Washington, DC’s paid leave program starts July 1

Almost one year after Washington, DC, started collecting an employer payroll tax to fund universal paid leave (UPL), the program will begin providing benefits on July 1. This article covers new developments and updated information since the GRIST published last year. Along with finalizing separate UPL rules on contributions and benefits, city regulators have issued employer guidance and FAQs. Covered employers also need to distinguish the UPL law from the temporary federal COVID-19 leave law.

What’s new?

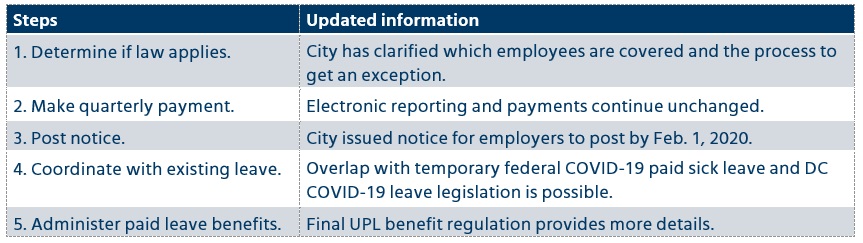

Last year’s GRIST set out seven steps for employers to comply with the UPL law. Final rules and other happenings in recent months fill in additional details for four of the first five steps.

The last two steps — update policies and training, and monitor compliance — remain unchanged from last year. Below is a discussion of new developments and updated guidance since June 2019.

Exceptions process

Any private-sector employer — whether for profit or nonprofit — paying DC unemployment insurance (UI) taxes for one or more employees is covered by the UPL law. Employees of a covered employer have UPL rights if they spend at least 50% of their work time — whether full-time or part-time — in the city. This has raised questions about whether employees with attenuated work connections to the city are covered by the UPL law. For instance, an employee may work in the city infrequently or work remotely from another jurisdiction, even though the employer is paying unemployment insurance in the district. In response, the city has clarified who is a covered employee and set up a formal process for employers to request UPL exceptions for specific employees.

Covered employees clarified

Guidance on the exceptions process says that employees working in the city during a particular quarter and reported by the employer to the district’s UI program are always covered by the UPL law, with no exceptions. Employees also are covered by the UPL law if their work performed outside of the district consists of just isolated transactions or is temporary, transitory or incidental.

District regulators indicate that this UPL policy is consistent with the federal government’s long-standing “localization of work” guidelines for state unemployment agencies, which the city has incorporated into its UI standards. Employers should review this information to make sure they are paying UPL payroll taxes for the correct employees.

Telework. Work performed outside the city is considered “incidental” when the location of the work is not essential to its performance, so teleworking is considered incidental. For example, an employee of a city-based employer who works remotely most or all of the time from home in Virginia generally is covered by the UPL law.

Obtaining an exception

An employer can apply to obtain a formal UPL exception for an employee who meets two conditions:

- Performs work outside the district that is not temporary, transitory, incidental or isolated.

- Spends more than 50% of his or her work time in a jurisdiction other than the district.

Employers must apply each quarter to request an exception. They must still pay the full quarterly payroll tax for the employee while the application is pending. If the district determines that an employee is excepted from the UPL law, the city will credit the quarterly payroll taxes paid for that employee to the employer’s account.

The guidance sets out the documentation required to request an exception and the email address for submitting the documentation. The district has provided a template for the employer’s cover letter and the required employee acknowledgement form.

Quarterly payments

Not much has changed in the quarterly UPL tax collection process, which uses an online portal. Unlike many state paid leave programs that have employees pay at least some contributions, the district’s UPL payroll tax is paid entirely by employers. The law does not provide any opt-out or private voluntary plan option for covered employers. The contribution regulation finalized last year sets out the employer registration, contribution and collection process.

Many employers have had their payroll vendors take care of this process. After completing UI reporting (Form UC-30), employers (or their vendors) submit quarterly wage reports using Form PFL-30 and pay the 0.62% quarterly payroll contribution via the Employer Self-Service Portal, consistent with the payment instructions.

The city’s Department of Employment Services (DOES) website has a quarterly tax calculator that an employer can use to estimate the amount of quarterly payments (gross quarterly wages x 0.0062).

Notice

Various notice rules apply to both employers and employees under the UPL law.

Employer notice to employees

The final contribution regulation sets out requirements for employers to notify employees about the new UPL law. Covered employers had to post a city-supplied notice by Feb. 1, 2020, in a conspicuous place accessible to employees at each worksite. Employers also must send copies to remote workers. Failure to post the notice at the worksite carries a $100 fine for each day of noncompliance.

Another $100 daily fine applies if employers fail to provide notice to individual employees:

- Within 30 days of hire (for employees starting after January 2020)

- On annual basis starting in 2020

- After receiving a “direct” notice from an employee about the need to take UPL for a qualifying event

Employee notice to employer

The benefit regulation finalized this year requires employees, when practicable, to provide their employer written notice about the need for UPL. When the leave is foreseeable, employees must give at least 10 days’ advance notice. When the need for leave is unexpected, shorter notice periods apply.

