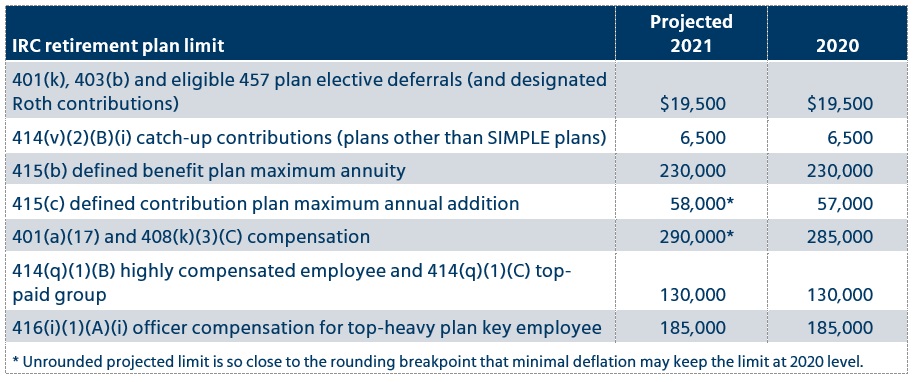

Mercer projects 2021 retirement plan limits

Most key Internal Revenue Code (IRC) limits for qualified retirement plans won’t increase in 2021, Mercer projects. The 415(c) maximum annual addition and the 401(a)(17) limit on retirement plan compensation will likely rise to the next rounding increment, but these limits are so close to the rounding breakpoint that even minimal deflation may keep the amounts at the 2020 levels.

These estimates are determined using the tax code’s cost-of-living adjustment and rounding methods, the Consumer Price Index for All Urban Consumers (CPI-U) through June, and estimated CPI-U values for July–September. Qualified plan limits are based on the year-to-year increase in the third-quarter CPI-U, so figures can’t be finalized until after September CPI-U values are published in October. IRS is expected to announce the official 2021 limits in late October or early November.