Litigation, legislation leave AHP guidance in flux

Republicans in Congress have introduced legislation (HR 2294/S 1170) to preserve the substance of Department of Labor (DOL) final rules that made it easier for small businesses and the self-employed to form association health plans (AHPs) after a federal court struck them down (New York v. United States Dep’t of Labor, No. 18-1747 (D.D.C. March 28, 2019)). The ruling eliminated (for now) one of two pathways to AHP formation. While the legislation faces dim prospects, DOL will appeal the court’s decision and has issued guidance to clarify the ruling’s impact. Meanwhile, AHPs formed under the new rules will need to make some quick decisions. This GRIST offers background on the final rules and discusses the implications of the court’s decision and the pending legislation. [This GRIST has been updated to reflect DOL’s decision to appeal the court’s ruling and statement on the agency’s new nonenforcement policy.]

Background

Before the final rules were issued last year, longstanding DOL guidance distinguished between “bona fide” AHPs, which have a single plan at the association level, and other AHPs, under which each participating employer separately sponsors its own ERISA plan. Bona fide AHPs enjoyed certain advantages relative to other AHPs under the Affordable Care Act (ACA) and ERISA. But the guidance set a high bar for bona fide status: Members had to not only control the plan but also have a common interest and a shared economic or representation purpose — unrelated to benefits — for forming the association. (This is now commonly referred to as Pathway 1.)

In October 2017, President Trump signed an executive order directing several agencies to promote healthcare choice and access. The administration prioritized three areas for guidance: AHPs; short-term, limited-duration insurance; and health reimbursement arrangements. In response, DOL issued final rules last June offering an easier way (Pathway 2) for groups or associations of employers to offer bona fide AHPs.

Key provisions of Pathway 2. The final rules:

- Permitted AHPs to satisfy the commonality-of-interest requirement if organized by state or metropolitan area, or by common trade, industry, line of business or profession

- Required AHPs to be controlled by the employer members in both form and operation

- Allowed AHPs to exist primarily to provide health coverage but also required them to have an unrelated substantial business purpose, such as organizing conferences or educational opportunities

- Allowed working owners with no common law employees to participate in AHPs if they either averaged 20 hours per week or 80 hours per month, or earned at least the cost of their coverage

- Adopted modified nondiscrimination requirements under the Health Insurance Portability and Accountability Act (HIPAA) that:

─ Prohibit conditioning employer membership in an association based on a health factor

─ Require AHPs to prohibit discrimination on the basis of a health factor as to eligibility for benefits, and premiums or contributions

─ Prohibit AHPs from using experience rating to determine premium rates for a particular employer member on the basis of a health factor, but allows distinctions based on nonhealth factors (e.g., industry or geography)

─ Allow an AHP to pass through different premium charges to its members' employees based on nonhealth factors (e.g., full-time/part-time status and occupation)

─ Prohibit distinctions based on nonhealth factors used as a subterfuge for health status discrimination

- Confirmed that AHPs could take advantage of the options in the new rule or continue to follow earlier AHP guidance (Pathway 1)

Pathway 2 Out for Now; Pathway 1 Still an Option

The court’s ruling has closed down Pathway 2 for the time being. And while the proposed legislation would reverse that outcome, it’s unlikely to pass anytime soon. Employers may still rely on previous guidance to form a bona fide AHP but should note that some states may have different or additional AHP mandates.

Court Ruling

The court found that DOL had unreasonably expanded ERISA’s definition of “employer.” The rules were “intended and designed to end run the requirements of the ACA,” the court said, by including groups without any real commonality of interest and working owners without employees, despite Congress’s clear intent that ERISA cover benefits arising out of employment relationships. As a result, the court concluded, the bona fide association and working owner provisions of the rule — the provisions that permit Pathway 2 — had to be set aside.

Notably, the court preserved the nondiscrimination requirements that apply to Pathway 2 AHPs. While the requirements place restrictions on different premium rates based on health status, the court said, they don’t limit which associations qualify as employers and therefore weren’t central to the case.

Nonenforcement Policy

The decision leaves much uncertainty about the final rules in its wake, especially for the AHPs already formed under them. DOL recently issued guidance to provide some clarity. Employers participating in insured AHPs generally should maintain that coverage through the end of the plan year or, if later, the contract term. DOL and HHS won’t pursue enforcement related to Pathway 2 AHPs for actions taken before the court’s decision, as long as the AHPs relied in good faith on the final rules and pay health benefit claims as promised.

For the next plan year or contract term, issuers may renew coverage for Pathway 2 AHPs only if the coverage complies with the relevant ACA market requirements for that employer’s size (e.g., for small employers, the essential health benefits requirements and premium rating rules). An insurer can satisfy guaranteed renewability requirements by continuing coverage for each employer-member of the association that chooses to continue coverage, either through the master policy with the association or through separate contracts with each employer-member on an outside-the-association basis.

