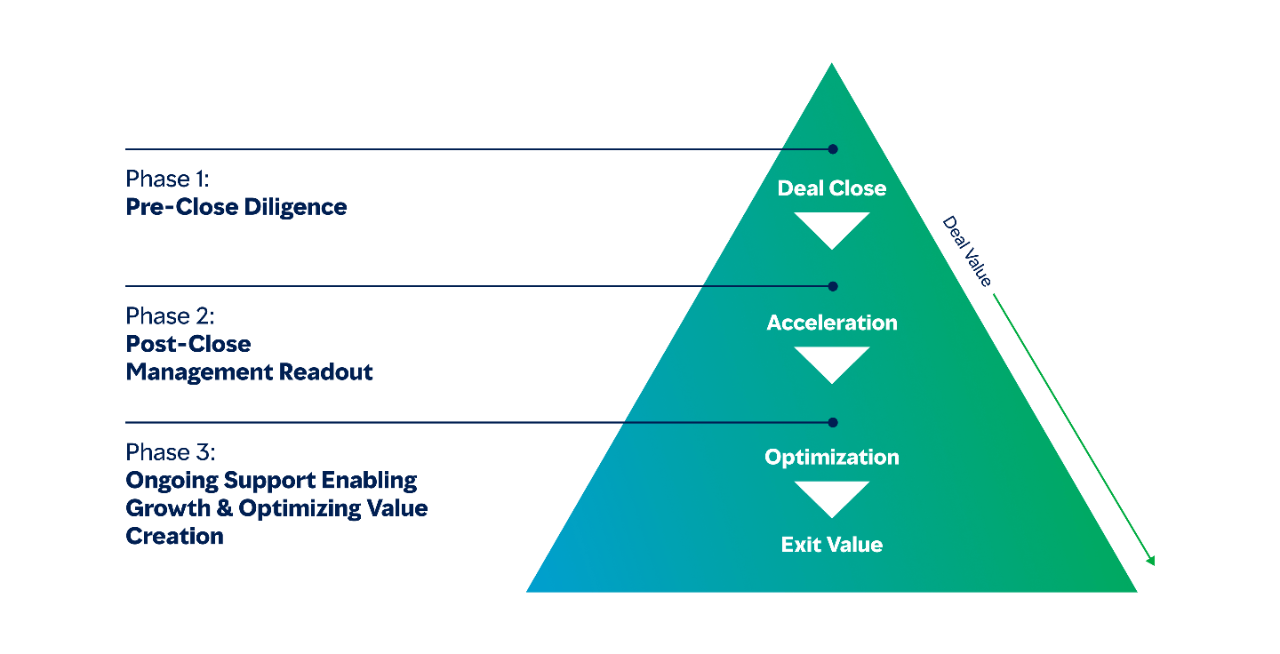

Evolved private-equity HR support goes beyond due diligence to maximise deal value

Outside of raw materials, people are our largest investment … and probably where we have our biggest black holes.

Delivering the deal by mitigating risks and removing factors that can derail a project

of deals fail primarily due to people risks.

of executives report that workforce risks were not quantified or built into the financial model.

report the leadership team as the primary cause the financial targets outlined in the deal model are not met.

increase in sales.

greater profitability.

Mercer’s value proposition

To have a successful exit, we need to demonstrate that we are more than just a sum of our parts.

What makes Mercer different?

years of deal experience

transactions annually

country operations

cross-border transactions

languages