How retirement plans can correct required minimum distribution errors

When an error in administering required minimum distributions (RMDs) from defined benefit (DB) or defined contribution (DC) plans violates Internal Revenue Code (IRC) Section 401(a)(9) requirements, plan sponsors may be able to fix the problem by making corrective distributions under IRS procedures. This article outlines the solutions available when qualified or 403(b) plans miss or miscalculate RMDs. The coverage includes streamlined procedures for plans applying for IRS approval of a proposed correction, and options for requesting a waiver of participants’ excise taxes. Related tax reporting and withholding rules also are addressed.

Overview of RMDs

In very general terms, the RMD payable each year is a portion of the total lifetime benefit — an annuity stream in a DB plan or a stream of payments spread over the participant's life expectancy in a DC plan. A participant’s first RMD is due by the required beginning date (RBD), which is April 1 of the calendar year after the year in which the participant’s trigger date occurs. The trigger date is the later of:

- The date the participant attains age 72 (or age 70-1/2 for participants born before July 1, 1949)

- The date the participant retires from employment with the employer maintaining the plan (except for 5% owners)

For 5% owners, RMDs must start by April 1 of the year after the participant attains age 72 or 70-1/2 (as applicable), even if a participant is still employed by the employer maintaining the plan.

Uniform RBDs permitted. Under existing 401(a)(9) regulations, plans have the option to define the RBD as April 1 of the year after a participant reaches age 70-1/2, even if the participant is still working. The recently proposed regulations would retain this approach, allowing plans to define the RBD as April 1 of the year after reaching age 72 for all participants born after June 30, 1949, and April 1 of the year after attaining age 70-1/2 for all participants born before July 1, 1949. Payments starting on these RBDs are considered RMDs for 401(a)(9) purposes.

Some plans start payments earlier. Some plans may require payments to start before the RBD. This article does not discuss the correction of missed required payments under these plans.

Participants with multiple accounts. If a participant has a benefit under more than one qualified plan, RMDs must be calculated and paid from each plan. However, a different rule applies to 403(b) plans. If a participant has more than one 403(b) annuity contract, RMDs must be calculated for each annuity contract, but the total RMD amount can be paid from a single contract. A similar aggregation rule applies to individuals with multiple IRAs, but RMDs from a 403(b) plan and an IRA cannot be aggregated.

Problem: erroneous or missed RMDs

Most plans have standardized administrative processes to calculate and pay RMDs. Despite best efforts, errors can occur. For example, plan records might not accurately track or reflect a participant’s date of birth or retirement; the RMD might have been miscalculated; the plan could not locate a participant; or the plan should have treated a portion of a lump sum distribution as an RMD but failed to do so. Errors may be even more likely now that the Setting Every Community Up for Retirement Enhancement (SECURE) Act (Sec. O of Pub. L. 116-94) has set different RMD ages for different groups of participants.

Failure to comply with Section 401(a)(9) could jeopardize a plan’s tax-qualified status or the tax-favored treatment of most 403(b) and 457(b) plans. Participants who miss RMDs are subject to an excise tax equal to 50% of the unpaid amount, though IRS will waive the tax under certain circumstances.

Solution: IRS correction procedures

Most errors in administering a plan’s RMD rules are considered “operational failures” correctable under IRS’s Employee Plans Compliance Resolution System (EPCRS). EPCRS correction procedures apply to qualified and 403(b) plans, but IRS also may review corrections made by governmental 457(b) plans on a “provisional basis” outside of EPCRS, using similar standards.

Underpayments. The EPCRS revenue procedure provides a safe harbor method for correcting RMD underpayments. This method involves distributing the missed RMDs with earnings through the date of distribution. Later sections of this article explain how to calculate RMDs and the earnings adjustments for corrective distributions.

Overpayments. EPCRS is silent on what to do when an RMD is overpaid (i.e., when a plan treats too much of a participant’s benefit payment as an RMD). An overpayment shouldn’t violate 401(a)(9) since the RMD amount has been fully paid. However, the plan may have to correct its tax reporting and withholding. The excess paid in one calendar year may not be applied toward RMDs due in future calendar years. The remainder of this article does not address overpayment errors.

Voluntary Correction Program (VCP)

Eligible employers must pay a user fee ranging from $1,500 to $3,500 based on the plan’s assets when submitting a VCP application describing errors and proposed corrections. Employers must use pay.gov to submit the application (Form 8950) and user fee. IRS’s tips for VCP submissions for RMDs help ensure efficient processing of employers’ filings. Sponsors generally must implement corrections within 150 days after IRS approval of the application.

