Mercer projects record increases for 2023 retirement plan limits

All key Internal Revenue Code (IRC) limits for qualified retirement plans will rise by unprecedented amounts from 2022 to 2023, Mercer projects. The 2023 limits will reflect increases in the Consumer Price Index for All Urban Consumers (CPI-U) from the third quarter of 2021 to the third quarter of 2022. Using this measure, inflation is projected to reach its highest level since indexing began, causing 7%–11% increases for most limits, based on their rounding levels. In addition, the non-SIMPLE plan catch-up limit — which has a large rounding threshold — will jump more than 15%. These record hikes come on the heels of 2021’s increases, which were the second highest ever at that time.

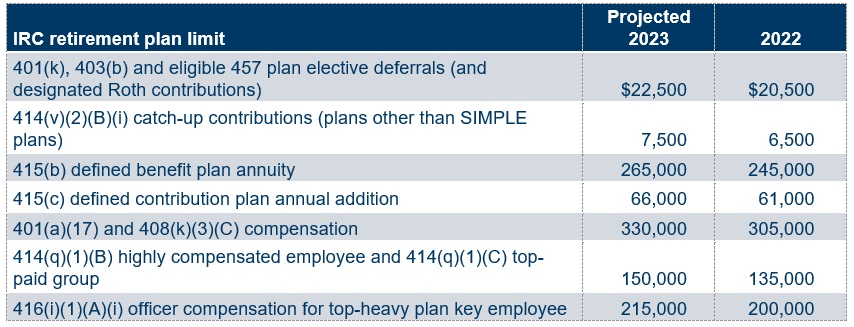

This updated article reflects the final CPI-U values for July, August and September. The table below shows Mercer’s calculation of the limits. IRS usually announces official limits for the coming year in late October or early November.

Mercer Law & Policy resources

- Quick benefit facts for 2022 (Jan. 19, 2022)

- Summary of 2022 benefit-related cost-of-living adjustments (Jan. 19, 2021)

- Quick benefit facts and COLA resources for benefit plans (2017–2022)