Vermont Reissues Employer Health Plan Assessment Reporting Guidelines

Vermont tax regulators have updated guidance (Pub. FS-1144) for employers subject to the state’s Health Care Fund Contribution Assessment. Under Vermont law (32 VSA Ch. 245), employers in the state face this assessment if they have more than four full-time equivalent (FTE) employees who lack qualifying health coverage. The updated guidance outlines which employees count in an employer’s FTE calculation, what causes an employee to be considered “uncovered,” and how employers should report and remit any assessments owed to the state.

Scope of the Law

Since 2007, Vermont law requires certain employers to pay a quarterly fee for “uncovered employees” who don’t have qualifying health coverage. No matter where the employer’s headquarters or health plan is legally located, any employer with more than four FTE uncovered employees working in Vermont in any calendar quarter is subject to the assessment.

The assessment applies regardless of the reason for employees’ lack of employer-sponsored coverage — whether the employer never offered any health coverage, or employees declined to enroll in the employer’s plan without having coverage from another employer. Employers likewise face the assessment if they have employees in the state enrolled in Medicaid or health insurance purchased — with or without any federal subsidy — through the state’s exchange.

Qualifying Coverage

Under the Vermont law, healthcare coverage means a private or public plan that includes hospital and physician services. In addition, the employer must contribute toward the cost of the coverage.

Uncovered Employee

To determine potential liability, employers must identify all employees subject to Vermont’s unemployment law who meet the state’s definition of “uncovered employees” — including part-time or seasonal workers, with one exception: If the employer offers qualifying health coverage to all regular full-time employees, then part-time and seasonal employees who enroll in exchange coverage aren’t considered uncovered.

An employer must count the hours of any uncovered employee who is age 18 or older, is subject to the unemployment law, and meets any of the following conditions:

- Declines employer-sponsored coverage and has no other coverage.

- Is full-time (generally works 30 or more hours per week) and not seasonal (works at least 20 weeks per year), but isn’t offered coverage to which the employer contributes (even if the employee has other health coverage).

- Is part-time (works fewer than 30 hours per week) or seasonal (works 20 or fewer weeks per year), isn’t enrolled in the employer’s plan, and has no other coverage.

- Purchases individual coverage on the Vermont exchange (even if eligible for employer coverage and ineligible for a federal subsidy to buy exchange coverage), unless the exception for certain part-time and seasonal employees applies.

- Enrolls in Medicaid.

- Doesn’t submit a declaration of health coverage to the employer.

Employee Declaration of Health Coverage

Employers must collect from each employee who declines employer coverage a signed annual declaration of health coverage (Form HC-2). This form states whether the employee has other coverage and provides information on the coverage. Employers must keep declarations on file for at least three years

The declaration can help identify employees enrolled in Medicaid or exchange coverage, although employers don’t need to verify the other coverage or submit the forms to regulators (unless requested). If an employee not covered by the employer’s plan fails to return the declaration, the employer must assume the employee is “uncovered.”

Computing and Reporting the Fee

The quarterly assessment per uncovered FTE employee is $167.02 for quarters ending in 2019. Fee amounts are annually adjusted based on premiums for the second-lowest cost silver plan on the state’s exchange. Regulators haven’t yet posted the 2020 rate.

FTE Calculation

The quarterly assessment is based on hours worked by each FTE uncovered employee, up to a quarterly limit of 520 hours per employee. Employers don’t need to include more than 520 hours per employee per quarter, no matter how many hours an employee actually worked. Unworked hours, such as vacation or sick time, may be excluded from the FTE calculation. A salaried employee counts as one full-time employee working 520 hours per quarter.

Employers must total all uncovered employees’ hours worked (up to the 520-hour cap per employee) in the quarter, then divide the result by 520 to determine the number of FTE uncovered employees. Employers can exclude up to four FTE uncovered employees from this result and may round down to the next lower whole number.

Fee Calculation

The final FTE number is multiplied by the assessment rate (currently $167.02) to determine the quarterly assessment owed.

Example. Evergreen Cleaning employs 10 full-time and 20 part-time employees in Vermont. Full-time workers are eligible for qualifying employer-sponsored coverage to which Evergreen contributes. Only employees with other coverage decline Evergreen’s health plan, and none of them have Medicaid or exchange coverage. Evergreen doesn’t offer health benefits to part-time workers; their only other coverage is through Medicaid. For the third quarter of 2019, Evergreen’s uncovered part-timers’ hours total 2,600. When that total is divided by 520, Evergreen has five FTE uncovered employees for the quarter. After excluding four uncovered employees as the law allows, Evergreen owes $167.02 for the quarter for one FTE uncovered employee.

The state provides a worksheet (Form HC-1) to aid employers’ calculations.

Employer Reporting

Wage and health coverage information is due to tax regulators by the 25th day after the end of each calendar quarter. Employers can file Form WHT-436, Quarterly Withholding Reconciliation and Health Care Contribution, using myVTax.vermont.gov or find the necessary forms and information on the department’s website.

