2023 Social Security, PBGC amounts and projected covered compensation

Social Security benefits payable in 2023 will increase by 8.7%, the Social Security Administration (SSA) announced Oct. 13 in updates that include the 2023 taxable wage base and the 2021 national average wage. The Pension Benefit Guaranty Corp. (PBGC) likewise has released the inflation-indexed 2023 premium amounts, maximum guaranteed benefit for single-employer pension plans and present value of the maximum guarantee. IRS has yet to issue 2023 covered compensation, but Mercer has projected those figures, using the published taxable wage base.

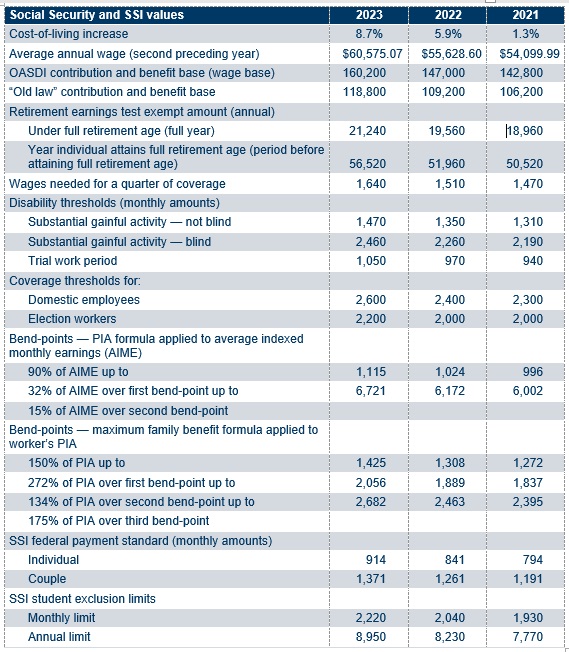

Social Security and Supplemental Security Income (SSI) amounts

The 8.7% cost-of-living increase for 2023 Social Security benefits reflects the change in the third-quarter Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from 2021 to 2022 and is the largest annual adjustment in more than 40 years. Other 2023 Social Security amounts are tied to the 8.89% increase in average annual wages from 2020 to 2021. The next table shows key Social Security values for 2021–2023 from SSA’s 2023 fact sheet and automatic determinations webpage.

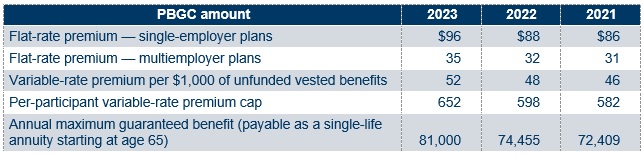

PBGC premiums, guaranteed benefits and maximum present value

On Oct. 14, PBGC announced inflation-adjusted 2023 premium rates and the variable-rate premium cap. Since 2020, all premium amounts — including the per-participant variable-rate premium cap — are indexed annually for wage inflation.

On Oct. 18, PBGC announced that the maximum guaranteed benefit at age 65 for terminating plans will rise to $81,000 in 2023 from $74,455 in 2022. This amount is determined using the Social Security “old law” contribution and benefit base (see Social Security and SSI amounts). The maximum guaranteed benefit is adjusted if benefit payments start before (or after) age 65 or are paid in a form other than a single-life annuity. Some of the guaranteed amount may be paid from the plan’s assets, and participants may receive more if the plan is better funded or PBGC can recover other amounts from the plan sponsor.

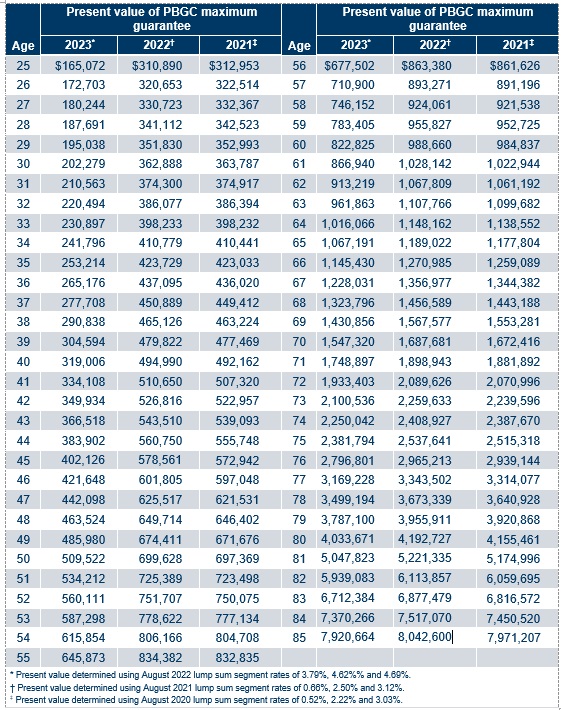

PBGC published the 2023 present value of the maximum guarantee table on Oct. 31. These values are used to administer Internal Revenue Code Section 436 restrictions on lump sums and other accelerated payments from underfunded plans. Plans at least 60% but less than 80% funded may only pay lump sums (or other accelerated distributions) up to the lesser of (i) 50% of the present value of the benefit otherwise payable or (ii) the present value of the participant's PBGC maximum guarantee. Plans subject to the restrictions must use the 2023 table for annuity starting dates in 2023, regardless of the plan year.

The present values will decrease significantly from 2022 levels, mainly because the increase in the maximum guaranteed benefit was worth less than the decrease resulting from using the August 2022 417(e) lump sum segment rates (3.79%, 4.62%, and 4.69% for 2023 present values vs. the August 2021 rates of 0.66%, 2.50%, and 3.12% used to determine the 2022 present values).

