San Francisco Health Care Expenditure rates released for 2023

San Francisco has posted the 2023 Health Care Expenditure (HCE) rates under the Health Care Security Ordinance (HCSO) rules. The HCSO applies to all employers that must obtain a San Francisco business registration certificate and have at least 20 employees in any location if at least one works in the city and county of San Francisco.

HCE mandate

The HCE is the minimum amount employers must spend on healthcare for each hour worked by a covered employee, defined as anyone employed for more than 90 days who regularly works at least eight hours a week in San Francisco. To determine workforce size, employers must count all employees, no matter where they live or work. However, the expenditure applies only for hours worked in San Francisco (i.e., in zip codes starting with 941xx. Special considerations apply for the 94128 zip code (i.e., the San Francisco International Airport).)

Employers subject to the HCSO make HCEs on a quarterly basis. Self-funded plans may be able to make annual HCE payments based on claim data and plan design (see the rules below). Rules limit the types of expenses considered HCEs, and employers need to make up the difference between the required HCE and the employer contribution.

Annual reports are normally due each April 30 (or the next business day, if April 30 is on a weekend). While the public health emergency cancelled reports due in 2020 and 2021, reporting resumed in 2022. Note that only reporting was suspended; the HCE requirement continued in 2020 and 2021. This may have caused employers to mistakenly believe that HCEs were not required during 2020 and 2021.

Excluded employees

Covered employees exclude managers, supervisors and confidential employees earning at least $109,643 annually (or $52.71 per hour) in 2022. Beginning Jan. 1, 2023, that amount rises to $114,141 per year (or $54.88 per hour). Employees covered by Medicare or TRICARE may also be excluded if the employer can document employee eligibility. In addition, the ordinance excludes employees covered by the Health Care Accountability Ordinance for city contractors or tenants.

Telecommuters

Telecommuters present additional challenges for employers under the HCSO. During the COVID-19 pandemic, many employees telecommuted from a San Francisco address and became subject to the law, or San Francisco employees worked remotely from home and could not come into the city/county during the public health emergency.

A 2021 HCSO amendment (Ordinance 92-21) clarified that work locations trigger the HCE. An employer must provide the HCE for a covered employee when the employer’s office or worksite is in San Francisco or the employee works from home in San Francisco as a telecommuter. The employer does not have to provide the HCE for employees who usually telecommute from outside the city in neighboring locations, such as Oakland. However, the new legislation required HCSO coverage for San Francisco employees working remotely solely due to public health orders, meaning HCEs could be due for an employee working remotely outside of San Francisco.

Since the city’s June 11, 2021 public health order (most recently updated on June 16, 2022) eliminated the remote-work recommendation, HCSO expenditure requirements do not currently apply to employees telecommuting outside of San Francisco. That could change if the city reinstates earlier public health restrictions.

Waivers

Employers may ask workers who have other employer-provided coverage to waive the expenditure, using the authorized SF HCSO voluntary waiver form. However, employees with other employer coverage need not waive the expenditure and can revoke the waiver any time. Waiver forms must disclose these employee rights for the waiver to be valid. If employees with other coverage do not sign the voluntary waiver, an employer must make up the expenditure in some other way. The waiver form must be signed each year and cannot be retroactive. Failure to use the proper waiver form and/or follow the waiver process could result in noncompliance penalties.

HCE creditable expenses

Employers can count toward their required HCE any premium payments to an insurance provider for medical, dental or vision coverage, as well as contributions to health savings accounts or other irrevocable reimbursement accounts. Only amounts irrevocably paid to third parties qualify as HCEs.

Employer contributions to health reimbursement arrangements (HRAs) are typically considered revocable. For an HRA contribution to be irrevocable, it must meet both of these conditions:

- Employers must pay contributions into a separate account on the employee’s behalf within 30 days of the end of each quarter.

- Employers may never recover any portion of the HRA contribution, even when employment ends.

Employers whose expenditures fall short of the required amount have 30 days after the end of the calendar quarter to remit the difference to the SF City Option program. These payments fund a medical reimbursement account (MRA) in the employee’s name. Special annual — rather than quarterly — reconciliation rules apply for some self-funded group health plans, as described below.

Uniform health plan

A covered employer may comply with the HCSO by providing uniform health coverage to some or all covered employees. The plan must have the same benefit design — including cost sharing, coverage tiers and eligibility criteria — for all participating employees. The average hourly HCE is calculated by dividing the total required HCEs for employees in the uniform health plan by the total hours paid to each of those employees during that quarter. (Total hours paid are capped at 172 per employee per month.) This method applies only to employees enrolled in the uniform health plan.

