IRS issues a potpourri of guidance for retirement plans

IRS has recently issued several pieces of administrative guidance for defined contribution (DC) and defined benefit (DB) plan providers and sponsors. The guidance addresses preapproved DB and DC plans, upcoming increases in certain user fees, and an updated reporting and disclosure guide.

Third cycle submission period for preapproved DC plans

From Aug. 1, 2020, to July 31, 2022, employers may adopt a newly preapproved DC plan document for the third remedial amendment cycle or request a determination letter for a modified preapproved document. Employers may be able to request a determination letter using either Form 5307 or Form 5300, depending on the type of plan and extent of the modifications.

In the Aug. 10 issue of Employee Plan News, IRS notes that the preapproved plan program includes employee stock ownership plans (ESOPs) for the first time. Since IRS has not yet updated Form 5307 to include ESOPs, the newsletter explains how employers using this form should complete it in the meantime.

List of required modifications for DB plans

IRS has issued its listing of required modifications (LRM) to help preapproved DB plan providers draft documents for the third cycle submission period, which runs from Aug. 1, 2020, to July 31, 2021. The LRM includes sample plan provisions reflecting changes in plan qualification requirements identified in the 2020 Cumulative List. The LRM reflects the format of a basic plan document with an adoption agreement; however, IRS notes a single plan document is also acceptable.

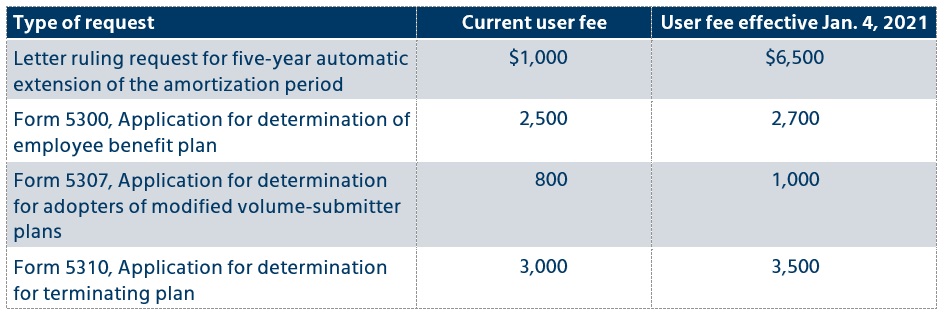

2021 user fee increases

Effective Jan. 4, 2021, user fees will increase for certain types of employee plan letter rulings and determination letter requests, IRS recently announced. The increased user fees are shown below:

New IRS reporting and disclosure guide

IRS recently updated Publication 5411, Retirement Plans Reporting and Disclosure Requirements. This quick reference guide covers reporting and disclosure items under the Internal Revenue Code and ERISA provisions for which Treasury and IRS have interpretive authority. The Department of Labor (DOL) maintains a similar guide — Reporting and Disclosure Guide for Employee Benefit Plans — for reporting and disclosure requirements within the purview of DOL and PBGC.

Related resources

- Announcement 2020-14 (IRS, Aug. 12, 2020)

- Employee Plans News (IRS, Aug. 10, 2020)

- Defined benefit listing of required modifications and information package (IRS, Aug. 10, 2020)

- Publication 5411, Retirement Plans Reporting and Disclosure Requirements (IRS, July 2020)

- Announcement 2020-7 (IRS, June 1, 2020)

- Notice 2020-14 (IRS, March 6, 2020)

- Rev. Proc. 2020-10 (IRS, Dec. 16, 2019)

- Rev. Proc. 2019-20 (IRS, May 1, 2019)

- Reporting and Disclosure Guide for Employee Benefit Plans (DOL, September 2017)