- Model VCP filings. IRS provides Form 14568, a model VCP compliance statement that plan sponsors can use to streamline the filing process. Form 14568 comes with schedules for common errors, including Schedule H for failures to timely pay RMDs to participants (but not beneficiaries of deceased participants). Using any of these forms is optional, but employers using the forms may not modify the format or content in any way. IRS no longer provides a discounted fee for the streamlined filing.

- Form of corrective payments. An issue that DB (and some DC) plan sponsors may want to raise in a VCP application is whether participants who are owed RMDs can be given an opportunity to elect one of the plan’s optional forms of payment. Normally, the participant and spouse must consent to an optional form of payment by the annuity starting date — which is deemed the RBD under these circumstances. So by the time the sponsor files the VCP, it’s too late to obtain the requisite consents. IRS has taken the position in informal guidance that retroactive annuity starting dates may not be used to correct RMD failures, meaning the distributions must be paid in the normal form of payment. But some sponsors might not prefer that approach, especially if the plan offers a lump sum option. To offer participants a choice of optional forms, the sponsor may want to seek IRS approval as part of the VCP filing (although some sponsors may be comfortable offering optional forms as part of a self-correction — discussed below).

- Excise taxes. Under VCP, IRS may waive the Section 4974 excise tax normally imposed on plan participants affected by RMD errors. IRS will consider waiving the excise tax at the employer’s request. If the employer doesn’t request a waiver, the affected participant must file Form 5329 to either pay the tax or request a waiver for “reasonable cause.”

Self-Correction Program (SCP)

Eligible employers may use SCP to correct operational failures without preparing a formal IRS submission or paying an IRS fee. Employers must correct “significant” errors within required time frames, but can correct “insignificant” errors at any time, even if the error is discovered during an IRS audit. But an employer’s determination that an error falls within SCP may be reviewed by IRS on audit. Even if an error is eligible for SCP, an employer might instead opt to use VCP, especially when submitting a streamlined filing or seeking an excise tax waiver.

Audit Closing Agreement Program (Audit CAP)

This program allows correction of all errors identified during an IRS audit and not already corrected under SCP or VCP. The Audit CAP closing agreement outlines the nature and timing of the corrective steps an employer must take. Employers in Audit CAP generally face IRS sanctions that “bear a reasonable relationship to the nature, extent, and severity” of the errors. The sanction is negotiated as a percentage of the approximate amount IRS could assess if the plan were disqualified. In some cases, IRS may permit correction of certain errors under SCP, without imposing a sanction.

Employers requesting a waiver of the participant excise tax through Audit CAP must provide an explanation supporting the request. After reviewing the request, the reasons for the failure, and other facts or circumstances, IRS will determine whether to approve the waiver as part of the Audit CAP closing agreement.

Correcting RMDs in DC plans

The EPCRS safe harbor method for correcting missed RMDs from a DC plan involves distributing the RMDs, adjusted for earnings from the date of the failure to the date of the distribution.

Calculating the RMD

The regulations provide a default method for calculating RMDs from a DC plan. The method requires dividing the participant’s account balance as of a specified valuation date by the applicable distribution period. This calculation is performed each year during the participant’s lifetime, up to and including the calendar year of death.

The account balance is determined as of the plan’s last valuation date for the year before the distribution calendar year (the calendar year to which the payment relates). If the plan’s last valuation date isn’t Dec. 31 of that year, then the account balance must be adjusted for any contributions, distributions and forfeitures (but not earnings or losses) between the valuation date and Dec. 31.

For RMDs due during the participant’s lifetime, the distribution period is based on the age the participant attains in the distribution calendar year. In most cases, the distribution period does not depend on the age of the designated beneficiary at the RBD. Instead, the regulations include a Uniform Lifetime Table (Table 2) that provides the same uniform distribution period for all participants of the same age. Use of the Uniform Lifetime Table is mandatory, with one exception: If the sole beneficiary is the participant’s spouse who is more than 10 years younger than the participant, then distributions are based on the longer distribution period in the Joint and Last Survivor Table (Table 3).

For RMDs due after a participant’s death, the life expectancy factor depends on whether the participant has a designated beneficiary, whether the beneficiary is the participant’s surviving spouse, and what the relative ages of the participant and beneficiary are. After the SECURE Act, post-death distributions from DC plans must be made in full within 10 years of the participant’s date of death for all but certain “eligible designated beneficiaries.” However, this rule does not change how RMDs from DC plans are calculated. Instead, when the 10-year rule applies, any remaining balance in the participant’s account must be distributed in full at the end of the 10-year period. (The five-year rule in effect before the SECURE Act still applies to beneficiaries who aren’t designated beneficiaries, eligible or otherwise.)

