DOL, PBGC announce retirement plan civil penalties for 2021

The Department of Labor (DOL) and Pension Benefit Guaranty Corp. (PBGC) have published their 2021 inflation-adjusted civil monetary penalties for retirement plans. The agencies must annually adjust these fines for inflation under the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015.

DOL penalties

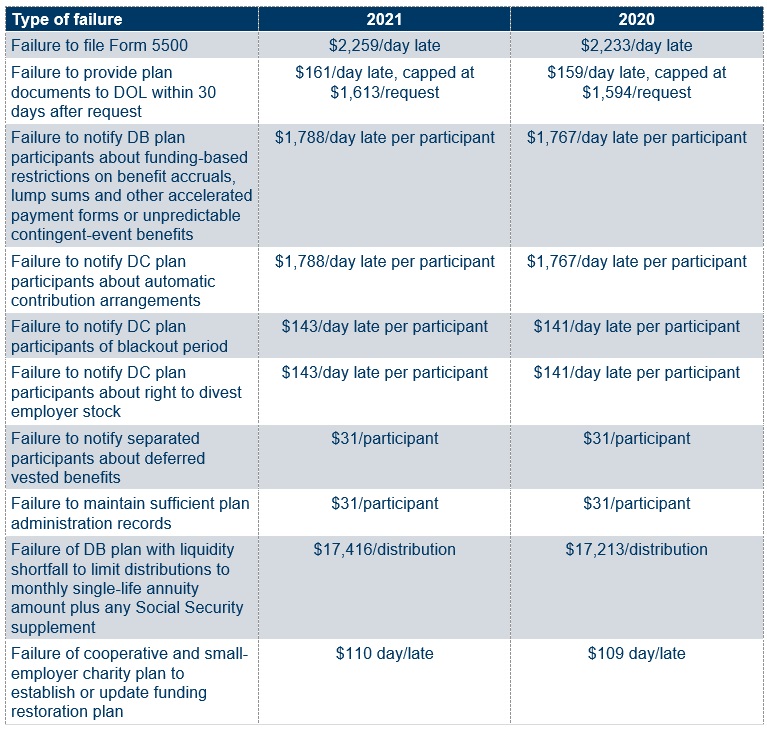

The chart below shows DOL’s maximum penalties relevant to single-employer defined benefit (DB) and defined contribution (DC) plans for 2021 and 2020. The increases apply to penalties assessed after Jan. 15, 2021, for violations occurring after Nov. 2, 2015.

PBGC penalties

PBGC’s 2021 maximum penalty under ERISA Section 4071 for single-employer DB plans is $2,259 a day (up from $2,233 in 2020) for each day a filing, notice or other information is overdue. The higher rate applies to penalties assessed after Jan. 13.

Broad scope

The $2,259 per day maximum penalty potentially could apply to virtually any late PBGC information or premium filing for a single-employer plan, including:

- Premium filings (the late-filing penalty is separate from the penalty on premium underpayments)

- ERISA Section 4010 controlled-group financial and plan actuarial information filings

- Form 10 or 10-Advance reportable-event filings

- Form 200 filings to report missed contributions in excess of $1 million

- ERISA Section 4062(e) notices (when permanent cessation of operations at a facility results in a workforce reduction affecting more than 15% of all employees eligible to participate in any qualified retirement plan in the controlled group)

- ERISA Section 4063 notices (when a substantial employer has withdrawn from a multiple-employer plan)

Maximum penalty rarely assessed

In practice, PBGC rarely assesses the maximum penalty. The agency’s current penalty policy calls for mush smaller penalties, especially when a delinquent filing is made soon after the due date or the plan is small. However, depending on the facts and circumstances, PBGC might assess the maximum penalty in two situations:

- A sponsor fails to file Form 200 reporting a missed contribution that brings the total unpaid amount (including interest) to more than $1 million — or files the form more than 10 days after the missed contribution’s due date — if PBGC would have perfected a lien had the agency known about the missed contribution. (If the sponsor promptly deposits the missed contribution, the agency typically won’t perfect the lien.)

- A nonpublicly traded employer with large unfunded vested benefits (for variable-rate PBGC premiums) fails to provide advance notice of a reportable event under ERISA Section 4043(b).

Related resources

- DOL adjustment of civil penalties for 2021 (Federal Register, Jan. 14, 2021)

- PBGC adjustment of civil penalties for 2021 (Federal Register, Jan. 13, 2021)

- PBGC assessment of penalties for failure to provide required information (Federal Register, July 18, 1995)