Seattle posts 2023 health expenditure rate for hotel employers

Seattle has announced 2023 calendar-year healthcare expenditure rates that certain hotel industry employers must make to or on behalf of each covered employee for medical care. The year-over-year rate increase will be 13%. The ordinance (Mun. Code Ch. 14.28), which first took effect for some covered employers on July 1, 2020, applies to most businesses that own, control, or operate a Seattle hotel or motel with 100 or more guest rooms and to “ancillary hotel businesses” with 50 or more employees worldwide. However, smaller ancillary hotel businesses (50 to 250 employees in any location) that contract with a hotel don’t have to comply until July 1, 2025, or the start of the annual open enrollment for employee health coverage on or after that date.

Expenditure requirement

Covered employers may comply with the expenditure obligation by one or a combination of these methods:

- Cash compensation — including direct deposit and checks payable to the employee — paid at least monthly and taxed as ordinary income in addition to the employee’s regular wages

- Payment to a third party like an insurer, a trust or a tax-favored health program, such as a health flexible spending arrangement (FSA), health savings account (HSA), or health reimbursement arrangement (HRA) that makes those amounts available to the employee and dependents

- Costs and administrative expenses paid to a third party for coverage under a self-funded group health plan, but excluding the employer’s internal administrative costs and any employee contributions

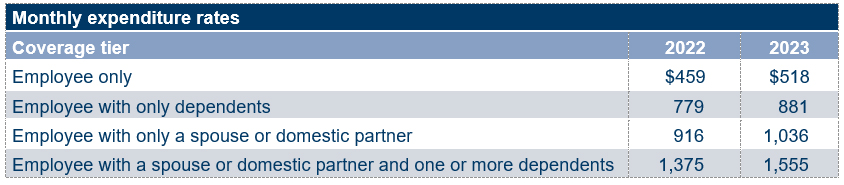

Expenditure rates

The Seattle Office of Labor Standards adjusts healthcare expenditure amounts each calendar year, varying the monthly rates by coverage tier.

Preemption challenge status

In January 2022, the ERISA Industry Committee (ERIC) petitioned the US Supreme Court to review the ordinance after the 9th US Circuit Court of Appeals upheld it in an unpublished opinion. The lower court concluded that ERISA does not preempt the ordinance because it does not relate to any employee benefit plan. In May 2022, the US Supreme Court invited the US solicitor general to file a brief, which delays a decision on the petition until at least October 2022, when the high court’s next session starts.

Employer considerations

Despite the ongoing litigation, covered Seattle businesses should already have a process to make the required healthcare payments. If not, this is an ongoing compliance concern. Employers with systems already in place should work with vendors to update the amounts for 2023. Regulators have already updated a 14-page Q&A document and expect to post updated employee rights posters before the new rates take effect on Jan. 1, 2023.

Related resources

- Improving access to medical care for hotel employees website (Seattle Office of Labor Standards, June 27, 2022)

- Mun. Code Ch. 14.28 (Seattle Municipal Code)

- ERISA Indus. Comm. v. Seattle, No. 21-1019 (US Supreme Court, petition pending)