Seattle posts 2022 health expenditure rate for hotel employers

Seattle has announced 2022 calendar-year healthcare expenditure rates that certain hotel industry employers must make to or on behalf of each covered employee for medical care. The ordinance (Mun. Code Ch. 14.28), which first took effect for some covered employers on July 1, 2020, applies to most businesses that own, control, or operate a Seattle hotel or motel with 100 or more guest rooms and to “ancillary hotel businesses” with 50 or more employees worldwide. However, smaller ancillary hotel businesses (50 to 250 employees in any location) that contract with a hotel don’t have to comply until July 1, 2025, or the start of the annual open enrollment for employee health coverage on or after that date.

Expenditure requirement

Covered employers may comply with the expenditure obligation by one or a combination of these methods:

- Cash compensation — including direct deposit and checks payable to the employee — paid at least monthly and taxed as ordinary income in addition to the employee’s regular wages

- Payment to a third party like an insurer, to a trust or into a tax-favored health program, such as a health flexible spending arrangement (FSA), health savings account (HSA) or health reimbursement arrangement (HRA) that makes those amounts available to the employee and dependents

- Costs and administrative expenses paid to a third party for coverage under a self-insured group health plan, but excluding the employer’s internal administrative costs and any employee contributions

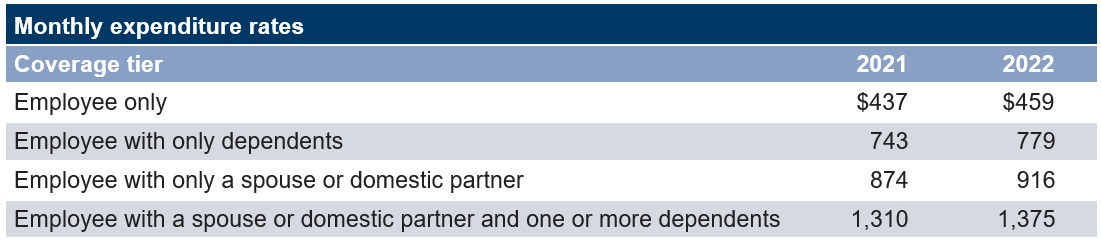

Expenditure rates

The healthcare expenditure amounts are adjusted each calendar year and vary by coverage tier or family size.

Preemption challenge status

The ERISA Industry Committee (ERIC) has asked the full US 9th Circuit Court of Appeals to review the ordinance after it was upheld by a three-judge panel in an unpublished opinion. The panel held that the ordinance does not relate to any employee benefit plan in a manner that triggers ERISA preemption. In a recent brief in support of a rehearing, ERIC notes that the question of whether ERISA preempts Seattle’s and similar ordinances has growing importance. If the law is upheld, employers likely will face a patchwork of state and municipal health coverage mandates. Unless the law is struck down or paused by the court, covered employers must continue to comply.

Employer considerations

Despite the ongoing litigation, covered Seattle businesses that don’t already comply should implement a process to make the required healthcare payments. Employers with systems already in place should work with vendors to update the amounts for 2022. Regulators note that updated Q&As and employee rights posters with the adjusted rates will be available before the new rates take effect on Jan. 1, 2022.

Related resources

Non-Mercer resources

- Improving access to medical care for hotel employees website (Seattle Office of Labor Standards, Aug. 12, 2021)

- The future of employee benefits is in the hands of the US 9th circuit (ERIC, July 22, 2021)

- Mun. Code Ch. 14.28 (Seattle Municipal Code)

- ERISA Indus. Comm. v. Seattle, No. 2:18-cv-01188-TSZ (9th Cir. March 17, 2021)