2023 HSA, HDHP and excepted-benefit HRA figures set

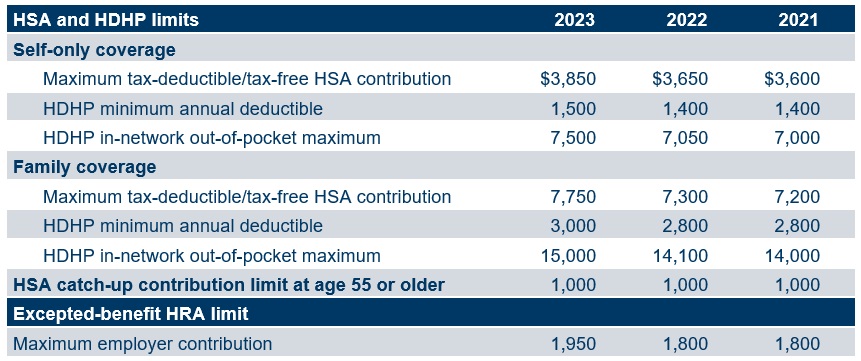

IRS has announced the 2023 inflation-adjusted amounts for health savings accounts (HSAs), high-deductible health plans (HDHPs) and excepted-benefit health reimbursement arrangements (HRAs). In 2023, tax-deductible/tax-free HSA contribution limits, HDHP in-network out-of-pocket maximums and HDHP minimum annual deductibles will increase for both self-only and family coverage levels. The HSA catch-up contribution limit is set by statute and hasn’t changed since 2009. The 2023 maximum annual employer contribution for an excepted-benefit HRA will increase to $1,950. The table below shows the HSA, HDHP and excepted-benefit HRA limits for 2021‒2023.

Affordable Care Act (ACA) out-of-pocket maximums are higher.

As announced by the Centers for Medicare and Medicaid Services (CMS) in December 2021, the out-of-pocket maximums for non-grandfathered group health plans under the ACA — $9,100 for self-only and $18,200 for other coverages — are higher than 2023 HDHP out-of-pocket maximums.

Related resources

Non-Mercer resources

- Rev. Proc. 2022-24 (IRS, April 29, 2022)

- Premium adjustment percentage, maximum annual limitation on cost sharing, reduced maximum annual limitation on cost sharing and required contribution percentage for the 2023 benefit year (CMS, Dec. 28, 2021)

Mercer Law & Policy resources

- 2022 quick benefit facts (Jan. 19, 2022)

- Summary of 2022 benefit-related cost-of-living adjustments (Jan. 19, 2022)

- Final rules ease restrictions on health reimbursement arrangements (June 14, 2019)

Other Mercer resources

- Consumer-directed health plans

- How to maximize HDHPs and HSAs to save costs, promote health and retain talent (March 17, 2022)

- Congress set to pass short-term renewal of pre-deductible telehealth coverage (March 10, 2022)

- HSAs: Saving for, and during, an emergency (May 14, 2020)

- Could free COVID-19 services sabotage your HSA? IRS just weighed in (March 12, 2020)

- HSA enrollment rises even as full-replacement strategies decline (Jan. 7, 2020)

- To treat or to prevent? That is (still) the HSA question (Jan. 7, 2020)