Coordinating UPL with other leave

A key implementation issue concerns how the new UPL benefit will coordinate with other leave — whether voluntarily provided by an employer or required under federal or district law. The final benefit regulation keeps proposed provisions from 2019 that discussed leave interactions.

Employer-provided leave

The UPL law does not prohibit an employer from maintaining or amending its existing or future short-term paid leave policies, such as paid sick time, vacation, short-term disability benefits and parental leave. An employer is free to change its policies to coordinate with UPL, for instance, to ensure combined weekly employer-provided paid leave and UPL don’t exceed an employee’s weekly wage.

No concurrent LTD and UPL benefits. Individuals receiving long-term disability (LTD) benefits under a private or public program are not eligible for UPL.

FMLA and DC-required leave

Concurrent FMLA and UPL benefits. If the reason for UPL also qualifies for unpaid leave under the federal or DC Family and Medical Leave Act (FMLA), paid UPL must run concurrently with — not in addition to —the unpaid FMLA leave. So employers must administer their FMLA obligations concurrent with UPL.

Unclear how UPL and paid sick leave interact. The regulations don’t discuss how or whether UPL will coordinate with paid sick leave under the city’s Accrued Sick and Safe Leave law.

No concurrent DC UI and UPL. Individuals receiving UI benefits from the city are not eligible for UPL.

COVID-19-related temporary leave

Until the end of 2020, the federal Families First Coronavirus Response Act (FFCRA) (Pub. L. No. 116-127) requires employers with fewer than 500 employees — with certain exceptions — to grant paid sick and expanded FMLA leave for certain pandemic-related reasons. The district also has temporarily expanded its FMLA and paid sick leave laws in response to the pandemic.

Federal paid sick leave for COVID-19. In some very limited circumstances, an employee’s need for UPL could overlap with the FFCRA’s emergency paid sick leave— for instance, when an employee is caring for someone under quarantine due to a serious health condition related to COVID. Federal guidance provides that the FFCRA’s paid sick leave is in addition to any benefits under state and local leave laws.

Federal FMLA leave for COVID-19. The FFCRA’s emergency FMLA leave is available only to employees unable to work because their child’s school or childcare has closed due to the pandemic. This FFCRA leave will not overlap with UPL since the city’s UPL law does not recognize a similar qualifying event.

DC FMLA leave for COVID-19. Emergency legislation (2020 Acts No. 23-247 and No. 23-326) temporarily expands the DC FMLA from March 11 through the end of the district’s public health emergency, which currently extends through July 24. Up to 16 weeks of emergency unpaid leave is available to an employee unable to work (even remotely) due to the need to quarantine, care for an individual under quarantine, or care for a child whose school or place of care has closed because of the public health emergency. Unlike the permanent DC FMLA, this temporary leave obligation applies to employers of all sizes and employees who have worked at least 30 days for the employer. Any employer-paid leave used counts against this new DC FMLA leave entitlement. An employee can elect (but an employer can’t require) to use this emergency unpaid leave before taking other leave available under federal or district law or an employer’s policies. Qualifying events under this temporary program and the UPL program could overlap if the leave involves taking care of someone with a serious health condition due to COVID-19.

DC paid sick leave for COVID-19. Supplemental emergency legislation (2020 Acts No. Act 23-286 and No. 23-326) amends the city’s Accrued Sick and Safe Leave Act from April 10 through the end of the DC public health emergency. The legislation expands the FFCRA’s paid sick leave to provide up to 80 hours of paid sick leave for full-time workers, with lower amounts for part time workers. Since the city’s public health emergency currently extends through July 24, this paid sick leave will overlap with the UPL program. The emergency sick leave applies to employees who have worked at least 15 days for the employer before requesting leave. Employees can use this leave concurrently with or after exhausting other leave available under federal or district law or an employer’s policies. When an employee takes this leave concurrently with other paid leave, an employer can reduce the amount paid for DC sick leave by the amount of other paid leave the employee receives.

Paid leave benefits

The final benefit regulation provides details on the UPL application process, benefit calculations and other information. The UPL law provides for three types of paid leave, each with a maximum duration:

- Family leave to care for a family member with a serious health condition — up to six workweeks

- Parental leave taken within one year of having a child born, placed for adoption or legally made the employee’s parental responsibility — up to eight workweeks

- Medical leave for the employee’s own serious health condition — up to two workweeks

An employee can’t receive more than eight weeks of UPL during a 52-workweek period, regardless of the types of qualifying events during the period.

Highlights of the final benefit regulation

The final benefit regulation has very few changes from last year’s proposal. The online process for claim submission, the wage-replacement calculation and other features are largely the same. Below are some points that employers will want to keep in mind.