Default method might not apply. If a DC plan is subject to the QJSA requirements and the spouse doesn’t consent to a different form of payment, then the plan must use the annuity distribution method for calculating RMDs from DB plans (discussed later).

Adjusting the RMD for earnings

DC plans must distribute missed RMDs with earnings from the date of failure to the date of distribution. EPCRS doesn’t specify how a DC plan should calculate earnings for this purpose, so actual earnings presumably must be used (though the EPCRS revenue procedure generally permits the use of reasonable estimates). Schedule H for the model VCP compliance statement requires an explanation of how the plan will determine earnings.

Multiple missed RMDs

A plan will have to make more than one corrective payment if a participant has missed multiple RMDs. In this case, each missed RMD is generally calculated as described above. However, under the EPCRS safe harbor correction method, the account balance as of Dec. 31 before the distribution calendar year is reduced for any missed RMDs from prior years.

Example

The following example illustrates the correction of missed RMDs from a DC plan.

Jay retires in 2015 at age 65 but doesn’t take an immediate distribution of his benefit under his employer’s 401(k) plan. He still hasn’t taken a distribution when he turns age 72 in 2022, so his first RMD is due by April 1, 2023. However, due to an error in the plan’s records, the plan doesn’t pay Jay’s first RMD by this date. Jay notifies the plan about the error in July 2023.

Calculating the RMD. Jay’s first RMD, originally due by April 1, 2023, is calculated based on his account balance as of Dec. 31, 2021 (the last day of the calendar year before he turns 72). On that date, his account balance was $415,110. His beneficiary is his wife, who is one year older than him. The age-72 factor from the Uniform Lifetime Table is 27.4. Jay’s RMD for 2022 is $15,150 ($415,110 ÷ 27.4). If Jay’s wife were age 58, the distribution period would be 30.3 from the Joint and Last Survivor Table, and the RMD for 2022 would be $13,700 ($415,110 ÷ 30.3).

Adjusting RMD for earnings. The plan distributes Jay’s first RMD on Oct. 1, 2023. His distribution must be adjusted for earnings from April 1, 2023 (the date of the failure) through the date of the distribution. During this period, Jay’s 401(k) plan account increased in value by 6%. Therefore, the plan adjusts his first RMD by 6%, for a total corrective payment of $16,059 ($15,150 x 1.06).

Multiple missed RMDs. Assume that in the example above, Jay doesn’t notify the plan about the RMD failure until January 2024, so he also misses his second RMD for 2023 (due by Dec. 31, 2023). His second RMD is based on the age he reaches in 2023 (age 73) and his account balance as of Dec. 31, 2022 ($456,621) reduced by his first RMD ($15,150). Jay’s age-73 factor from the Uniform Life Table is 26.5. His second RMD equals $16,659: ($456,621 – $15,150) ÷ 26.5. The plan pays both of Jay’s missed RMDs on March 1, 2024, adjusting his first RMD for earnings from April 1, 2023, to the distribution date, and his second RMD for earnings from Dec. 31, 2023, to the distribution date.

Considerations for 403(b) plans

Although the above correction procedures apply to 403(b) plans, identifying RMD errors may be particularly challenging for 403(b) plan sponsors. Participants often contribute to multiple 403(b) contracts held with one or more custodians — in some cases, under a single plan. RMDs must be calculated separately for each 403(b) contract and then aggregated to determine the total RMD amount, which may be taken from any one or more of these contracts.

In practice, many custodians of 403(b) contracts calculate RMDs for each contract and then permit participants to elect the contract or contracts from which to withdraw the total RMD; custodians typically do not force payment from any contract. Even though employers tend to have little involvement with this process, they still must confirm that a 403(b) plan complies with the RMD requirements in both form and operation. Employers should consider verifying 403(b) vendors’ procedures for determining RMDs and identifying potential RMD errors.

Correcting RMDs in DB plans

Calculating the RMD

Annuity payments made by a DB plan, such as a single life annuity or a QJSA, typically satisfy the RMD rules, assuming the payments start on time. The entire annuity payment usually is considered an RMD, and no portion is eligible for rollover. If a DB plan pays a lump sum, only a portion is an RMD and the remainder is eligible for rollover.

IRS provides two methods for calculating RMDs when a DB plan pays a lump sum (Treas. Reg. § 1.401(a)(9)-6, Q&A-1(d)):

- Account balance method. This RMD calculation treats a participant's DB plan lump sum like a DC plan account balance as of the end of the prior year. For a lump sum paid in the first distribution calendar year, the RMD for that year is determined by dividing the lump sum by the distribution period shown in the applicable IRS table (as would be used by a DC plan) for the age the participant attains that year. If the lump sum is paid in the second distribution calendar year and no RMD was paid in the first distribution calendar year, a portion of the lump sum will cover the RMDs for the first and second distribution calendar years. These two RMDs are determined as follows:

- The RMD for the first distribution calendar year equals the lump sum divided by the distribution period shown in the applicable IRS table for the participant's age in that year.