The next table shows the present values for 2023 and the two prior years. Tables of present values for every year back to 2008 are available on the PBGC website, along with downloadable Excel tables.

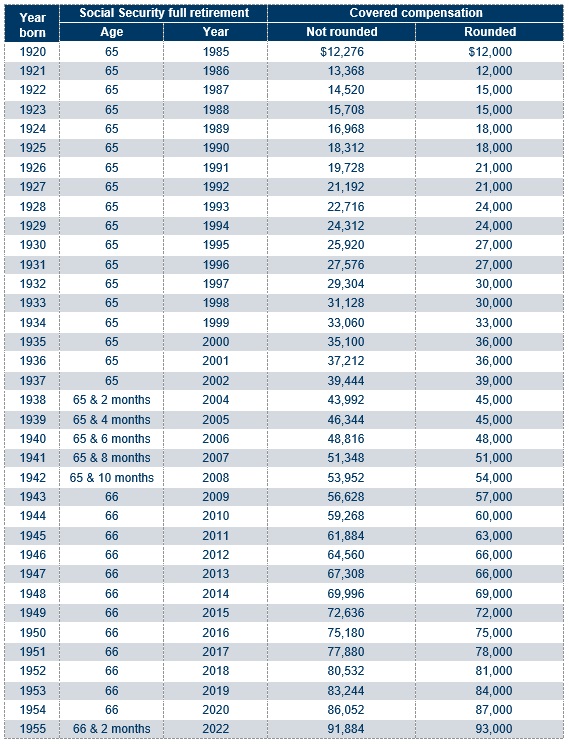

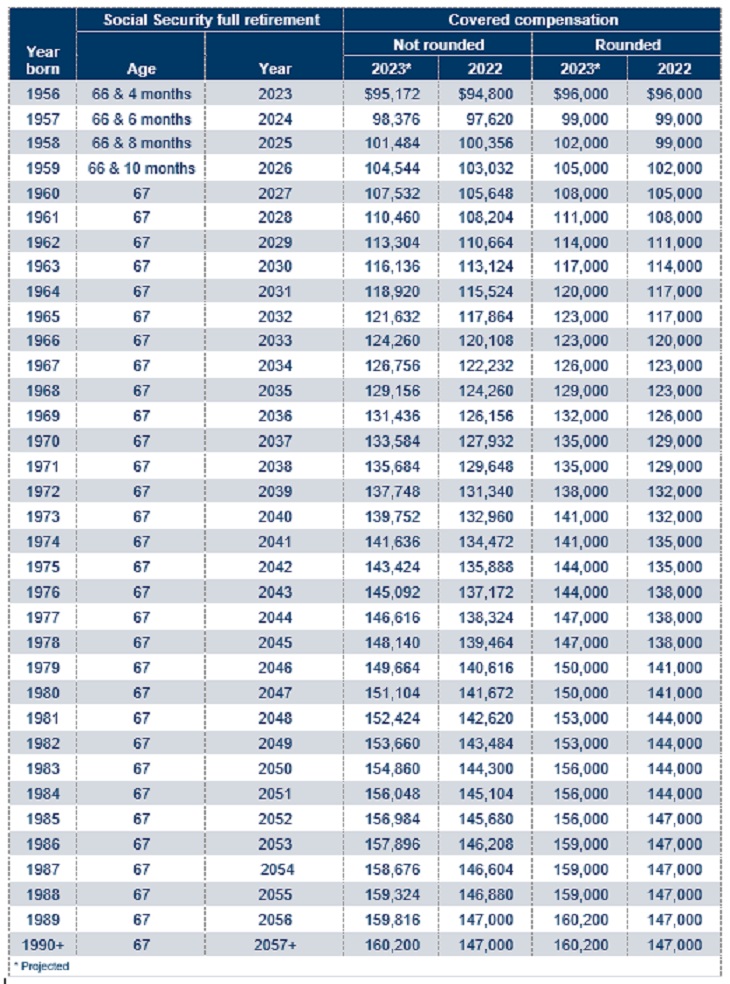

Projected covered compensation

Qualified defined benefit (DB) pension plans use covered compensation to determine “permitted disparity” under Section 401(l) design-based safe harbor rules and “imputed disparity” under Section 401(a)(4) general nondiscrimination testing rules. Covered compensation is the average Old-Age, Survivors and Disability Insurance (OASDI) contribution and benefit base for the 35 years ending with the year the employee reaches Social Security retirement age. Qualified plans have the option to determine permitted or imputed disparity using either actual or rounded covered compensation.

IRS has not yet issued 2023 covered compensation tables, but Mercer has projected these amounts based on the increase in the taxable wage base to $160,200 for 2023 from $147,000 for 2022. The next table shows covered compensation amounts for individuals who have already reached Social Security full retirement age. (At that age, covered compensation becomes fixed and is no longer affected by annual changes in the OASDI contribution and benefit base.)

This table shows Mercer’s projected 2023 amounts for individuals below Social Security full retirement age.

Related resources

- Present value of PBGC maximum guarantee (PBGC, Oct. 31, 2022)

- Maximum guaranteed benefit tables (PBGC, Oct. 18, 2022)

- Premium rates for 2023 and earlier years (PBGC, Oct. 14, 2022)

- Press release on Social Security COLA for 2023 (SSA, Oct. 13, 2022)

- Automatic determinations (SSA)