DOL sets 2022 penalties for health and welfare benefit plan violations

Employers violating Department of Labor (DOL) regulations — including employee benefit, wage and hour, mine safety, occupational safety and health, and workers' compensation rules — could face stiffer penalties in 2022, thanks to new inflation adjustments. The higher rates apply to penalties assessed after Jan. 15, 2022, for violations occurring after Nov. 2, 2015. DOL rarely assesses the maximum and often waives penalties entirely for failures due to reasonable cause. But the penalty threat is an important enforcement and deterrent tool.

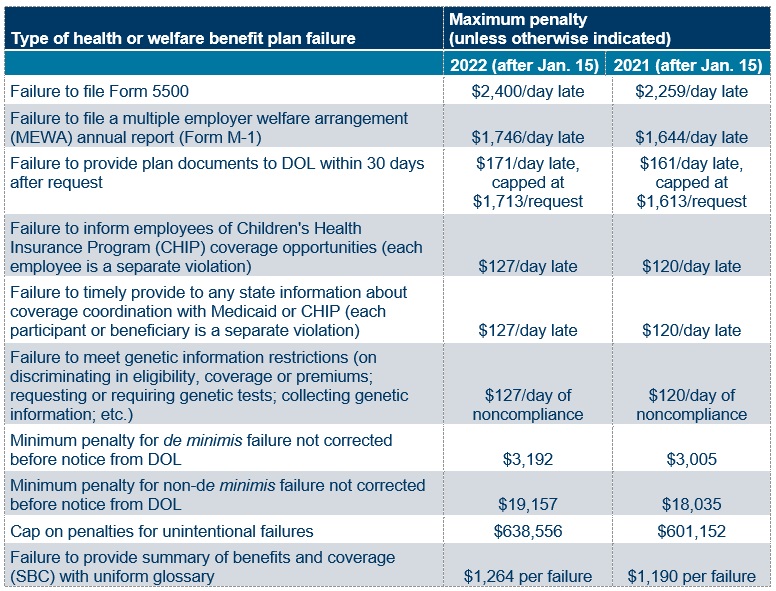

2022 adjustments for health and welfare benefits. The year-over-year inflation increase for 2022 is 6.222%. Annual inflation adjustments are based on the percent change between the October Consumer Price Index for All Urban Consumers (CPI–U) preceding the date of the adjustment, and the prior year’s October CPI–U; in this case, the percent change in the October CPI–U from 2020 to 2021. The following chart shows the 2022 and 2021 maximum (and in some cases, minimum) penalties for certain health and welfare plan violations assessed after Jan. 15.

Related resources

Non-Mercer resources

- DOL civil penalties annual adjustments for 2022 (Federal Register, Jan. 14, 2022)

Mercer Law & Policy resources

- HHS adjusts 2021 HIPAA, certain ACA and MSP monetary penalties (Nov. 30, 2021)

- DOL sets 2021 penalties for health and group benefit plan violations (Jan. 19, 2021)