- The RMD for the second distribution calendar year equals the lump sum divided by the distribution period shown in the applicable IRS table for the participant's age in that second year. (Note: Although the regulations are silent, the lump sum value apparently is not reduced to reflect the RMD for the first year when making this second-year calculation.)

- The RMD for the first distribution calendar year equals the lump sum divided by the distribution period shown in the applicable IRS table for the participant's age in that year.

- Annuity method. This method expresses the participant's benefit as an annuity with a starting date of Jan. 1 of the first distribution calendar year. If the lump sum is paid in the first distribution calendar year, then the RMD equals one year's worth of annuity payments. If the lump sum is paid in the second distribution calendar year and no RMD was paid during the first distribution calendar year, then the RMD equals two years' worth of annuity payments.

Calculating the correction

For DB plans, the permitted correction is to distribute the missed RMDs plus interest. EPCRS requires that the interest reflect the plan’s actuarial equivalence basis in effect on the date the distribution should have been made. Plans generally make these distributions as lump sums but may also make the payments in another form, such as by actuarially increasing future annuity payments.

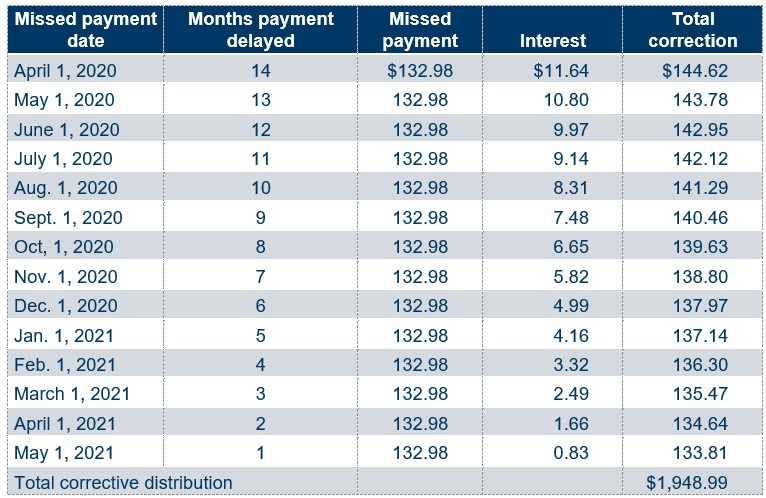

Example. Under company B’s DB plan, RMDs for terminated vested participants must commence no later than the RBD. An unmarried participant terminated from B in 2015 and reached age 70-1/2 in 2019. Required monthly minimum payments of $132.98 (in the form of a single-life annuity) were due to begin April 1, 2020, but no payments were made from April 1, 2020, to May 31, 2021. To correct this failure, the plan must distribute the 14 missed payments totaling $1,861.72, adjusting each $132.98 payment by an annual earnings rate. The total corrective payment, as adjusted, will be included with the participant’s first actual monthly benefit payment on June 1, 2021. (None of these payments is eligible for rollover.) EPCRS provides no examples of how to apply interest, but the table below demonstrates one reasonable method, using an annual plan interest rate of 7.5% and a monthly interest rate of 0.625%:

Effect of Section 436 benefit restrictions

If the plan makes the corrective distribution in a lump sum or other accelerated form of payment, the distribution is not subject to IRC Section 436 benefit restrictions, even if the plan is under restrictions on the distribution date. But if the plan was subject to 436 restrictions when the payment should have been made and the correction is paid in an accelerated form, the sponsor must make a special contribution to the plan as part of the correction. This contribution does not count toward the plan’s minimum funding requirements and can’t be added to the plan’s prefunding balance.

The special contribution equals the corrective distribution if the plan’s adjusted funding target attainment percentage (AFTAP) on the correction date is below 60% (or below 100% for a sponsor in bankruptcy). The special contribution equals half the corrective distribution if the AFTAP is at least 60% but less than 80% and the sponsor is not in bankruptcy. No special contribution is required if the correction isn’t paid in an accelerated form.

Tax reporting and withholding

Plan sponsors discovering RMD errors will need to address tax reporting and withholding issues.