Proposed Legislative Fix

With language that largely mirrors the final rules, the proposed legislation introduced in Congress would amend ERISA to include the Pathway 2 criteria. But the measure faces long odds — it may gain traction in the Senate but stands little chance of passing in the Democratic-led House.

Remaining Pathway

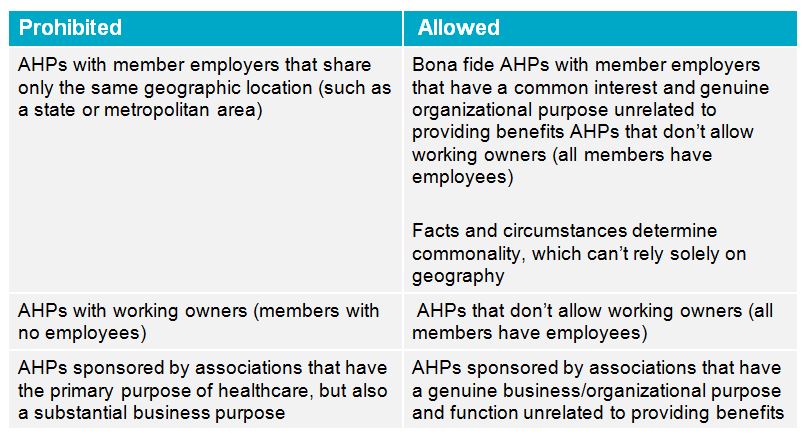

AHPs developed under prior guidance — primarily DOL advisory opinions and earlier court rulings — aren’t affected by the court’s decision and can proceed unchanged. The following chart provides a brief overview of what’s allowed and prohibited in the wake of the court’s ruling:

Potential State-Level Stumbling Blocks

Although Pathway 1 is still viable, state laws may present hurdles for associations trying to establish an AHP. As a type of MEWA, AHPs are subject to both federal and state regulation. For example, DOL requirements include compliance with HIPAA nondiscrimination rules and filing the Form M-1. A number of states have additional or different AHP requirements than federal guidance imposes. For example, states may:

- Require associations to have existed for a certain period before offering an AHP

- Classify coverage as part of the individual, small-group, or large-group market based each member's size, meaning individuals and small businesses must comply with small-group market standards, including essential health benefits and community-rating requirements

- Prohibit working owners without common-law employees from participating in an AHP

- Allow an AHP to cover only residents of the state in which it is established

Next Steps for AHPs

The court’s ruling has muddied the AHP waters. But while the final rules may be in flux, a viable AHP pathway still exists.

Pathway 1 AHPs. While Pathway 2 is no longer an option for forming AHPs (for now), nothing in the opinion affects the legitimacy of Pathway 1 or the AHPs created under it. The previous guidance is still effective and — unless a court rules otherwise — may be relied on to form a bona fide AHP. Of course, Pathway 1 AHPs may still be prohibited in certain states.

Pathway 2 AHPs. DOL has made clear that for now Pathway 2 AHPs must keep their promises in accordance with the insurance policies issued and pay valid claims, even if they make changes due to the ruling. Absent further legal developments in the case, additional DOL guidance or developments on the Hill, AHPs formed under the now-invalid rules will need to make some quick decisions with the help of legal counsel.

Related Resources

Non-Mercer Resources

- Statement on New York v. United States Dep’t of Labor (DOL, Apr. 29, 2019)

- Association Health Plans Act of 2019, HR 2294 / S 1170 (US Congress, April 11, 2019)

- Press Release on Association Health Plans Act of 2019 (Sen. Enzi’s Office, April 11, 2019)

- New York v. United States Dep’t of Labor, No. 18-1747 (D.D.C. March 28, 2019)

- FAQs on Court Ruling in New York v. United States Dep't of Labor (DOL, April 1, 2019)

- Final DOL Rule on Definition of “Employer” Under Section 3(5) of ERISA — Association Health Plans (Federal Register, June 21, 2018)

- Proposed DOL Rule on Definition of “Employer” Under Section 3(5) of ERISA — Association Retirement Plans and Other Multiple-Employer Plans (Federal Register, Oct. 23, 2018)

- Press Release on Proposed Rule (DOL, Oct. 22, 2018)

- Executive Order 13813 (White House, Oct. 12, 2017)

Mercer Law & Policy Resources

Links to any resources in the Mercer Select archive are accessible to Mercer consultants. Clients may contact their consultants for free copies:

Other Mercer Resources

- Proposed Guidelines for Association Health Plans (Jan. 8, 2018)

- New Association Health Plan Rules Present Opportunity for Small Businesses (June 19, 2018)