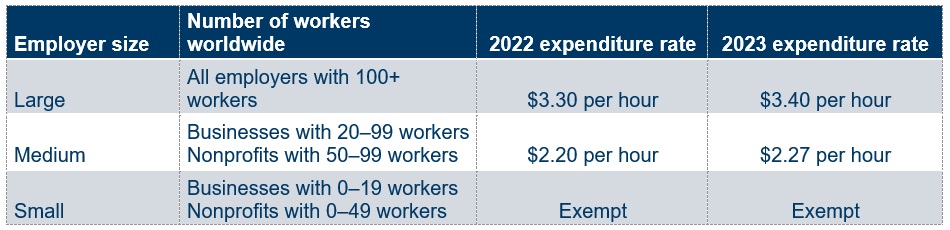

Updated rates

The current and updated HCE hourly rates are as follows:

Self-funded plan expenditures

HCEs must reflect amounts irrevocably paid to third parties. Rules prohibit employers from using continuation coverage rates under the federal Consolidated Omnibus Budget Act of 1986 to determine quarterly expenditures for employees enrolled in self-funded plans. Instead, these plans must use one of two options to determine expenditures: fixed expenditures or paid healthcare claims. These methods apply only to HCEs for employees enrolled in the plan.

Fixed expenditures

Under this option, the employer pays premiums and/or fees to the third-party administrator of a self-funded plan, and no portion of those premiums or fees are returned to the employer. The premiums and fees paid for a calendar quarter must meet or exceed the required HCE for each covered employee for that quarter.

Paid healthcare claims

Under this option, the employer pays claims when incurred, and the prior year's average hourly expenditures must meet or exceed that year's HCE rate for the employer. This option is limited to uniform health plans, as described earlier. The employer can choose to include only covered employees (the eligible San Francisco population) or all employees participating in the uniform health plan. Employers using this option do not need to reconcile expenditures every quarter for employees covered under the plan. Instead, if actual paid claims during the calendar year are less than the required HCE, employers can make additional contributions (known as “top-off payments”) through the end of February of the next year.

Practical considerations

Most self-funded plans have both fixed expenditures and paid healthcare claim components. The rules do not explicitly recognize situations in which an employer uses the combination of the two to meet the minimum expenditure. The San Francisco Office of Labor Standards Enforcement (OLSE) has provided informal guidance that recognizes the combined use of both types of expenses but does not include specifics. For example, the required frequency of compliance determination (quarterly vs. annual) differs for the two types.

The rules also do not explicitly address stop-loss reimbursements, prescription drug rebates, paid claim adjustments (like subrogation), returned administrative fees (for example, performance guarantee penalties) and other variables. Whether these types of transactions should count as returned fixed expenditures or offset paid claims is unclear. The rules do not currently require including these transactions in the HCSO compliance determination.

Employer next steps

Employers with workers in San Francisco will need to prepare for compliance with the 2023 HCE and understand the HCE’s application to San Francisco workers. Once premiums are set for insured plans, plan sponsors can review any deficits and determine the best approach to make up any shortfall and make the quarterly payments. Self-funded plans may want to work with their third-party administrators and actuaries to evaluate spending options. Payments for self-funded plans may be measured quarterly or annually, subject to plan design and the availability of claims data.

Due to the public health emergency rules for telecommuters, employers may wish to review census information to see if they have any workers in San Francisco. For an employer that determines an HCE for a worker in San Francisco may be due, the employer can consider making a voluntary correction with the OLSE.

Finally, employers subject to the HCSO should become familiar with notice posting requirements, complaint process and penalties for noncompliance.

Related resources

Non-Mercer resources

- Health Care Security Ordinance resources (San Francisco OLSE)

- Health Care Accountability Ordinance resources (San Francisco OLSE)

- SF City Option

- San Francisco business registration (San Francisco Office of the Treasurer & Tax Collector)

- Voluntary waiver form (San Francisco OLSE, Nov. 1, 2017)

- Amended HCSO rules (San Francisco OLSE, Oct. 29, 2017)

Mercer Law & Policy resources

- San Francisco's annual Health Care Expenditure report due May 2 (March 31, 2022)

- San Francisco posts 2022 Health Care Expenditure rates (Aug. 12, 2021)