Seattle healthcare expenditure for hotels survives ERISA challenge

Covered employers and employees

Hotels in Seattle with 100 or more guest rooms or suites, whether occupied or not, must comply as covered employers. Certain ancillary hotel businesses with 50 or more employees worldwide also are covered employers. The ordinance defines ancillary businesses as companies in Seattle, including chains and franchises, that routinely contract to provide food and beverages sold on a covered hotel’s property or other hotel-related services.

Covered employees include those subject to Seattle's minimum wage who work at least 80 hours per month at a covered hotel or ancillary business. To determine hours worked per month, an employer must make “a reasonable estimate” of the average monthly hours an employee will work over the course of the calendar year or the period of temporary or seasonal employment. The law exempts certain managers, supervisors and confidential employees.

Effective date

For most covered employers, the mandate takes effect on the later of July 1, 2020, or the first annual open enrollment period for health coverage, if offered, after July 1, 2020. However, ancillary businesses with 50 to 250 employees don’t have to comply until the later of July 1, 2025, or the employer’s next open enrollment period after July 1, 2025.

Neither the legislation nor the rules clarify whether an employer’s expenditure obligation begins at the start of the open enrollment period or the start of the ensuing plan year. While it seems unlikely that employer expenditures coincide with the start of open enrollment, that is how regulators are interpreting the law, according to informal guidance. Future guidance may clarify or amend this understanding. However, employers should plan to comply with the expenditure mandate at the start of their next open enrollment or July 1, whichever is sooner.

Example. XYZ Co. holds its annual open enrollment from Oct. 12 through Oct. 24, 2020, for a plan year starting on Jan. 1, 2021. The ordinance seems to require expenditures to begin on Oct. 12, 2020, rather than Jan. 1, 2021. According to the informal guidance, this is correct: Expenditures must begin on Oct. 12, 2020, not the Jan. 1 start of the 2021 plan year.

Expenditures

Unlike San Francisco’s similar Health Care Security Ordinance (HCSO), which sets expenditures per hour worked, Seattle requires specific monthly amounts per coverage tier. An employer may delay expenditures for a new hire in a group health plan’s waiting period for up to 60 days.

The full expenditure may be satisfied by one or a combination of the following methods:

- Cash compensation — including direct deposit and checks payable to the employee — paid at least monthly and taxed as ordinary income in addition to the employee’s regular wages

- Payment to a third party like an insurer, to a trust or into a tax-favored health program, such as a health flexible spending arrangement (FSA), health savings account (HSA) or health reimbursement arrangement (HRA), with amounts available to the employee and dependents

- A self-insured group health plan that meets certain conditions

Self-insured group health plans

A self-insured group health plan sponsor’s required expenditure can include coverage costs and administrative expenses paid to a third party, but not the employer’s internal administrative costs or any employee contributions. The employer may base its monthly per-capita coverage cost for a benefit option on all plan participants or limit it to covered Seattle plan participants. The calculation can’t include any Seattle employees who don’t participate in the health plan.

The expenditure rate may be based on an estimated premium equivalent amount. Employers using this method must either obtain an actuarial certification verifying the amount or conduct an end-of-plan-year audit. The audit must be completed by the end of the third month after the plan year closed. An employer must make up any shortfall, including any shortfall due to an underestimate of covered employee hours, but cannot recoup any overpayment.

Expenditure amounts

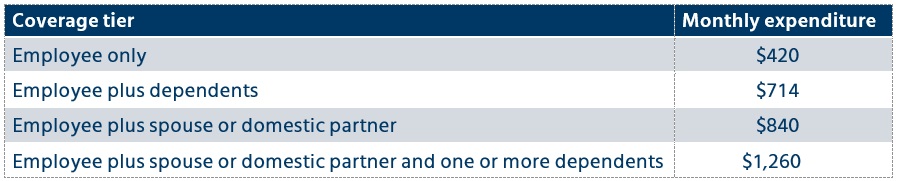

Determined by coverage tier, expenditure amounts are adjusted annually for medical inflation. Covered employers must make a monthly healthcare expenditure to each covered employee or on the employee’s behalf, using the following rates for 2020.

The Office of Labor Standards (OLS) is expected to publish rates for 2021 later this year.

Waivers

An employee who waives employer coverage during a group health plan’s open enrollment does not automatically waive the right to receive the healthcare expenditure. An employee who has other coverage may sign a revocable waiver of the healthcare expenditure by signing the voluntary ordinance waiver published by the OLS in the employee’s own language.

Employees who want to opt out of some or all of the employer expenditures for themselves and their family members, such as family insurance coverage, may sign a voluntary healthcare expenditure (EXP) waiver published by the OLS. This will satisfy the employer obligation only if the following conditions are met:

- The employer offers a healthcare expenditure that fully satisfies the relevant monthly expenditure rate for the employee, which includes payments toward an employer-sponsored health insurance plan.

- The employee doesn’t have to pay more than 20% of the healthcare expenditure rate for a single employee ($84/month in 2020) toward the employer-sponsored health insurance plan.

- The employee voluntarily waives the offered healthcare expenditure in writing, using the EXP waiver form.

Employees cannot be pressured, coerced or led to believe they must sign the waiver. If an employee declines health coverage but does not sign a waiver, the employer must find another way to meet its expenditure obligation.

Notices and records

Covered employers must conspicuously post in the workplace a notice about employees’ rights to the healthcare expenditure. If displaying the poster isn’t feasible, employers may provide a copy in the employee’s own language in person, by mail or electronically in a reasonably accessible manner. The OLS will create, update and make the posters available in English and other languages for electronic download.

Employers must maintain for three years records showing monthly expenditures per employee and any executed waivers.

Enforcement, retaliation, penalties

The OLS will enforce the new law and may initiate an investigation if the agency has a reason to believe a violation has occurred or may occur. The ordinance also prohibits any retaliation against workers for exercising their rights, including any adverse employment action within 90 days after an employee asserts those rights. Sanctions can include fines, back pay with interest, damages, civil penalties, and other unspecified penalties and fines. In addition, an employee may retain a right of private action.

Related resources

- Seattle Mun. Code Ch. 14.28

- ERISA Indus. Comm. v. Seattle., No. 2:18-cv-01188-TSZ (W.D. Wash. May 8, 2020

- Final Seattle Human Rights Rules, Ch. 190 (OLS)

- Improving Access to Medical Care for Hotel Employees website (OLS)

- Improving Access to Medical Care for Hotel Employees Q&As (OLS)

- Seattle minimum wage (OLS)

- Seattle voluntary ordinance waiver (OLS)

- Seattle voluntary healthcare expenditure waiver (OLS)

- San Francisco HCSO (Office of Labor Standards Enforcement)