Interaction With ACA

Coverage that qualifies as minimum essential coverage (MEC) under the federal Affordable Care Act (ACA) may not qualify in Vermont as employer-sponsored coverage to avoid the state’s assessment. In addition, the definition of uncovered employees includes a broad spectrum of individuals not included in the federal play-or-pay law.

Coverage Standards

For employers to avoid having uncovered employees, Vermont requires health coverage to include physician services and hospitalization. As a result, some coverage that qualifies as MEC under the ACA may not satisfy the Vermont law. For example, a “skinny-med plan” might cover preventive care, few (if any) physician visits and no hospitalization. This type of plan doesn’t satisfy Vermont’s law but could qualify as MEC under the ACA.

To avoid ACA shared-responsibility penalties, however, employers must offer MEC that is affordable and has a certain minimum value. Both the IRS (Notice 2014-69) and the Department of Health and Human Services (HHS) (Notice of Benefit and Payment Parameters for 2016) have concluded that coverage lacking substantial benefits for hospital and physician services doesn’t meet the minimum-value requirement. So employees offered an employer-sponsored skinny-med plan would remain eligible to enroll instead in exchange coverage and receive premium tax credits. IRS proposed regulations from 2015 would apply this definition of minimum-value MEC for ACA employer play-or-pay purposes, but those rules are not final yet.

‘Uncovered’

The ACA imposes assessments on employers whose full-time employees qualify for subsidized coverage on a public health insurance exchange. Employees who enroll in Medicaid or don’t receive a federal subsidy to buy exchange coverage don’t trigger the ACA’s employer assessments. In contrast, employers could incur a fee for any of their Vermont employees enrolled in Medicaid or the state’s public exchange, even if the individual isn’t eligible for a subsidy.

Example. Joan and Mike work full-time for Red K Co., which offers all employees an HMO that meets ACA’s minimum-value requirement and has employee contributions that satisfy ACA’s affordability standards. Joan can afford the coverage but prefers a PPO, so she signs up for coverage on the Vermont exchange, even though she won’t be eligible for a subsidy. Mike is a low-wage worker at Red K who qualifies for and enrolls in Medicaid. Although Red K won’t owe any federal play-or-pay assessment to IRS for either Joan or Mike, the company must count both employees as “uncovered” for Vermont reporting and could owe the state assessment.

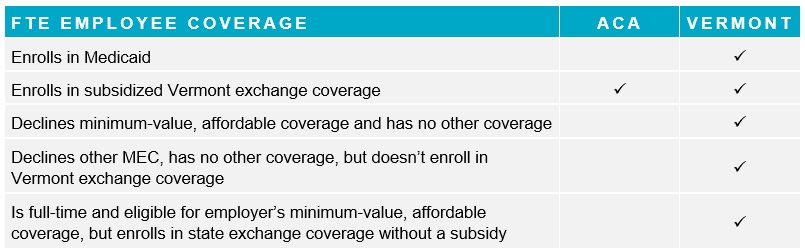

The following chart compares how certain coverage situations could trigger a potential employer assessment under the ACA versus the Vermont play-or-pay law:

Employer Considerations

Employers may want to take these steps to ensure compliance with Vermont’s law:

- Evaluate whether the employer-sponsored plan qualifies as health coverage under the Vermont law.

- Project possible assessment costs by reviewing quarterly data related to Vermont employees’ hours worked relative to the number of Vermont employees who have declined or are ineligible for coverage.

- Establish or continue a process to collect declarations of health coverage from employees who decline coverage and part-time employees who have no other private or public coverage (other than Medicaid).

- Determine if a system is already in place or needs to be established to report “uncovered employees” to tax regulators and remit required amounts.

Related Resources

Non-Mercer Resources

- Pub. FS-1144 (VT Dep’t of Taxes, Revised August 2019)

- Form HC-1, Health Care Contributions Worksheet (VT Dep’t of Taxes)

- Form HC-2, Declaration of Health Care Coverage (VT Dep’t of Taxes)

- Form WHT-436, Quarterly Withholding Reconciliation and Health Care Contribution (VT Dep’t of Taxes)

- 32 Vt. Stat. Ann. tit. 32 §§ 10502–10505, Health Care Fund Contribution Assessment (VT Legislature)

- myVTax.vermont.gov (VT Dep’t of Taxes)

- Vermont Health Connect

- Minimum Value and Affordability (IRS, Jan. 31, 2019)

- HHS Notice of Benefit and Payment Parameters for 2016 (Federal Register, Feb. 27, 2015)

- Notice 2014-69 (IRS, Nov. 4, 2014)

Mercer Law & Policy Resources

- 2020 Affordable Percentage for Employer Health Coverage Shrinks (July 23, 2019)

- 2020 ACA Cost-Sharing Caps Set, Play-or-Pay Penalties Projected (May 8, 2019)

- HHS Posts 2019 Federal Poverty Levels (Jan. 28, 2019)