Mercer projects 2021 IRA and saver’s credit limits

Mercer has projected 2021 limits for individual retirement accounts (IRAs) and the saver’s credit. These unofficial 2021 limits are determined using the Internal Revenue Code (IRC)’s cost-of-living adjustment methods, chained Consumer Price Index for All Urban Consumers (chained CPI) values through July and Mercer’s projected chained CPI for August. IRS is expected to announce official 2021 limits for these benefits in October, along with final 2021 limits for qualified retirement plans.

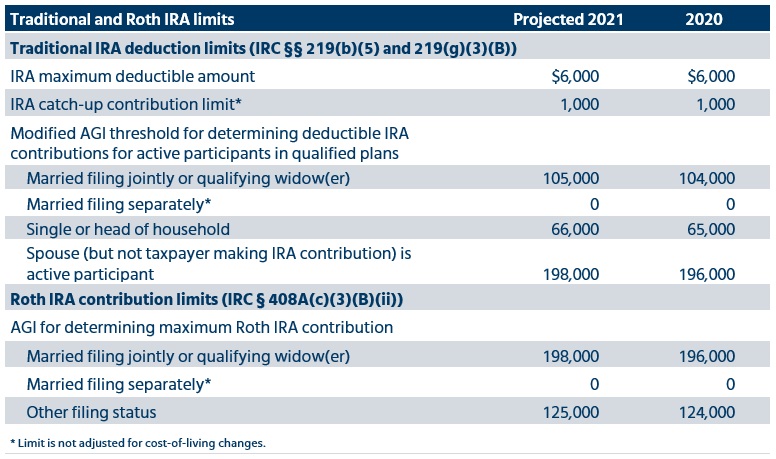

Traditional and Roth IRA limits

Maximum 2021 deductions for traditional IRA contributions are projected to remain at 2020 levels. Adjusted gross income (AGI) phase-out thresholds for Roth IRA contributions and a qualified plan participant’s deductible traditional IRA contributions are projected to increase slightly in 2021. The catch-up contribution limit isn’t annually adjusted. The AGI thresholds for spouses filing separately are set to $0.

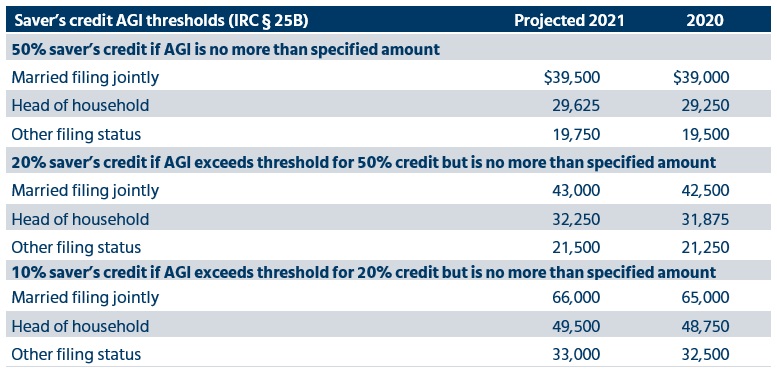

Saver’s credit

AGI levels at which employee contributions to a qualified retirement plan or an IRA qualify for saver’s credit are all expected to increase slightly in 2021.

Related resources

- Chained Consumer Price Index for All Urban Consumers (Bureau of Labor Statistics)

- Consumer Price Index — July 2020 (Bureau of Labor Statistics, Aug. 12, 2020)