Income taxes and withholding

An RMD is reported as a taxable distribution (ineligible for rollover) on Form 1099-R for the year the RMD is paid. The RMD is subject to federal income tax withholding, unless the participant elects otherwise. Under these voluntary withholding rules, nonperiodic payments are subject to a 10% withholding rate, while periodic payments are subject to the withholding tables for monthly wages. State tax withholding requirements also may apply. These principles hold true even when an RMD is late — the late payment is reported as taxable in the year paid and subject to voluntary withholding.

Excise taxes

Unless waived by IRS, the participant excise tax is due for each tax year for which an RMD was missed. The participant should report the tax on Form 5329 for the applicable year. If the employer doesn’t request an excise tax waiver as part of a VCP filing, the participant can do so on Form 5329.

Tax issues for lump sum payments

In addition to triggering the potential excise tax, lump sum payments that include missed RMDs can complicate Form 1099-R reporting. In general, the RMD portion of the lump sum should be reported as taxable and subject to 10% voluntary withholding as a nonperiodic distribution ineligible for rollover (Treas. Reg. § 1.402(c)-2, Q&A-7). But mistakes often happen, resulting in either under- or over-withholding on the RMD portion of the lump sum.

Underwithholding may occur if the participant rolls over the entire lump sum (including the RMD portion) to an IRA or other plan with no taxes withheld. Conversely, if no funds are rolled over, the plan administrator may mistakenly apply 20% mandatory withholding to the entire lump sum, resulting in over-withholding on the RMD portion.

What happens when this error is discovered? Although EPCRS offers no guidance, the following practices are commonplace among plan administrators:

- If the error is discovered before Form 1099-R is sent to IRS and the participant, the administrator will report the correct federal tax treatment on the form and will inform the participant that the RMD amount was ineligible for rollover and subject to federal (and possibly state) tax.

- If the error is discovered after Form 1099-R is sent to IRS and the participant, the administrator will issue a corrected Form 1099-R reporting adjusted taxable amounts for the year of distribution and will inform the participant that the RMD amount was ineligible for rollover and subject to federal (and possibly state) tax.

In either case, the participant must include the applicable amount in gross income for federal tax purposes, unwind an ineligible rollover to an IRA or other retirement plan, and (if applicable) pay the 6% excise tax imposed on “excess IRA contributions.” (RMDs accidentally rolled over may be removed without penalty by the tax filing deadline, with extensions, for the year of rollover. Excess contributions not removed by the deadline are subject to the excise tax for every year they remain in the IRA.)

Calculating the rollover-ineligible amount

When a participant receives a late lump sum — of a DB benefit or a DC account balance — after the RBD, the portion attributable to the late RMDs can’t be rolled over. Therefore, the calculation of the late payment will generally split the lump sum between the amount eligible for rollover and the ineligible amount.

Although the 401(a)(9) regulations specify how to calculate the RMD when the lump sum is paid on time, they are silent on how to calculate the RMD portion when the lump sum is late. EPCRS is similarly silent on how to do this calculation.

The most conservative method would generally be to determine each year’s RMD, without adjustment, as a portion of the actual lump sum paid. This method will produce the largest RMDs and the smallest amount eligible for rollover. But IRS has approved other methods that take prior years’ missed RMDs into account when determining the missed RMD for a later year. (IRS reportedly considers the interest for late payment to be part of the RMD and thus ineligible for rollover).

VCP applications will often include a proposed method for determining the rollover-ineligible amount.

Missing participants

RMDs owed to missing participants are an ongoing headache on for plan administrators. Although a plan’s failure to pay RMDs when due can be a qualification failure, IRS will not treat a plan as failing to pay an RMD if the only reason for the failure is because the participant could not found, despite the administrator’s diligent search efforts. A diligent search includes all of the following steps:

- Searching for alternate contact information (address, telephone or email) held by the plan, any related plan, the plan sponsor, and any publicly available records or directories

- Using a commercial locator service, credit reporting agency or proprietary internet search tool

- Sending a contact letter via certified mail to the participant’s last known address and any other alternate addresses found as part of the search

Related resources

Non-Mercer resources

- Proposed 401(a)(9) regulations (Federal Register, Feb. 24, 2022)

- Rev. Proc. 2021-30 (IRS, July 16, 2021)

- 26 CFR § 1.401(a)(9), current RMD regulations (electronic Code of Federal Regulations)

- Correcting RMD failures (IRS)

- Correcting plan errors (IRS)

- Tips for VCP submissions for RMDs (IRS)

Mercer Law & Policy resources

- IRS proposes updates to RMD rules for SECURE Act and more (April 20, 2022)

- IRS updates mortality tables for required minimum distributions (Nov. 12, 2020)

- Administering CARES Act’s waiver of 2020 RMDs from DC plans (June 25, 2020)