Qualifying events occurring before July 1. While an employee cannot submit a UPL claim until July 1, parental leave benefits could be available after that date for a birth or adoption that occurred earlier, according to informal guidance from city regulators during a recent webinar. The parental leave benefit is available for up to a year after a new child’s arrival. So, for example, an employee who had a child on Jan. 5 could apply for the parental leave benefit after July 1. The benefit will be based on the average weekly wage in the employee’s highest-paid four of the five quarters worked for covered employers immediately before the qualifying event (in this case, the last quarter of 2018 and all quarters of 2019).

Employer information about approved benefits. Within three business days of receiving a claim for UPL benefits, the city will notify the employer to request specific information about the applicant. After the city makes a determination on a claim, both the employee and employer will receive a notice giving the start and end dates of the leave, if approved. The notice to the employer will not provide information about the specific dollar amount of the benefit, unless the employee has consented to this disclosure. Final regulations indicate, however, an employer can require that an employee share this information to receive other employer-provided benefits.

Intermittent leave. Employees can choose to take UPL continuously or on an intermittent basis. The minimum increment for intermittent UPL is one day. If the city approves intermittent leave for an employee, an employee must indicate which days he or she will take for the leave and follow a process for amending those days, if needed. The law prohibits an employee from working and receiving UPL benefits on the same day. For instance, if an employee wants to take two hours off to seek treatment for a serious health condition, the employee must use a whole day of UPL benefits and not work that day (or use other paid leave benefits that permit smaller increments).

Employer actions

To prepare for the July 1 start of the UPL program, covered employers should update their policies and procedures for final rules and get ready to monitor compliance. The city’s Office of Paid Family Leave (OPFL) has made UPL resources available on its website. Here are some actions to consider before July 1:

- Identify employees covered by the law in light of updated guidance, especially when so many employees are working remotely during the COVID-19 pandemic. Employers and employees will want to be clear about how UPL applies to teleworkers, since those rules might differ from the local income and other tax requirements that apply to teleworkers.

- If this task is still outstanding, make sure to post and distribute the required notice. Since the original notice for posting has been updated since first issued, verify the latest version is posted.

- Consider how or whether current paid leave policies should change in light of the new UPL benefit. Will employer-provided paid leave wrap around or be provided in addition to UPL? What’s the best way administratively to wrap any employer-provided benefit around the UPL benefit? What’s the best way to communicate any policy changes to employees?

- If currently providing short-term disability benefits to employees, consider restricting benefit terms to limit the payout when an employee is receiving similar wage-replacement benefits elsewhere. This would prevent employees from simultaneously receiving STD and UPL benefits that total more than the average wage.

- The UPL law does not cover absences due to short-term illnesses that do not meet the definition of “serious health condition,” but the city’s paid sick leave law does address these shorter absences. Check whether current policies distinguish extended medical leave from brief sick leave to better coordinate across the expanding leave landscape.

- Review the city’s intermittent UPL standards against other state and federal intermittent-leave requirements. Varying rules on intermittent leave can make implementation an administrative challenge for employers. Review whether existing intermittent-leave policies and procedures need amendments specific to DC employees.

- Confirm leave policies include the prohibition on retaliation against employees for exercising their rights under the UPL law. While the UPL law contains no separate job protections, the federal and DC FMLA rights to continue group health plan coverage during leave and return to the same or an equivalent position afterward will apply to UPL taken for the same reasons. Employees taking UPL leave for reasons not provided under the federal or DC FMLA presumably won’t have these job protections.

- Check whether the district’s temporary COVID-19 leave legislation remains in effect after July 1. While the city’s public health emergency currently extends to July 24, it could end earlier or continue past that date. Employers might need to take this unpaid DC FMLA and paid sick leave into account for certain overlapping qualifying events.

- An employee’s serious illness (not due to COVID-19) could qualify for UPL benefits, unpaid federal and DC FMLA leave, and employer-provided medical leave. Employers need a clear policy on how these programs apply to employees with serious illnesses.

Example. An employee needs to take an eight-week absence to undergo treatment and recover from a serious illness. Unpaid federal and DC FMLA applies for the entire eight weeks. The employee can apply to use UPL for two of the eight weeks, which must run concurrently with both federal and DC FMLA leave. This leaves the employee with six weeks of unpaid FMLA leave. Any employer-provided paid leave could fill in some of all of the six weeks. An updated policy could set out how and when an employee can apply the employer-provided leave.

Related resources

Non-Mercer resources

- Coronavirus Support Emergency Amendment Act of 2020 (DC Council, May 27, 2020)

- COVID-19 Supplemental Response Emergency Amendment Act (DC Council, April 10, 2020)

- 2020 Paid Family Leave Employee Notice (DOES, April 1, 2020)

- COVID-19 Response Emergency Amendment Act (DC Council, March 17, 2020)

- Final UPL benefit regulation (DOES, Jan. 6, 2020)

- Process for determining employee exceptions from PFL coverage (DOES, July 1, 2019)

- Final UPL tax regulation (DOES, Feb. 11, 2019)

Mercer Law & Policy resources

- DOL and IRS issue guidance on COVID-19 emergency paid leave (April 29, 2020)

- Employers need to prepare now for Washington, DC’s universal paid leave (June 11, 2019)