How Mercer’s financial advisers can help you

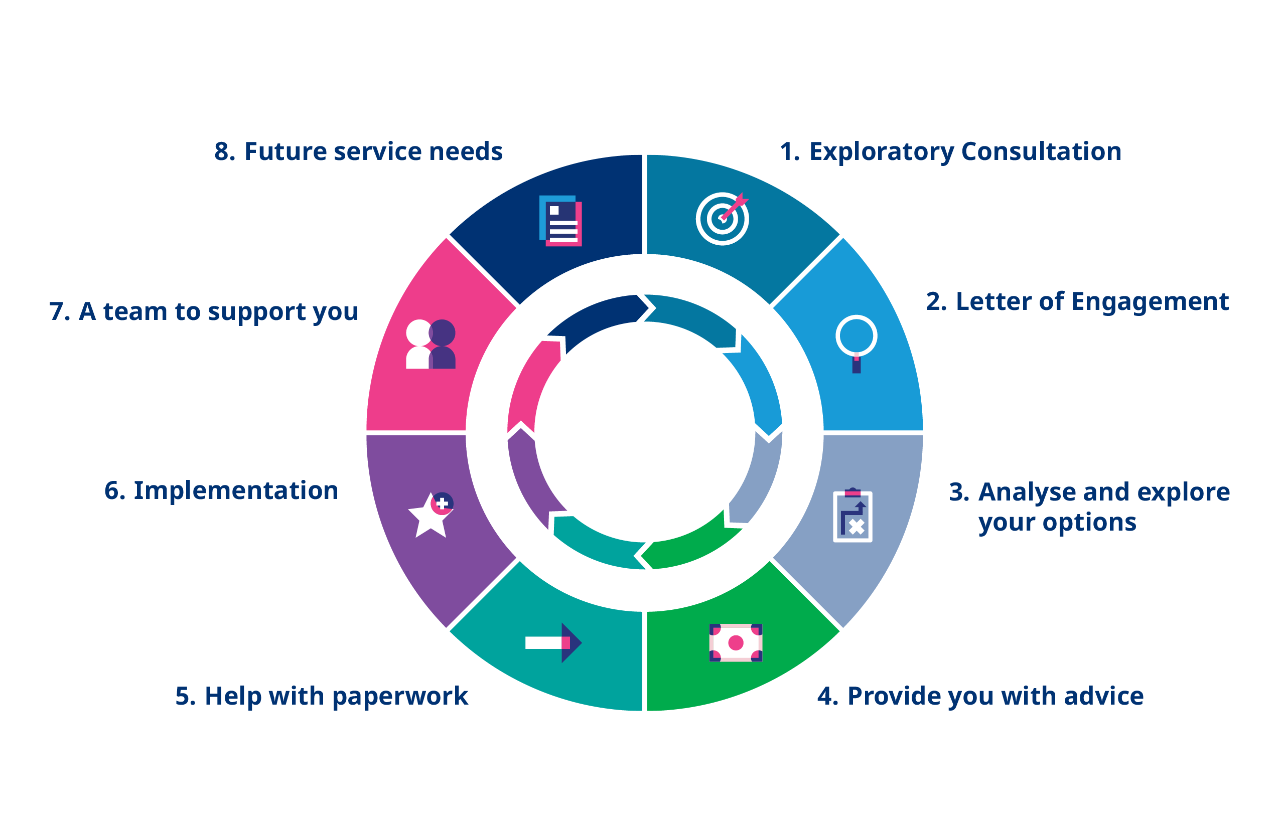

Are you interested in getting financial advice, but unsure about what the process involves? We discuss the eight simple steps that Mercer Financial Advisers will take you through as part of a long-term wealth management strategy.

-

Set up an exploratory consultationThis is your opportunity to share your current financial situation and outline your wealth management goals and objectives.

-

Supply a Letter of EngagementAfter agreeing on the scope of financial advice and services to meet your needs, your financial adviser will provide a Letter of Engagement confirming the applicable fees.

-

Analyse and explore your financial optionsYour financial adviser will analyse and explore the options available to help you meet your financial goals.

-

Provide you with adviceYour financial advisor will present and discuss the recommendations and outcomes of the advice. Payment for the agreed cost of the advice will be arranged at this time.

-

Help you with paperworkOnce you have agreed to proceed with the advice service, the Mercer Financial Advice team will prepare the necessary paperwork for you to securely complete, either at a Mercer office, via electronic signature (e.g., Docusign), or through the post.

-

Begin the implementation phaseIf you wish, Mercer Financial Advice will take care of the implementation side of any Statement of Advice issued to you, including follow-up with product issuers and other third-party specialists.

-

Count on our team to support youYou will receive the support of your Mercer Financial Advice team should you have any questions about your financial arrangements.

-

Plan your future service needsThis step involves a discussion about your future service needs and how we can help.

FAQs

Everyone’s situation is different, so the cost of preparing and implementing a Statement of Advice will vary depending on the complexity of your needs and circumstances and the advice required.

Following your initial consultation and before proceeding with any Statement of Advice your Mercer Financial Adviser will assess your specific advice needs as well as explain the fees and costs associated with the development of the financial plan and, if required, to implement the recommended advice strategies.

You can choose to pay your fee directly, or you may be eligible to pay from your super account.

You can choose whether or not to receive ‘one off’ advice or to engage a financial advice on an annual service package, meaning your financial plan remains relevant and appropriate as your personal circumstances change during the year.

Your financial adviser will discuss the different options with you – Mercer Financial advisers are fully transparent about any fees you will need to pay.

Financial advisers are required to find out as much as possible about your current financial situation and circumstances. Prior to your first meeting you should prepare your financial documentation such as bank account statements, insurance policies, asset information, loan and credit card statements, income/expenses and tax file number to help them understand your financial position.

They will also need to understand how comfortable you are with investment risks, so they can assist you with any investment product recommendations.

Read our insight article ‘First meeting with a financial adviser’ to understand how to prepare.