2021 health FSA, other health and fringe benefit limits now set

Health FSA, certain HRA, Archer MSA and LTC limits

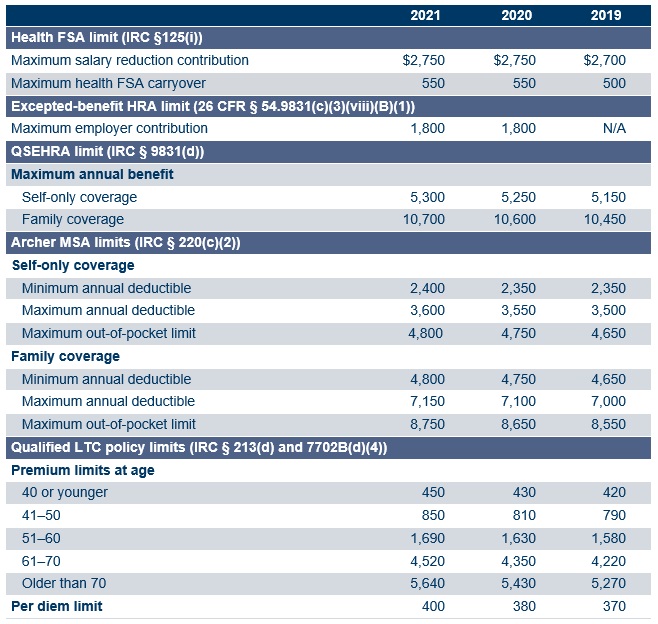

The table below shows the 2021 adjusted amounts for health FSAs, QSEHRAs, Archer MSAs and qualified LTC policies, along with the limits for 2020 and 2019. Also shown is the 2021 maximum annual employer contribution for excepted-benefit HRAs set by Rev. Proc. 2020-43. The health FSA carryover limits shown reflect the maximum unused funds that can carry over to the next plan year.

The 2021 adjusted amounts for health savings accounts (HSAs), HSA-qualifying high-deductible health plans, out-of-pocket maximums in non-grandfathered group health plans and various indexed amounts for the ACA’s employer-shared responsibility provision were announced earlier this year.

Qualified transportation fringe benefits and adoption assistance programs

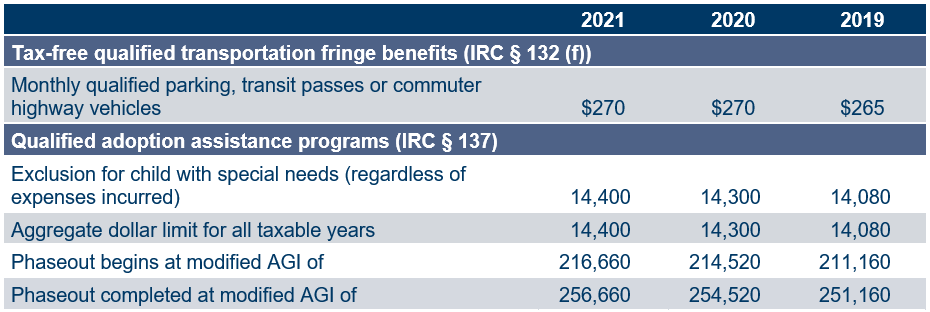

This table shows the 2021 adjusted figures for qualified transportation fringe and adoption assistance benefits set by Rev. Proc. 2020-45, along with amounts for 2020 and 2019.

Related resources

Non-Mercer resources

- Rev. Proc. 2020-45 (IRS, Oct. 26, 2020)

- IRS provides tax inflation adjustments for tax year 2021 (IRS, Oct. 26, 2020)

- Rev. Proc. 2020-36 (IRS, July 21, 2020)

- Rev. Proc. 2020-32 (IRS, May 20, 2020)

- Final HHS notice of benefit and payment parameters for 2021 (Federal Register, May 14, 2020)

- Notice 2020-33, Modification of carryover rule for health FSAs and clarification of premium reimbursements by individual-coverage HRAs (IRS, May 12, 2020)

Mercer Law & Policy resources

- 2021 quick benefit facts (Oct. 27, 2020)

- 2021 transportation, health FSA and Archer MSA limits projected (Aug. 14, 2020)

- Affordable percentage will rise for employer health coverage in 2021 (July 22, 2020)

- 2021 ACA out-of-pocket maximums, ESR penalties, other changes ahead (June 3, 2020)