2022 HSA, HDHP and excepted-benefit HRA figures set

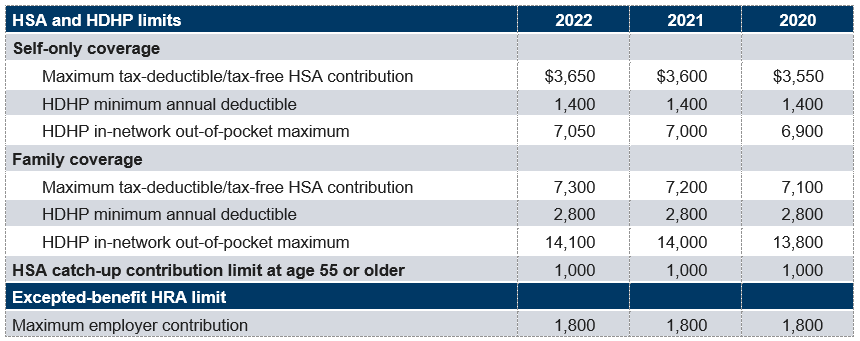

IRS has announced the 2022 inflation-adjusted amounts for health savings accounts (HSAs), high-deductible health plans (HDHPs) and excepted-benefit health reimbursement arrangements (HRAs). In 2022, tax-deductible/tax-free HSA contribution limits and HDHP in-network out-of-pocket maximums will increase for both self-only and family coverage levels, while HDHP minimum annual deductibles will stay the same. The HSA catch-up contribution limit is set by statute and hasn’t changed since 2009. The 2022 maximum annual employer contribution for an excepted-benefit HRA will remain unchanged. The table below shows HSA, HDHP and excepted-benefit HRA limits for 2020‒2022.

Affordable Care Act (ACA) out-of-pocket maximums are higher. As announced by the Department of Health and Human Services (HHS) in May 2021, the out-of-pocket maximums for non-grandfathered group health plans under the ACA — $8,700 for self-only and $17,400 for other coverages — are higher than 2022 HDHP out-of-pocket maximums.

Related resources

Non-Mercer resources

- Rev. Proc. 2021-25 (IRS, May 10, 2021)

- HHS Notice of Benefit and Payment Parameters for 2022 (Federal Register, May 5, 2021)

Mercer Law & Policy resources

- Tracking federal COVID-19 laws affecting employee benefits, jobs (March 30, 2021)

- 2021 quick benefit facts (Jan. 21, 2021)

- Summary of 2021 benefit-related cost-of-living adjustments (Jan. 21, 2021)

- 2021 health FSA, other health and fringe benefit limits now set (Oct. 27, 2020)

- 2021 ACA out-of-pocket maximums, ESR penalties, other changes ahead (June 3, 2020)

- IRS offers relief to cafeteria plans, HDHPs, individual-coverage HRAs (May 28, 2020)

- Employer health plans have to meet new COVID-19 coverage mandate (April 21, 2020)

- CARES Act boosts telehealth, makes other health, paid leave changes (March 27, 2020)

- COVID-19 spurs IRS relief for HDHPs, state insurance guidance (March 18, 2020)

- Final rules ease restrictions on health reimbursement arrangements (June 14, 2019)

Other Mercer resources

- HSAs: Saving for, and during, an emergency (May 14, 2020)

- Could free COVID-19 services sabotage your HSA? IRS just weighed in (March 12, 2020)

- HSA enrollment rises even as full-replacement strategies decline (Jan. 7, 2020)

- To treat or to prevent? That is (still) the HSA question (Jan. 7, 2020)

- Balancing the risks and rewards of saving through an HSA (Jan. 7, 2020)